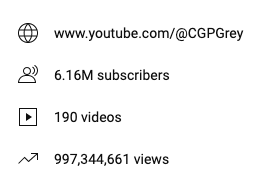

During which month will the number on this page cross one billion views: https://www.youtube.com/@CGPGrey/about

Related markets I made before I realized that multiple options was a thing:

A Billion Before:

During 2024: https://manifold.markets/CGPGrey/will-cgp-greys-channel-cross-1-bill-d13bca99c206

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ6,009 | |

| 2 | Ṁ4,053 | |

| 3 | Ṁ2,071 | |

| 4 | Ṁ1,733 | |

| 5 | Ṁ1,680 |

it is currently March in UK local time as implied by the close date and where CGP lives

Multiple option markets suck Grey, the parimutuel payout format means you can't do expected value calculations based on what you think will actually happen, but you have to try and also guess how future people will bet. In order for them to have any validity you need to pull the close day way way way in advance of the resolve date, so people don't steal the lunch of people who guessed correctly early. Stick to the fixed payout markets!

@CGPGrey Binary markets, (including numeric markets such as the one I linked below), are fixed-payout markets. If you bet M$1 on YES at 50%, you get two YES shares, and those shares are each worth M$1 if the market resolves YES. Your payout if the market resolves YES is locked in as soon as you place your bet, and can't change afterwards.

Multiple choice and free response markets on the other hand do not use this system. The total amount of mana in the pool is simply split evenly among everyone holding shares in the winning answer, proportional to how many shares they hold. Since there's no limit to how many shares you can buy, this means one person can "dilute away" other people's winnings. For example, if a market has M$100 in potential winnings and I buy M$10 of the winning answer and then the market resolves, I get M$110, for a profit of M$100. But if before the market resolves someone else buys M$990 of the same answer, now that M$100 is going to be split with M$99 of it going their way and only M$1 of it coming to me. Basically, as soon as the outcome is known, people will just pour large amounts of mana into the correct answer in order to receive the winnings, and there's not much incentive to predict correctly in advance.

If you're curious about the exact market math, multiple choice markets are Dynamic Parimutuel Markets (DPM), whereas binary markets use a Constant Function Market Maker (CFMM). You can Google those terms to learn more about them in general, and Manifold's implementations are described here for DPM and here for CFMM.

As a result, multiple choice and free response markets are mainly just "for fun", and don't have a lot of predictive value. The exception being if the market will be closed before most answers are ruled out, which prevents people from diluting away the others.

Manifold is aware of these issues and is working on converting multiple-choice markets to be fixed-payout, but the math is hard and they haven't fully figured it out yet.

@CGPGrey @IsaacKing Isaac is right that payouts can be taken from good bettors by latecomers betting on the known answer.

However, I think he's overstated the problem.

A typical worst-case is that someone who bet correctly gets one-half the profit implied by the price of their shares. (E.g. you buy 1 share at 33%, shares triple in value, and you double your money instead of triple.)

You can also easily avoid this case by closing the market earlier. I'd recommend doing that. To be safe, you could close by July, though a few months later would probably also be fine.

As one of the founders of Manifold, I actually think that this system, Dynamic Parimutuel is way underrated. Sure, payouts are not fixed, but it's approximately right, and also the system is great at building up liquidity (so people can place large bets on the answer they believe in and still get a good payout!).

Welcome @CGPGrey and thanks for trying out Manifold Markets!

@JamesGrugett @IsaacKing Aren't these mutually exclusive potential outcomes? Either my profits can be diluted to 1% or only to 50% once the outcome is known.

Right now I have M30 in "Marty Dettman" on this (https://manifold.markets/IsaacKing/who-will-win-the-manifold-mtg-tourn) market. That option is at 12%, and my payout would be M309 if chosen right now, but I can sell the shares for M33. I don't understand the math that says my shares have gone up in value since I bought in, but it looks like my profit is 309-30=289.

If I buy M1000 in the same, I'd get Ṁ1,891 payout if chosen right then. How much would that take off of the M309 from my earlier M30 investment? Well, the % would go from 12% to 68%, so I guess M30 would payout a factor of 100/68, or M44. But then, maybe my M30 has gone up in value, like it did to become a sell value of M33. So maybe it's worth enough that it garners half of the original payout's profit? That'd be 289/2=145, (145+30)/(100/68)=119. My M30 has quadrupled in sell value?

If someone could please buy M1000 so I could test this theory...

@TylerColeman I probably misunderstood the details, I never bothered to learn the exact math for DPM. I assume James is correct. The page I linked for DPM math has the exact formula.

i did some simulations based on the last 24 months of social blade data here: https://twitter.com/pressed_tin/status/1643035204679008256

@MpP Roughly, yeah. The linear fit intercepts 1B in Nov, and the exponential one intercepts 1B in Oct. I only have 9 data points from the past 2 years though so not very precise.

@Nikola This is what I have (in millions)

# Data

data = {

'Date': pd.date_range(start='2021-01-01', periods=9, freq='3M'),

'Views': [621, 648, 687, 730, 748, 782, 818, 865, 891]

}@SemioticRivalry For the STD I just took the the average of (average difference between the data points) and (difference between exp and lin prediction). This is probably a really bad way of estimating the STD.

@SemioticRivalry Yes, we can probably expect swings in probabilities towards earlier dates upon uploads and a slow crawl towards later dates in case of no uploads.

@Nikola Im currently using the linear regression from this source:

https://socialblade.com/youtube/user/cgpgrey/futureprojections/views