If a company has more than 12 creditors, any 3 of them can join together to put the company into involuntary bankruptcy proceedings. Twitter certainly meets the minimum requirement and they also haven't been paying a lot of bills. This includes any rent on its offices, fees to arbitration company dealing with ex-employees, contractors, etc.

This market resolves YES if any creditors work together to force bankruptcy proceedings by the end of 2023.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ320 | |

| 2 | Ṁ125 | |

| 3 | Ṁ112 | |

| 4 | Ṁ61 | |

| 5 | Ṁ30 |

People are also trading

Still no answer to my question. It is obvious that twitter does not go into involuntary bankruptcy the moment 3 creditors file paperwork. (Consider what if amounts were disputed by company. A judge has to consider merits of claims and that takes time and the company can pay off the creditors before a judge gets to consider details to decide whether to put company into involuntary bankruptcy.)

Is 1. The filing of the paperwork sufficient to cause a true judgement here or is this insufficient to "force involuntary bankruptcy proceedings"?

If that is insufficient then 2. Is the start of case being considered in court sufficient for resolution?

or 3. Does Twitter actually have to enter involuntary bankruptcy? What if there is chapter 11 protection from bankruptcy instead?

@ChristopherRandles All that needs to happen is the creditors need to attempt to force bankruptcy. Doesn’t necessarily have to happen.

@BTE So three contractors seeking to bankrupt Twitter over disputed debts would count even if the judge refused to proceed further on the basis that the debts were contested?

@NiallWeaver Would that judge not be making that judgement as part of the bankruptcy proceedings?

If the judge ruled the disputed debts were not valid then the 3 creditors are not really creditors. If partly disputed and partly paid such that the judge doesn't rule for involuntary bankruptcy then likewise I think you can say they are not creditors at the time of the ruling but some may have been outstanding at the time the paperwork was first filed. So it could be rather ambiguous

>"This market resolves YES if any creditors work together to force bankruptcy proceedings by the end of 2023."

So how does this work? Suppose 3 or more creditors work together to file for bankruptcy proceedings but Twitter then pays them before the proceeding start making the application invalid before proceedings start and filing is withdrawn. Does the existence of the filing cause a true judgement or does the proceedings not starting mean the question is still open until deadline?

@ChristopherRandles It doesn't work like that. The bankruptcy proceedings would be involuntary, at that point it is too late for Twitter to pay them and why would you take it when you could just own Twitter. Some of the creditors include Oracle, Google, Amazon, companies that would happily take Twitter for peanuts. Perhaps this is what Musk is hoping for since he doesn't need the money?

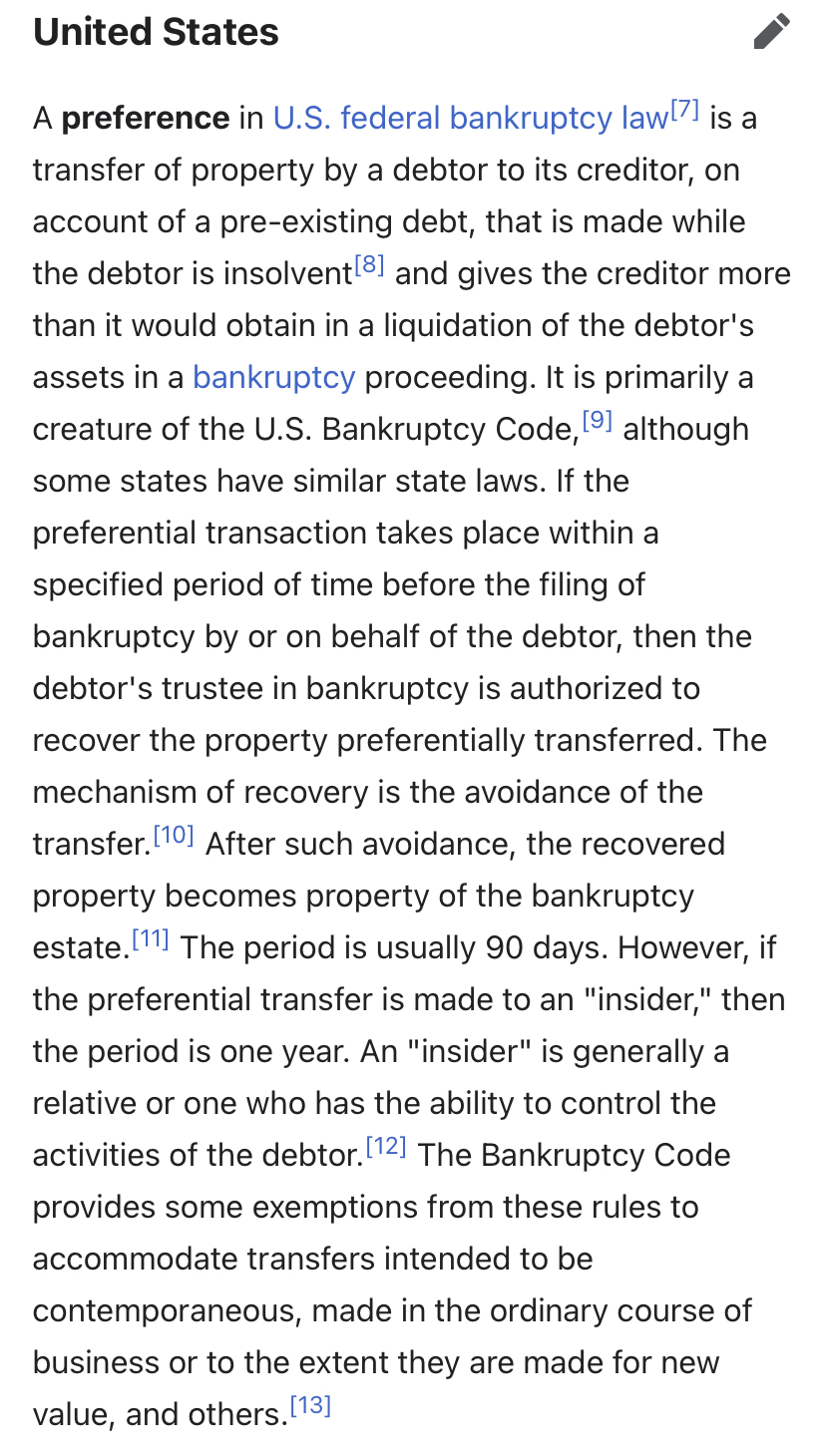

@ChristopherRandles I can’t speak authoritatively for the US but at least in some jurisdictions if you pay off one creditor in preference to others whilst insolvent, and go bankrupt later, the payment can be clawed back from the preferred creditor so that it’s shared equitably amongst all creditors.

@NiallWeaver This is true if you pay yourself or a related party. It never happens with paying an unrelated 3rd party. The company only goes insolvent when Musk makes official decision not to provide further funding. Until that point company can pay 3rd parties while the company is not insolvent because there is chance Musk will provide adequate funding.

@BTE If the company actually goes bankrupt the unsecured creditors likely get very little, with most getting swallowed up by secured creditors and the administrators fees. It is a bit of a nuclear option for unsecured creditors where all lose. Unsecured creditors in such a position would gladly take payment rather than get very little.

Puck article suggest Musk could pay (well obviously he could) but isn't doing so in order to try to buy out banks loans at a cheap rate. If this is Musk's game and he takes it too far with some creditors then he can provide cash to Twitter in order for Twitter to pay creditors.

I simply don't believe it is instant, the moment paperwork is filed, it makes a lot of sense to see if the parties can work out a settlement before destroying lots of value by putting company into bankruptcy.

@NiallWeaver I don't dispute that but while Musk is providing funds to Twitter as needed according to him then Twitter isn't insolvent (even if it is technically insolvent for having a negative balance sheet).

Proving when a company is insolvent is very hard for a third party, much easier for a director with the necessary information. Paying yourself or a relative or a company owned by a relative when company is insolvent will likely get you into trouble and could result in funds being clawed back.

Paying an unrelated 3rd party for bills due when the directors are maintaining the company is solvent would only result in action by other creditors only in extreme circumstances because it is so difficult for those creditors to prove when the company became insolvent. Insolvency is often a director decision as to when they decide to stop providing funding. Technically it may be possible to pursue, but I still suggest this practically never happens with unrelated 3rd parties being paid in ordinary course of business.

I know situation in UK reasonably well being a Chartered Accountant. My knowledge of US law and practices is much less but I doubt there is that much difference.