🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ929 | |

| 2 | Ṁ459 | |

| 3 | Ṁ70 | |

| 4 | Ṁ12 | |

| 5 | Ṁ5 |

People are also trading

@BoltonBailey Lol, I'm dumb, I posted this on the right market, I scrolled up and saw the embed and thought I posted it in the wrong one.

Manifold team, please give us the power to ninja edit/delete our comments.

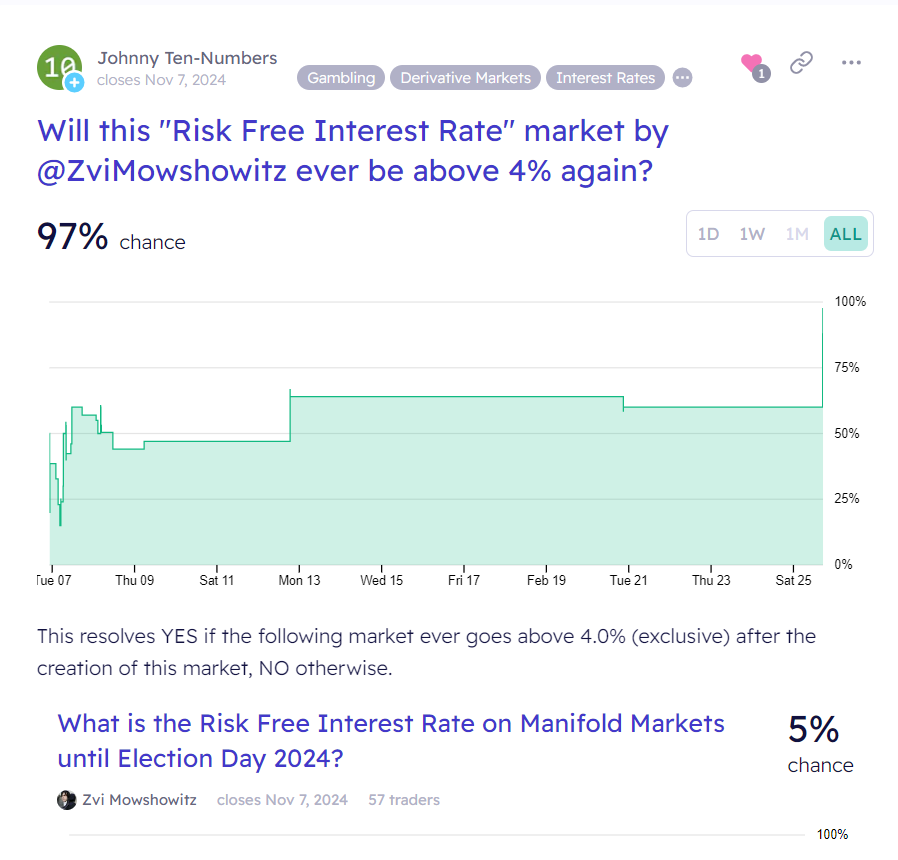

@BoltonBailey This is super weird now though, right? The mispricing just isn’t remotely disappearing despite being very public. Let me spell it out even more, maybe give that old invisible hand a nudge:

Let’s say the underlying market by @ZviMowshowitz is at 1% and this derivative is at 50%, which is about the current value. Then you can buy M$2 of NO here and M$1 of YES in the other market with a limit order to sell at 4%. Then either way, you get back M$4 on your M$3 investment. 33% ROI, risk-free! @Catnee might be up to something, but it's guaranteed fixed profit for the arbitrageur either way.

Personally, my time discounting is too steep to do that. The strategy might take more than a year. But it’s way better returns than buying boring NOs in that other market.

@1941159478 I wouldn't say the ROI is 33%. To be truly risk free you need to be guaranteed to make a profit even if this market resolves YES. If you bet $1M on this market at 50% to make M$2 if this resolves NO, you need to be making the M$1 in profit from your 4% limit order which requires you to reserve M$25 for that order. So the ROI should only be 8%.

@BoltonBailey Sorry that's in the situation where you're ok making nothing if this resolves YES. If you want to make a profit either way, you need to double the money you reserve for the other market.

@BoltonBailey Lots of imprecise math in the above post, but again, no way to edit my mistakes, sorry folks.

@1941159478 I think I didn't get what you were saying in your comment - you were suggesting to bet on YES in the other market because that way if the price goes up you automatically have the money to cash out the limit order. This makes sense, but last I recall, you couldn't cash out a limit order if you're broke, even if you held the opposite outcome share. Maybe this has changed, though.

@BoltonBailey Oh yeah, you’re totally right! You do need some cash on hand to fill the limit order. The nice thing about that M$25 (or however much) maybe would be that you’d get it back immediately when your newly bought NO shares cancel out the YES shares. So at least for users who have some liquidity anyway for other trading adventures it wouldn’t tie up capital. And even 8% ROI is much better than that other market. So I do maintain that the market is being stubbornly irrational.

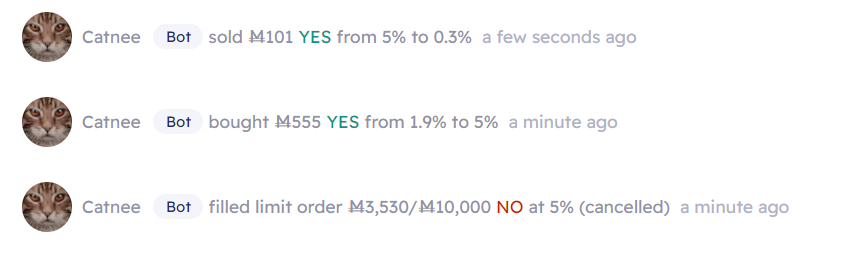

@1941159478 I think the plan for yes is that people make limit orders for the free mana but then don't have the mana to cover them and they are canceled. Not impossible, but the more no limit bettors the less likely it becomes.

@AndrewG oh wait, that doesn't even seem to be correct; probably a UI bug (the limit orders should make this several thousand)

@AndrewG I think the M$250 is correct, you just have lots of leverage against the limit orders at small probabilities.

And there is a different k(risk-free!) arbitrage possible too: Since the probability here is currently more than 25 times that of the original market, you can buy NO here, buy YES there and put a NO limit order at 4% to sell them.