This question relates to the result of the Rootclaim challenge: https://manifold.markets/chrisjbillington/will-bsp9000-win-the-rootclaim-chal

Rootclaim published an 89% likelihood that the COVID-19 pandemic began as a leak of an engineered virus from a research laboratory. A debate was held in front of two judges asked to determine if the likelihood was over or under 50%. What did the judges believe the likelihood to be following the debate?

tl;dr The probability associated with this market is "37% chance" for the past few hours. If the result is announced anytime in the next few hours, the result will be compared to a 2.6-logit increase (2.6 = 13/5) in lab-leak probability from 89% to about 99.1%. If judges agree with numbers in Rootclaim's final presentation, the market resolves "NO" and if judges find "lab leak" even a bit less likely that Rootclaim or more, the market resolves "YES".

Per @PeterMillerc030:

It was requested, but not required, that judges give a number to estimate the relative probability of the 2 Covid origin theories.

Regarding the expected timing of announcing the result, @PeterMillerc030 most recently wrote:

For reasons outside of my control, I am unfortunately unable to share the outcome of the Rootclaim debate at this time. The expected date of publication is now February 18th.

The question resolves at time time that:

Both judges estimated likelihoods (or decision not to give an estimate) are published, or, if sooner,

Two weeks after the overall result is announced, and

Any judge not providing a probability will be assigned likelihood of 50% if undecided, 89% if decided in favor of Rootclaim (>50%), and 11% if deciding in favor of Peter Miller (<50%).

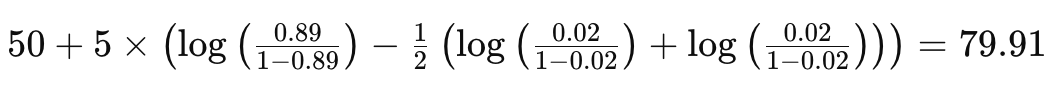

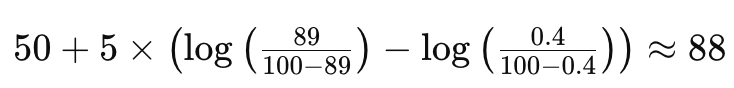

At that time, the median likelihood of this market the 24-hour period prior to the announcement will be calculated to determine the reference value, X. This will be compared to Y, the average shift in likelihoods given by judges, relative to Rootclaim's public 89% probability, measured in logits.

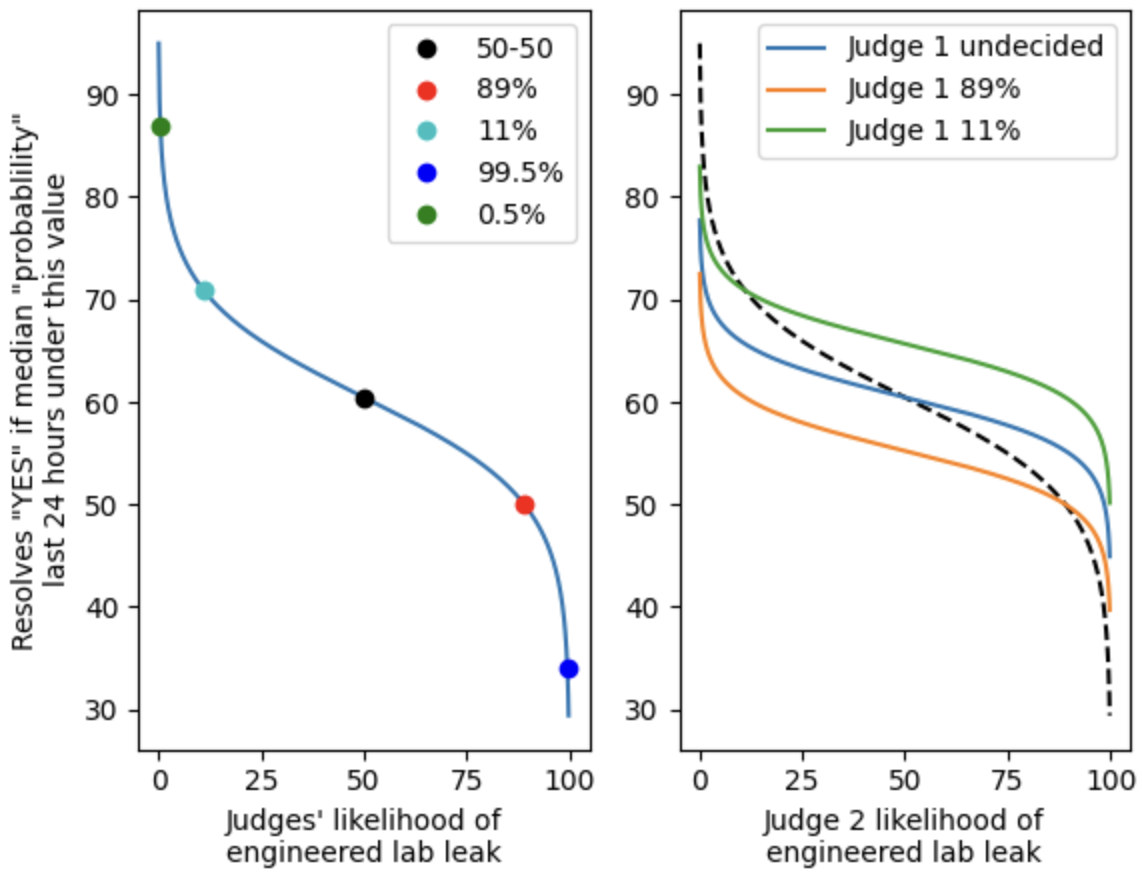

If X is less than 50+5*Y then the market resolves YES. The factor of 5 is quasi arbitrary to make a wide range of reasonable prices that includes Rootclaim's likelihoods given during the debate (circa 99.5%) as well as equally low likelihoods.

Here are some examples for when both judges give equal likelihoods or when one judge gives a decision without a likelihood.

I will not participate in this market.

Some contingencies:

"Announcement" means results are public, unambiguously acknowledged to be true by Peter Miller and/or Rootclaim, and neither party unambiguously states that the results are false.

I will try to check in on this daily and resolve as quickly as I can. It's conceivable that the precise timing of the announcement will be somewhat ambiguous and I will take up to 24 hours consider any arguments in the comments regarding correct timing.

If results are published less than 24 hours after posting, the median price over the entire history of the market will be used.

I'm not entirely clear on which likelihoods judges were asked to give; I will calculate the most similar quantity possible to: "likelihood the COVID-19 pandemic originated as a lab leak of an engineered virus, normalized by the sum of likelihoods of scenarios considered by the judges." This will handle the case where judges were asked to compare "zoonosis" to "engineered virus lab leak" without considering other scenarios, but 89% will still be used as the reference.

I will check back later today and resolve NA if I screwed up something fundamentally and erase this bullet point if not.

Edits since posting:

More detail in figure axes labels for examples

Added tl;dr

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ109 | |

| 2 | Ṁ35 | |

| 3 | Ṁ33 | |

| 4 | Ṁ28 | |

| 5 | Ṁ5 |

People are also trading

To make sure everyone is as up to date as I am on public information, "Both Rootclaim judges were over 98% confident that covid is not a lab leak."

https://manifold.markets/IsaacKing/did-covid19-come-from-a-laboratory?tab=comments#y3wqzoc42o

The current 24-hour median is ~88 and the person who made that statement also bid the price up to 97, so you can draw your own inferences about the likelihood that he (1) is pulling our chain, (2) knows likelihoods will be announced soon and are about 99.6% or higher "not a lab leak", (3) knows likelihoods will be announced later and are even higher.

Edit: And yes I should've just made a multiple choice market.

@zcoli "the median likelihood of this market the 24-hour period prior to the announcement" - when the announcement happened, the market was below 70% and had never been above 70%. so i think this should resolve YES pretty much no matter what happens going forward. Both judges published documents clearly giving credences <2% for lab leak

@JulianMTG Yeah if that's the case and the docs are published then sure I just haven't seen that they're published yet. Will resolve if so.

@JulianMTG OK I found the written decisions are now included in the descriptions the judges' respective youtube videos:

https://www.youtube.com/watch?v=OKwunTJ1b40

https://www.youtube.com/watch?v=YlxTztAkdGQ

Given the likelihoods given, the question clearly resolves YES.

@zcoli Yes, to be clear, the written documents were made public with the videos yesterday afternoon. Before that the odds on here were 65%

@zcoli I’m told that in Bayesian frameworks these sorts of numbers are as close as you get to a sure thing and it’s not worth looking more closely. However I think it’s still good to see the remaining data that could be published and more samples from nature even if it seems very unlikely to change my mind.

@Pykess The time is more confusing that price! Are the judge’s individual odds published yet? If they are not and they are not published within the next two weeks, their probabilities will be assumed to be 11% (ie would resolve to NO from 90%, but would resolve YES from current median of last 24 hours circa 60%).

this is a weird market. if the fair value for the comparison threshold is 70%, that doesn't mean the market price should go to 70% really, due to YES buyers getting a worse payout when the price gets close to 70. We're also partially betting on the timing of the announcement and behavior of other participants. What is the goal here?

@JulianMTG The goal for me is to see what people think that judge's will think. If someone thinks the current 55% is low and are would get uncomfortable around, say, 80%, they can buy YES now, place a limit order of an equal potential profit for NO at 80% and be OK?

So at the moment I could hedge Ṁ100 YES with about a dozen NO at 80%. The 24-hour-median also helps not need to pay too much attention too regularly to what others are doing.

To help people calibrate a fair price here, the “will Peter Miller win…” market embedded in this comment is for the likelihood of a better outcome for Peter Miller than (1) judge 1 undecided and (2) judge 2 decides less than 50% lab leak likelihood. The right side of the figure shows that in that case the market will resolve “YES” if the median likelihood in past 24 hours is below about 60, and will resolve “NO” otherwise. So in a rational, liquid market we are currently undervalued at 45, but liquidity is very low.

@VNetChrome Honestly I did not follow Rootclaim’s presentation closely enough to know how specific they were about this.