Fractional shares if needed, Reinveseting dividends

Tracking spreadsheet: HERE

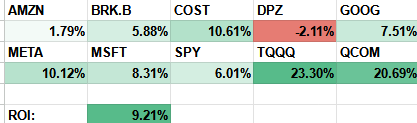

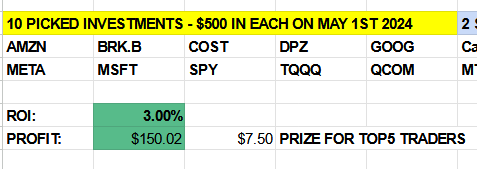

10% into the following 10 picks determined by Manifold predictions:

META, DPZ, TQQQ, COST, MSFT, BRK.B, SPY, GOOG, AMZN, QCOM

See:

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,127 | |

| 2 | Ṁ293 | |

| 3 | Ṁ223 | |

| 4 | Ṁ30 | |

| 5 | Ṁ21 |

People are also trading

spreadsheet now helps track roi https://docs.google.com/spreadsheets/d/1s1OxlwEalnadLVi8z0OMdV-tToKSRUnu8NpE52AF1hQ/edit#gid=0

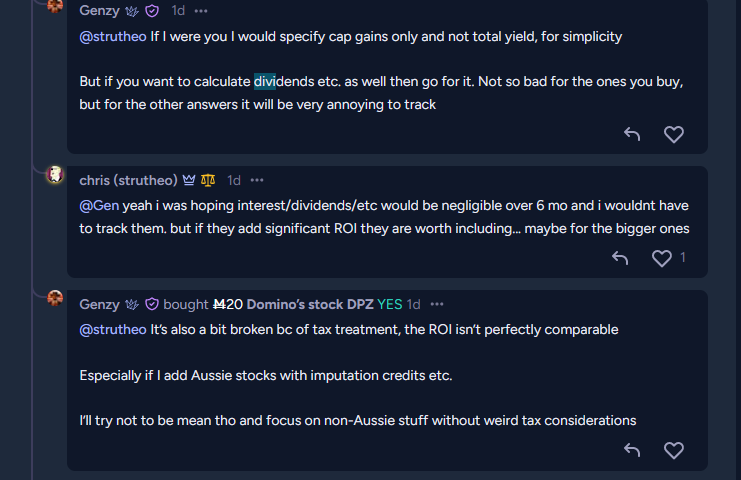

@strutheo Like, if I recommend you a stock that pays a 20% special dividend, and ends flat, you will treat it as though it didn't make money even though it returned 20%?

@strutheo It's a thing that happens from time to time. I'm not making a recommendation right now.

Anyway, just enable automatic dividend reinvestment, which any broker will let you do.

@strutheo Oh, internationals, yuck.

But if you don't count dividends you are hugely discriminating against stocks that pay them. Some are significant.

@HarrisonNathan i might just decide when the 10 are chose, and only track it for those 10 and not the others...?

@strutheo Well, it's easy with the ones you choose, if you just reinvest the dividends. For others, it might be annoying. It probably won't matter for most, but if a stock pays a large dividend or is right on the line, it may make a difference. It will probably only be relevant to a few names anyway, so not a huge deal to calculate.