Resolution Criteria: US-China Trade Deal Before June?

This market will resolve to “Yes” if the United States and the People’s Republic of China jointly announce a finalized agreement related to trade and/or tariffs between April 8, 2025, and May 31, 2025, at 11:59 PM Pacific Time (PT).

To qualify:

• The agreement must be mutually confirmed by both governments through official press releases, public statements, or signed documentation.

• The agreement must include substantive trade or tariff-related terms, such as adjustments, reductions, or new trade commitments.

• Agreements involving additional countries will qualify only if the US and China are explicit signatories and the trade-related terms between them are clearly stated.

Resolution Sources:

• Official communications from the White House, U.S. Trade Representative (USTR), or Department of Commerce, and from China’s Ministry of Commerce or Ministry of Foreign Affairs.

• In the absence of a joint statement, an overwhelming consensus of credible media reporting confirming a finalized, mutual agreement will also suffice.

The market will not resolve to “Yes” if:

• There are only unilateral, informal, or non-binding announcements.

• Negotiations are ongoing or announced but not finalized.

• The joint announcement occurs after May 31, 2025, 11:59 PM PT, even if negotiations conclude earlier.

If no qualifying agreement is announced within the time window, this market will resolve to “No”.

Update 2025-05-13 (PST) (AI summary of creator comment): The creator confirms their interpretation: An interim agreement (e.g., a temporary tariff pause) does not count as a "finalized agreement" if broader trade negotiations are still ongoing. Such a situation falls under the existing exclusion that the market will not resolve to "Yes" if "Negotiations are ongoing or announced but not finalized".

Update 2025-05-13 (PST) (AI summary of creator comment): Regarding Resolution Sources: Official communications from the listed US and Chinese government entities must be published on their respective official government websites.

Update 2025-05-13 (PST) (AI summary of creator comment): Regarding a joint statement as the 'Official communication' for resolution:

The text of the joint statement itself must be published on the official government websites of both a listed U.S. entity (White House, USTR, or Department of Commerce) and a listed Chinese entity (Ministry of Commerce or Ministry of Foreign Affairs).

A mere reference to a joint statement by one government, or a unilateral confirmation of a statement primarily published by the other, is insufficient. The joint statement text itself must be published by the specified entities on both sides.

Update 2025-05-13 (PST) (AI summary of creator comment): A temporary agreement, such as a tariff pause, can qualify as the 'finalized agreement' required for a 'Yes' resolution. This is contingent on the agreement meeting all joint publication requirements previously outlined (i.e., the text of the joint statement itself must be published on the official government websites of both a listed U.S. entity and a listed Chinese entity). Such a published temporary agreement can lead to a 'Yes' resolution even if broader trade negotiations are still considered ongoing.

Update 2025-05-13 (PST) (AI summary of creator comment): The creator emphasizes that an agreement must be finalized and published to qualify for a "Yes" resolution.

Finalized: A temporary agreement (e.g., a tariff pause) made while broader trade negotiations are still ongoing is not considered "finalized". This aligns with the existing market rule that the market will not resolve to "Yes" if "Negotiations are ongoing or announced but not finalized."

Published: The agreement must be published according to previously stated requirements: the text of the joint statement itself must appear on the official government websites of both a listed U.S. entity and a listed Chinese entity.

Update 2025-05-14 (PST) (AI summary of creator comment): The creator has announced that this market will be resolved as N/A. See the linked comment for the announcement.

People are also trading

Joint Statement from White House

中美联合声明 from MOFCOM (in Chinese)

China and US

Trade Deal

Before June

A objective YES resolution.

@Joshua I agree with you, but at the same time Polymarket is not well known for providing a correct resolution. As we seen the case with Gold missing from Fort Knox and many other markets.

But I will leave it to the traders and @mods like yourself to intervene. Whatever you guys think is correct thing to do, I will gladly follows general consensus's advice.

@predyx_markets please don’t. Your criteria are well chosen and clearly explained. You should be in charge of evaluating and resolving your own market!

@predyx_markets Super confused as to what's going on here. We are now betting on the definitions of the words "finalized" and "published"?

I bet No here, under the logic that the Trump admin is incompetent and bad at negotiation, China wouldn't budge easily, and the tariff clusterfuck would likely continue.

I think I lost that bet, as there's a reasonably good deal now with lower tariffs. Everyone betting here seemed to agree. Polymarket seemed to agree. So I sold out for whatever mana I could salvage.

I'm happy enough to lose Mana because I made a bad prediction (i.e. if this resolves Yes). I'd be rather annoyed if this resolves No based on some technicality.

But now I suppose you have other people that are betting the opposite direction based on your rules clarification, and those people are going to have the opposite views, if the rules change again and this does resolve Yes. So I can see why Joshua is saying N/A.

Up to you, of course, but I basically wouldn't touch this market, at the moment, since we're no longer predicting some external event, we're just trying to guess what the rules mean and if they will change again.

@predyx_markets It's a tough case and I think there are good arguments for yes and no, which is a great time to N/A since it's all just play money. Trade relations are just a very difficult thing to write airtight rules about.

@Joshua there is no technicality here.

They finalized a agreement reducing the tariffs and both parties published their joint statements.

Everything happened before June.

https://manifold.markets/predyx_markets/uschina-trade-deal-before-june#uigprifkvyh

@predyx_markets I'm a bit confused. How can this N/A? It's not June yet. Isn't it still possible for this to unambiguously resolve YES?

@spiderduckpig All they did was agree to temporarily pause tariffs while negotiations continue. Trade deals are extremely complex taking on average around 18 months to finalize. Even though the administration backed itself into a corner and wants to expedite the process, I think it’s unlikely anything gets done before the 90 day pause expires let alone in just 14 days.

@ReeMARKable if I read the qualifying terms for the agreement:

– agreement must be mutually confirmed by both governments ✅

– agreement must include substantive trade or tariff-related terms (tariff pause) ✅

– agreement does not involve additional countries, so third term does not apply

Also, the agreement is obviously "related to trade and/or tariffs". So I wonder, what prevents the pause agreement to qualify for a Yes resolution?

@aleven I don’t think the criteria has been met though to warrant a YES resolution based off of two conditions. First, as stated above “This market will resolve to “Yes” if the United States and the People’s Republic of China jointly announce a finalized agreement related to trade and/or tariffs between April 8, 2025, and May 31, 2025, at 11:59 PM Pacific Time (PT).” No finalized agreement has been announced as negotiations are still on going as the administration stated.

Second, stated at the bottom “The market will not resolve to “Yes” if:

• There are only unilateral, informal, or non-binding announcements.

• Negotiations are ongoing or announced but not finalized.

• The joint announcement occurs after May 31, 2025, 11:59 PM PT, even if negotiations conclude earlier.” The current 90 day pause would fall under these conditions.

This is just my opinion though. I only brought a small amount of NO shares because I saw potential value in the chance that the creator interprets the resolution conditions the same as I me when I first read them. Maybe the creator will update the traders on the current status of the market.

@ReeMARKable I think your doubts are warranted, buying No was a wise call. My logic is that this is a joint statement stating that the two countries have agreed to modifying application of duties (it is a pause, but still, it is an agreement and has to do with tariffs). So all the conditions seem to apply. If negotiations were ongoing, or countries did not go beyond announcements, i.e. did not agree to taking any specific action, then I would see the case for a No.

@ReeMARKable is correct.

No finalized agreement has been announced as negotiations are still on going as the administration stated.

Joint announcement:

Official communications from the White House, U.S. Trade Representative (USTR), or Department of Commerce, and from China’s Ministry of Commerce or Ministry of Foreign Affairs.

@predyx_markets https://www.cnn.com/2025/05/12/business/us-china-trade-deal-announcement-intl-hnk

>A spokesperson for China’s Commerce Ministry called the joint statement “an important step by both sides to resolve differences through equal-footing dialogue and consultation, laying the groundwork and creating conditions for further bridging gaps and deepening cooperation.”

Official communications must be published from Government website of White House, U.S. Trade Representative (USTR), or Department of Commerce, and from China’s Ministry of Commerce or Ministry of Foreign Affairs.

@predyx_markets PRC MFA website published a press conference which just says to refer to the official readout:

>Bloomberg: We understand that as a result of the talks in Switzerland, China will lower tariffs on U.S. goods to 10 percent from 125 percent for 90 days and the U.S. will cut its tariffs on Chinese goods to 30 percent for 90 days. Can you comment on the outcome of the negotiations in Switzerland? (A similar question was asked by China-Arab TV)

Lin Jian: Regarding the China-U.S. high-level meeting on economic and trade affairs, the Chinese side has issued a readout, and the two sides have just released a joint statement reached at the meeting, which you may refer to.

https://www.fmprc.gov.cn/mfa_eng/xw/fyrbt/202505/t20250512_11619489.html

"the two sides have just released a joint statement reached at the meeting, which you may refer to"

- Doesn't qualify. We need to see joint statement published from White House, U.S. Trade Representative (USTR), or Department of Commerce, and from China’s Ministry of Commerce or Ministry of Foreign Affairs

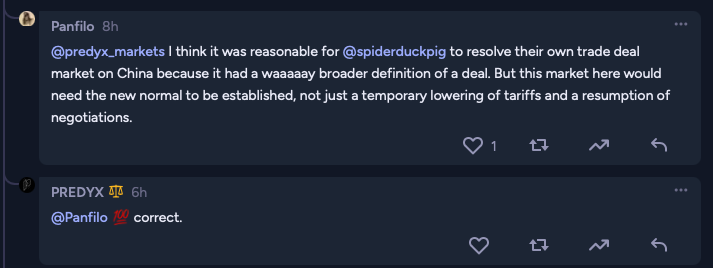

@predyx_markets I think it was reasonable for @spiderduckpig to resolve their own trade deal market on China because it had a waaaaay broader definition of a deal. But this market here would need the new normal to be established, not just a temporary lowering of tariffs and a resumption of negotiations.

@predyx_markets What I understand from this thread is that the missing criterion is that the statement has not been published by PRC MFA? There is nothing in the resolution criteria about establishing “the new normal”. Also, the fact that there are ongoing negotiations is disjoint from the fact that a joint statement has been released (while I understand not published by an official PRC source)

@predyx_markets @aleven I agree, determining this to not be a trade deal seems kind of arbitrary to me

@spiderduckpig what is questionable, in my opinion, is conflating the “resolution source” (joint statement that is published from both the WH as well as an official PRC body like those listed by the creator) with “qualifying terms to resolve yes”, which I think have been met per my previous comments.

@predyx_markets even in absence of a statement published on PRC govt channels, one can rely on media reporting, as per your criteria. The CNN article linked above is titled “US and China agree to drastically roll back tariffs in major trade breakthrough”. I am sure many more such articles can be found. Why can’t we use these as a resolution source? Waiting for publication of the statement from PRC govt channels seems a pretty thin reason not to resolve Yes, in my opinion.

@predyx_markets it’s not a matter of being sorry, I would like to know what prevents the “overwhelming consensus of credible media reporting confirming a finalized, mutual agreement” resolution criterion from kicking in, in absence of the publishing.

@predyx_markets I am confused, if the issue is merely that the MFA has not yet published it, can we go over the resolution criteria and see what exactly is not being met? I thought earlier you were saying that this doesn't count because you were saying it's not a final deal and there are negotiations, but if the issue is that the MFA didn't publish a statement on their website, where is this in the resolution criteria? Is the issue that the deal as it stands now does not count as a deal, or that the deal has not been published?

>The agreement must be mutually confirmed by both governments through official press releases, public statements, or signed documentation.

It was confirmed through press releases on both sides

>The agreement must include substantive trade or tariff-related terms, such as adjustments, reductions, or new trade commitments.

>Agreements involving additional countries will qualify only if the US and China are explicit signatories and the trade-related terms between them are clearly stated.

I think these are clearly true

>Official communications from the White House, U.S. Trade Representative (USTR), or Department of Commerce, and from China’s Ministry of Commerce or Ministry of Foreign Affairs.

>In the absence of a joint statement, an overwhelming consensus of credible media reporting confirming a finalized, mutual agreement will also suffice.

The MFA did indeed communicate, through a press release. However, if that is not acceptable, then surely there is an overwhelming consensus that this agreement still occurred?

@spiderduckpig Must be finalized and published. I'm not arguing anymore. If you don't like this market - or are unhappy with resolution please stop trading on this market. Feel free to give me 1 stars on the resolutions - I'm expecting that.

@predyx_markets I am not angry about the market, and I certainly won't give a 1 star, I'm just asking to clarify for the market traders if the issue is that the deal as it stands is not finalized, or that the deal has not been published, or both