Resolves when a law is passed eliminating income taxes on gambling winnings. The law may be limited in scope, such as no taxes on the first $10k of gambling winnings. A deduction for winnings (not losses) would count.

This is unrelated to any notion of profits (winnings - losses), only winnings

The law must be enacted before the end of his term. If Trump is no longer president, this continues until his successor finishes the rest of his term.

Update 2025-12-11 (PST) (AI summary of creator comment): The One Big Beautiful Bill Act (OBBBA) does not count toward resolution. The OBBBA only changed the deduction for losses, not winnings. For this market to resolve YES, a law must change the tax treatment of gambling winnings specifically.

People are also trading

I haven't launched any research into this yet, but what if such a law was already passed during this term?

@nikki Uh Oh. How do you interpret the One Big Beautiful Bill?

Edit: I asked a dumb question. This is about the elimination of the taxes, not enacting them.

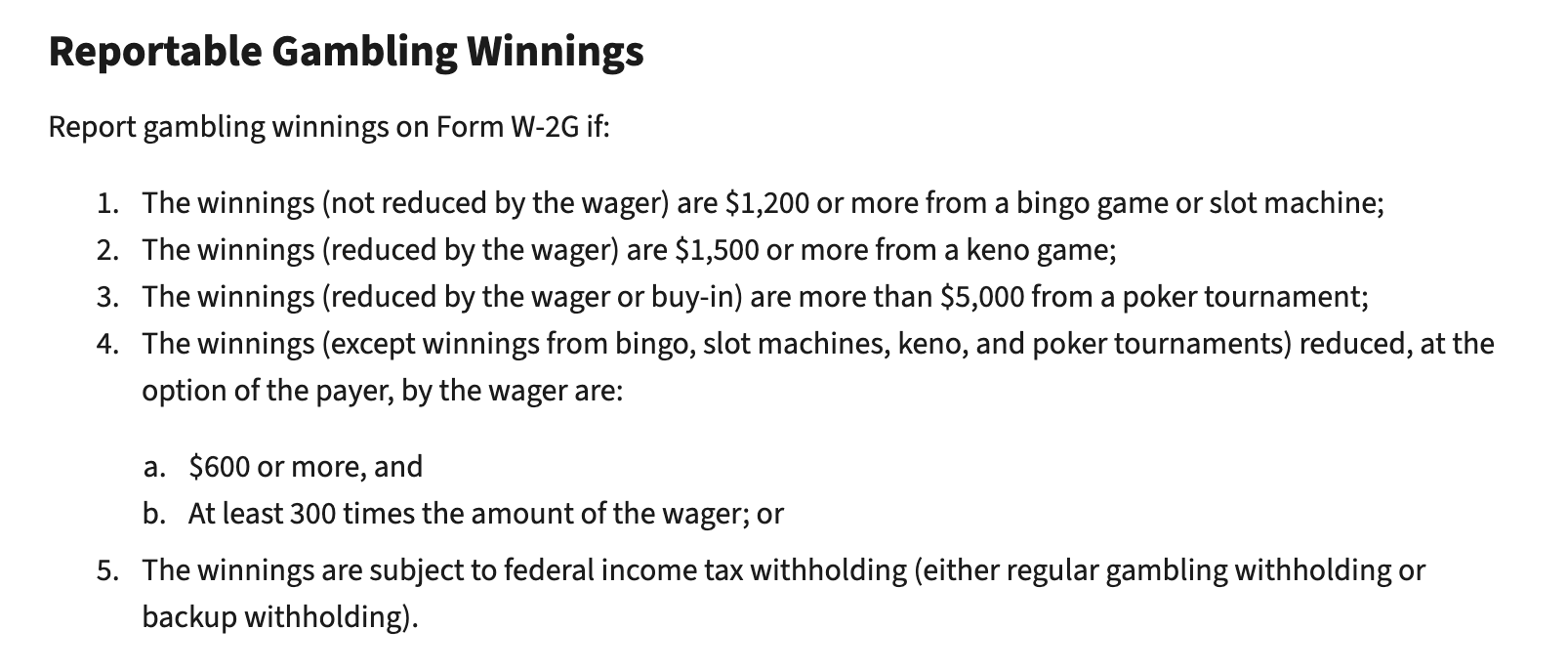

@Quroe No such law has been passed. Right now, you need to report gambling winnings on a tax return. The OBBBA only changed the deduction for losses, not winnings