Resolves to whatever my RISK credit score is at 7:00 PM Pacific Time, May 31, 2025.

Holy cow! Please be careful betting in this market!! I just found this market because some folks @'d me in the comments. Allow me to answer some questions and provide some clarity.

First and foremost: This is for fun. I want it to be useful and accurate, but that's, well, hard. It should also be noted that I update my algorithm when users report problems. This means that my system can be volatile without warning. Such as today- I pushed a major update today which incorporated new variables and changed the weights of other variables. I might even call it version 2.0 because it's such a huge update.

Okay, let's address some comments and questions now.

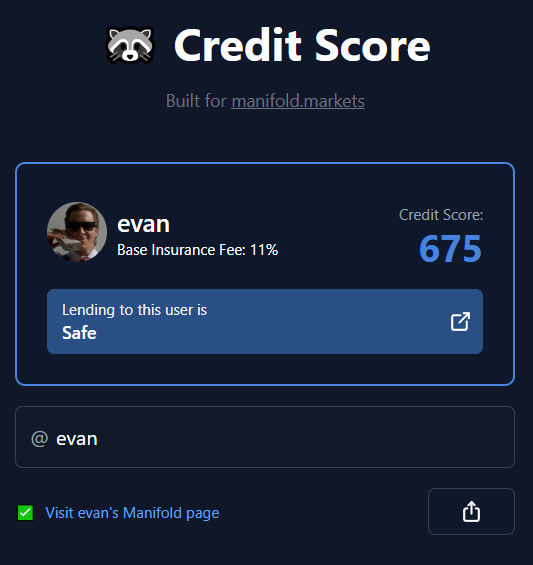

@evan mentions: "The 🦝RISK credit score mostly looks at three things: how much you have, how well you've done, and how long you've been around."

This absolutely was true when you wrote it. It is no longer the full story. Here is the updated info from our dashboard:

"

The 🦝RISK credit score is calculated using a weighted combination of six factors: your current balance, managrams, profit, account age, transaction quantity, and league rank. Each component plays a specific role:

Balance reflects how much you have.

Managrams how much you have received vs how much you have been given.

Profit tracks how well you've done financially over time.

Age adds credibility based on how long you’ve been around.

Transaction quantity reflects how much you engage with the Manifold.

League Rank gives credit for your relative performance compared to peers.

These values are combined using specific weights to produce your credit score. The formula is proprietary and central to our model, so we don’t open source the exact algorithm.

"

@GleamingRhino asks: "Do we know what affects score or is it intentionally secret?"

No, you don't know the exact formula- it is closed source but due to user demand I am probably going to open source it soon. Maybe in the next month or two.

@nikki responds to @4fa: "i've told crowl in the discord how to calculate profit correctly. the old way was only counting ranked markets"

This is true and very much appreciated. Nikki's suggestions were implemented in the version 2.0 update that was pushed today.

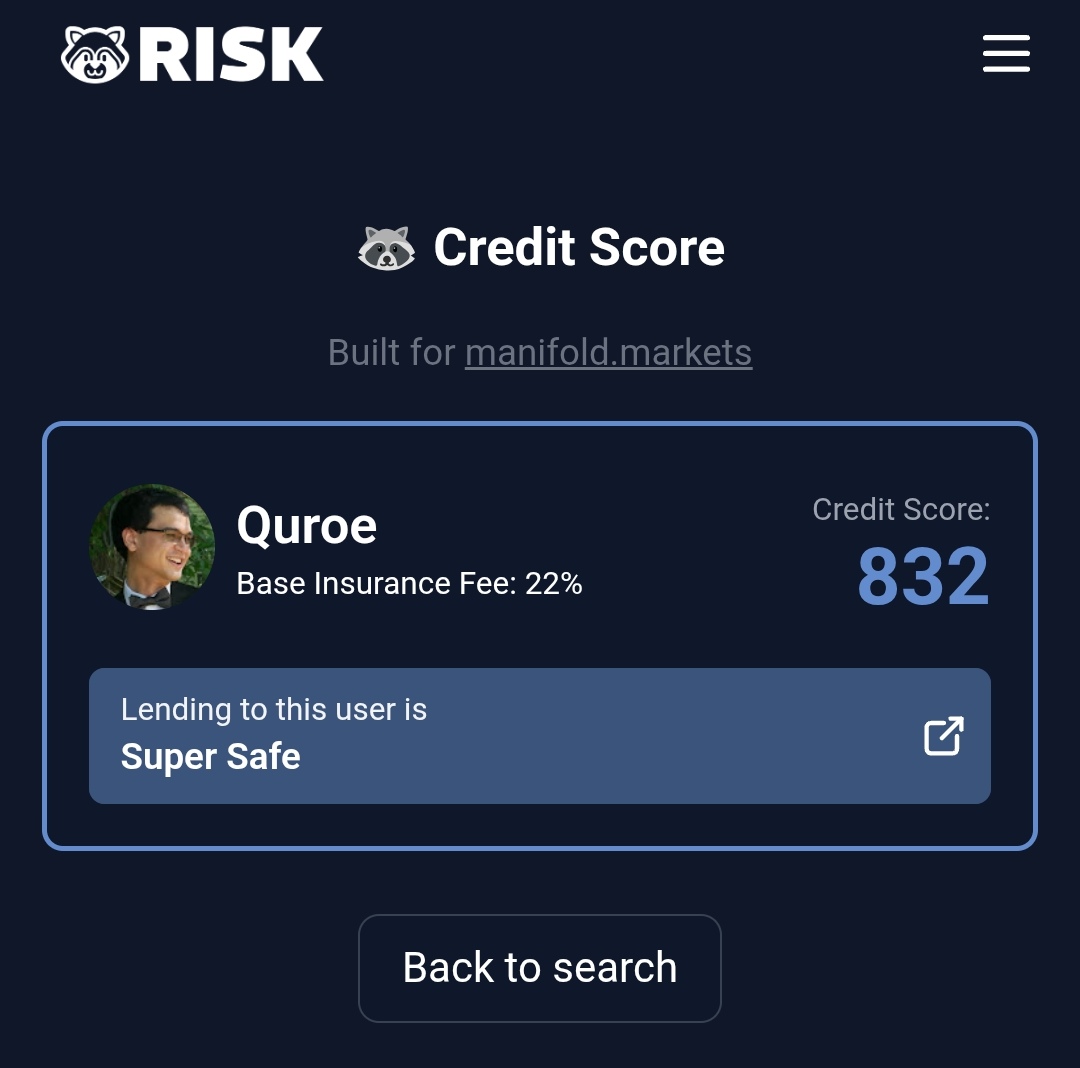

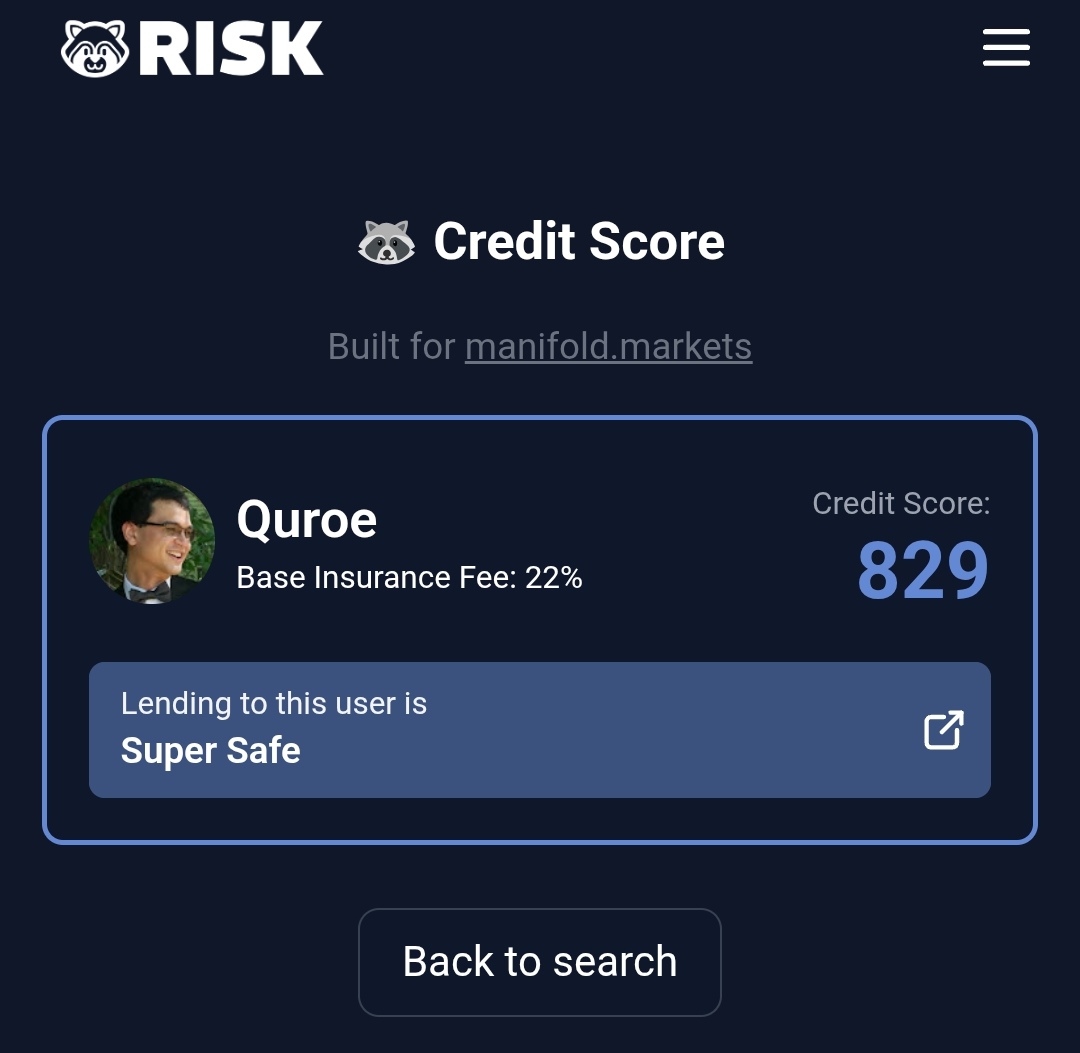

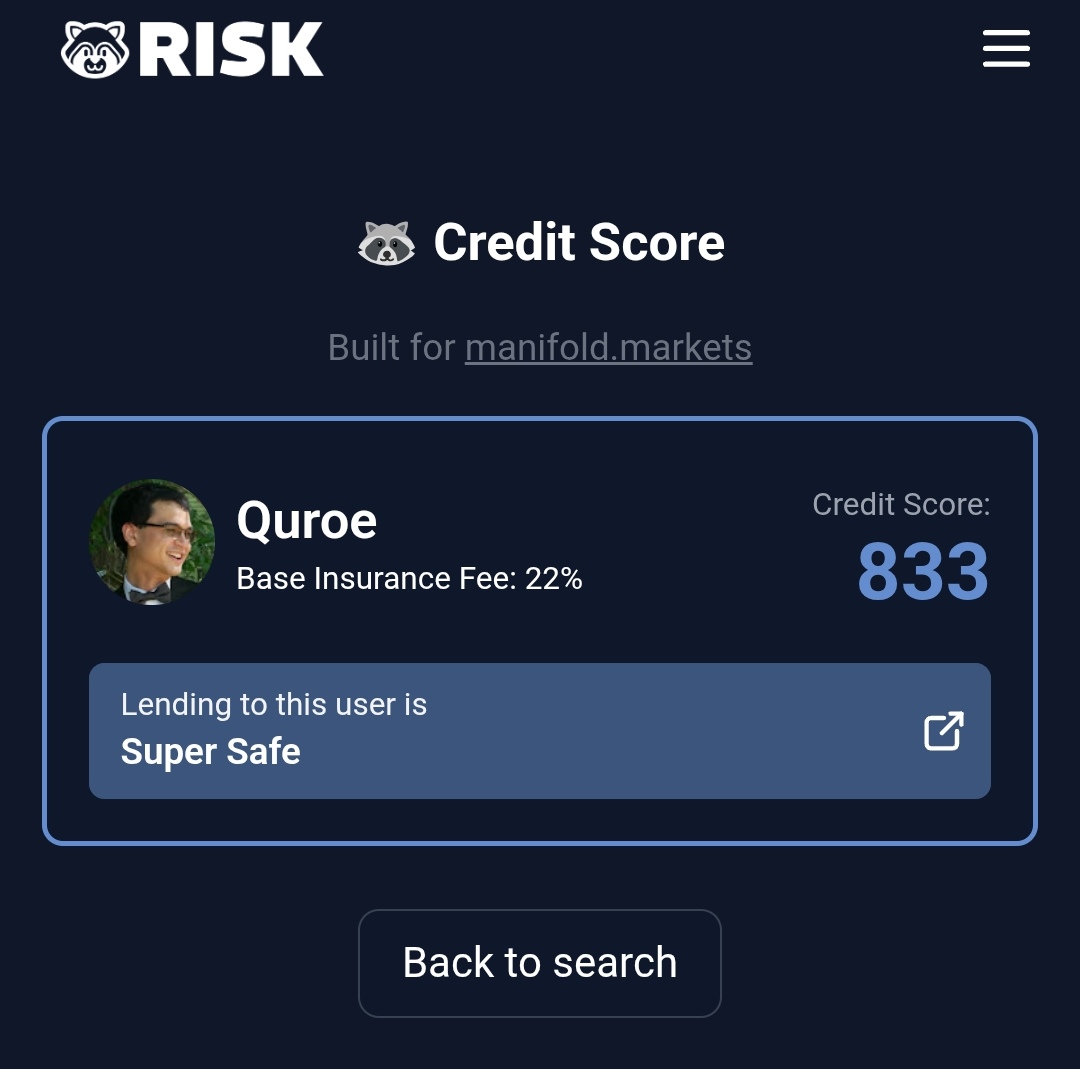

@Quroe says: "This market is now actually asking if the RISK system will identify loans in the wild.

Edit: Or, at the very least, these loans in particular."

As of today's version 2.0 update, the algorithm attempts to track this. It uses incoming and outgoing managrams to determine a number value. This value is now part of the credit score calculation.

@4fa wonders: "I've also come to this conclusion in the meantime. 😅 Now the question is whether the system is changed before this market closes – I think the loans are due after market close."

Yes the system just changed and will likely change again before this market closes.

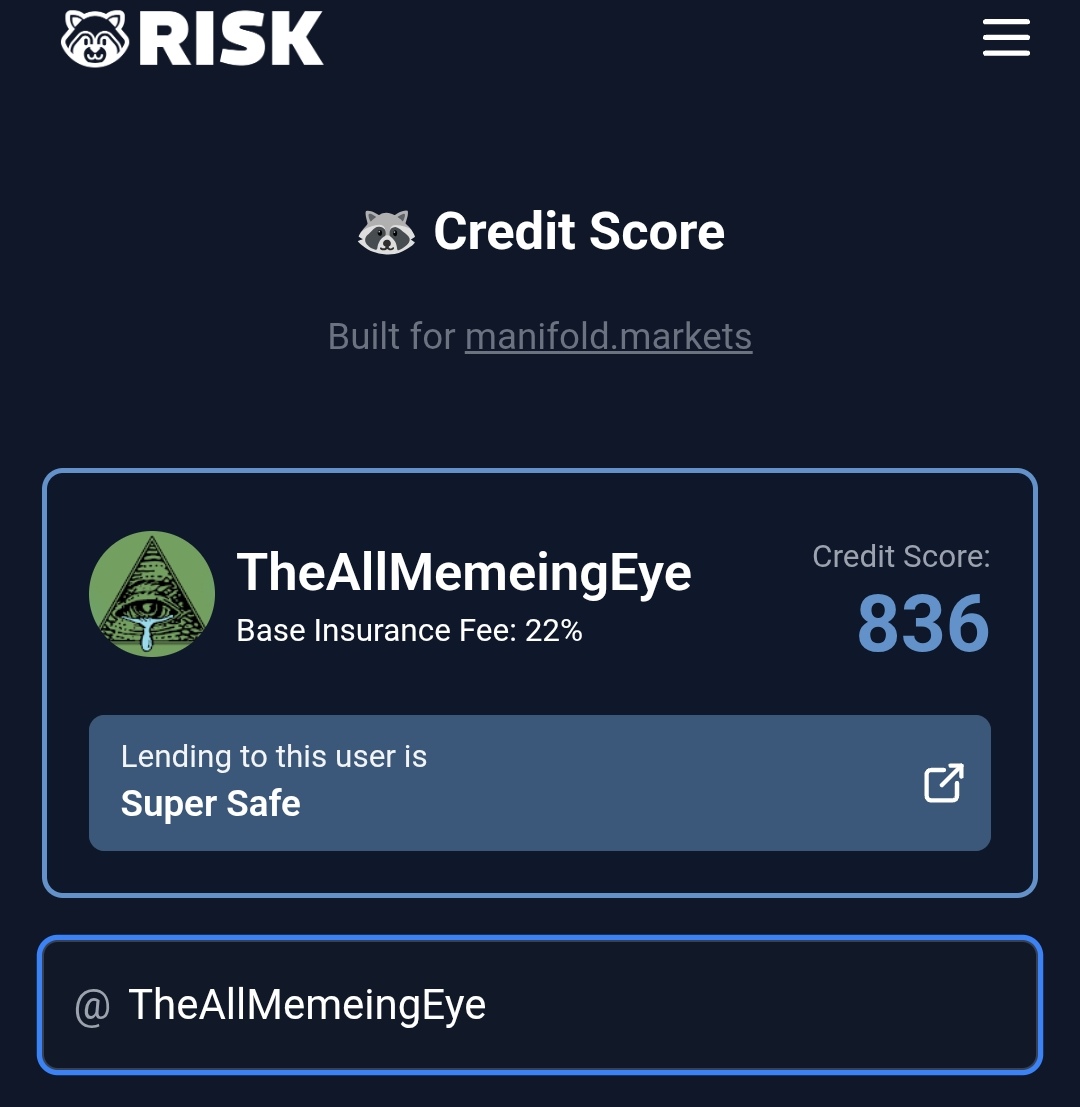

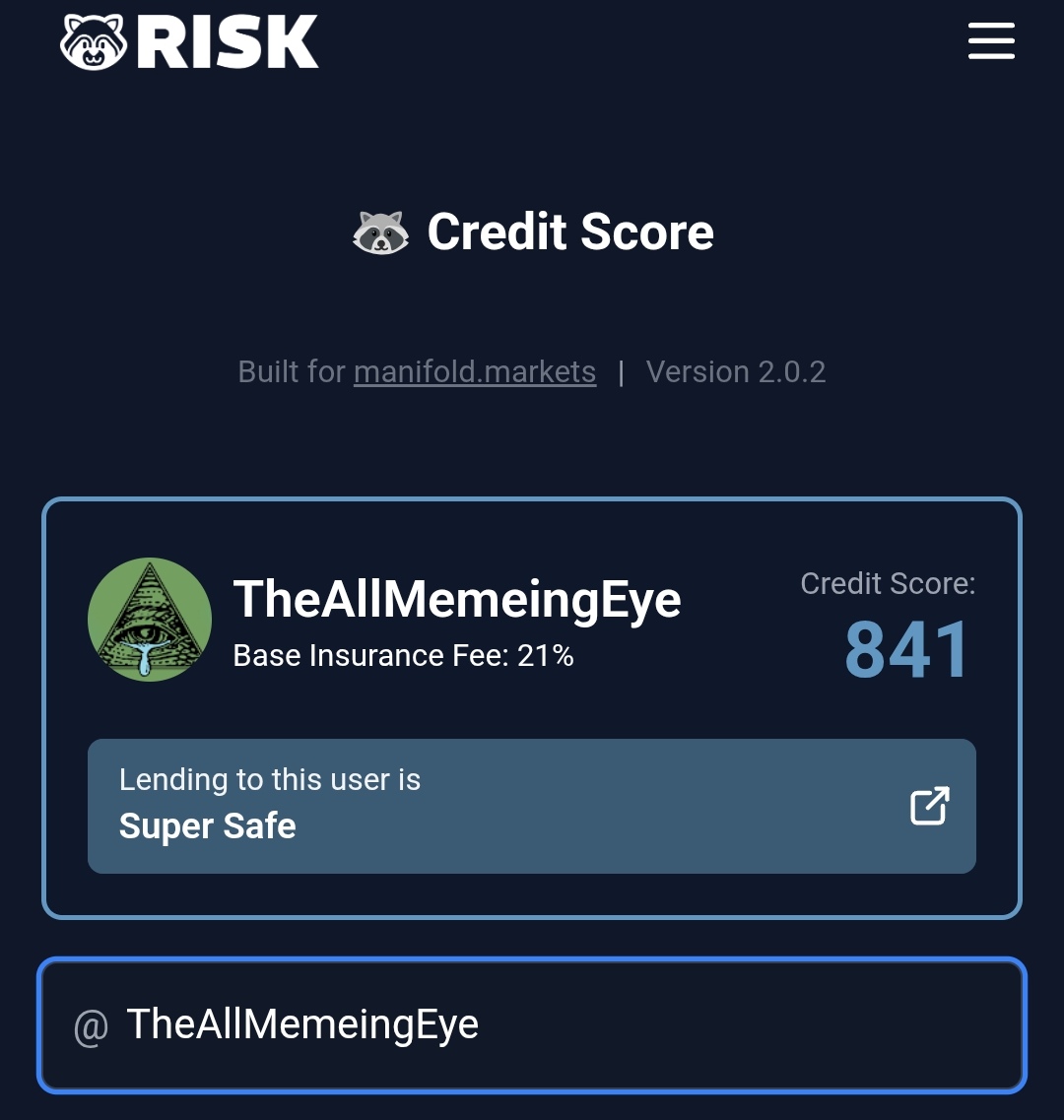

@TheAllMemeingEye asks: "btw is it true that a major parameter is liquid balance? Would it not be more useful to be using net worth? A user who needs loans will necessarily have a low liquid balance, and the investments making up a high net worth can be liquidated to pay back debts, right?"

This was true before today's update. Now the score incorporates all time profit and managram history with much more weight than current balance. You are right in your assessment that the old way was not ideal.

@4fa notes: "A credit score that can go from "Outrageously Dangerous" to "Super Safe" in a single day with no indication that it was "Outrageously Dangerous" the day before, umm, needs work. 😅 @crowlsyong Would be nice to implement at least one of these features: Show credit score history, show recent credit score volatility, show a credit score confidence interval, or at least show a conservatively low estimate / the lower bound of the confidence interval / the bottom decile of the credit scores over the last month or year… That'd be cool and useful! 👍 "

Love this! You are right that it needs work. I am testing a credit history database combined with a nice graphical interface through chart.js. This is a big undertaking so I can't promise a timeline right now. It's a bit tricky because I don't want to spam the Manifold API to create a datapoint for every single user (that would require... thousands or maybe hundreds of thousands of API calls?), so the only way I can think to do this in a way that isn't spamming the API is to only create a datapoint when someone uses the program, and I'd have to implement some kind of limit, like no more than 1 datapoint every 5 minutes per user or per IP address. Lots to consider.

I hope this helps folks. Please feel free to DM me on Manifold or discord with any questions/comments. And remember that this is for fun!

🦝RISK RECOVERY INSURANCE SERVICE KIOSK

@crowlsyong Oh and to avoid any suspicion or corruption, I won't bet in this market. But I definitely approve of its existence 🙂.

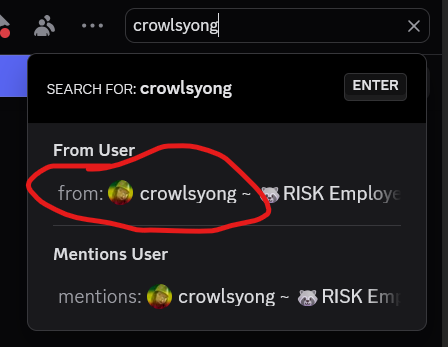

And a lil tip to those who bet in this market: check the manifold discord once in a while because many of my updates have been a direct result of discussions on the manifold discord. You can use the discord searchbar to find messages from me or search "credit score" and you'll probably find some relevant stuff.

@Quroe I might be wrong, but my intuitive expectation is that the managrams are being subtracted from net worth to determine non loaned net worth as a factor contributing to ability to repay, thus the effects of sending him mana would cancel out

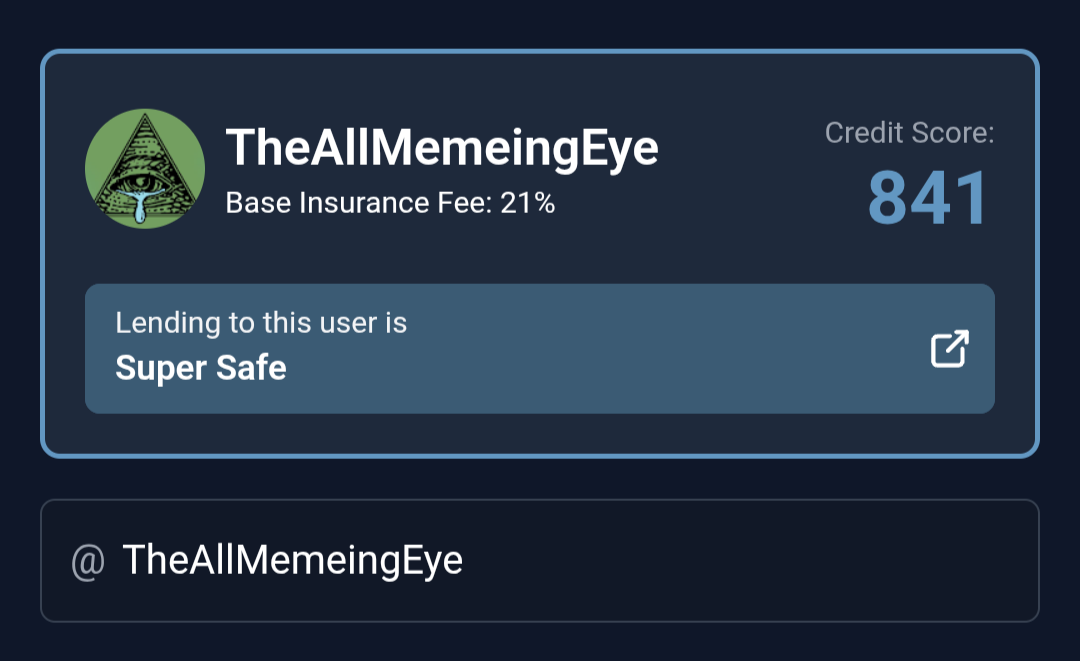

@4fa I could send Meme 20k mana and we could see what that does to our credit scores. If the Meme doesn't send it back to me in 24 hours, that tanks the entire credibility of the loan bank they have set up.

@Quroe Ah, that sounds safe. 😁 I first thought you wanted to test it on Evan. 😅

@Quroe Very briefly, I am a whale lol, but yeah I'll send it back

Kinda surprised it harms both our scores

@Quroe you can also post here how the score changed after @TheAllMemeingEye sent it back. It's also valuable information!

@TheAllMemeingEye I think it harmed both scores because person A's balance decreased and person B now has a managram which the algorithm assumes is a loan.

@crowlsyong why does receiving a loan decrease score though? Surely with my pre-existing balance / net worth plus the loan I am at least equally likely, if not slightly more, to be able to repay new loans?

@TheAllMemeingEye hmm i’m not sure I follow. Is this a meme? xD

if you receive a loan, you are in debt. If you receive huge loans, you are hugely in debt.

Folks who are in debt should have a worse score. Er am I missing something?

It would cool to give more weight to repayment, so if you had 100k given to you and you paid back 100k to lender, then instead of having no change, you should have an improved score. I might be able to get that working…

@crowlsyong Can you identify how long loans are open for? If you don't, we will get people quickly pushing mana back and forth between accounts (like earlier between Meme and I) to see if they can speed run their way to a maxed out credit score.

In other words, this is "length of credit"!

@Quroe Wait didn't your score return to normal? So if you quickly sent mana back and fourth it would just keep zeroing out. Or is that not what happened? Also managram history is a variable in the equation, not the full story. you could theoretically 'max out' your managram weight but if your other account variables (like profit, net worth) are bad then you won't get a perfect 1000.

@crowlsyong It went back to normal as expected, yes.

I'm suggesting some sort of "time" variable when you implement loan history tracking so that repaying loans actually boosts the credit score, if that is your intent.

@Quroe Ohhh I understand now. Yeah there could definitely be a rate limit for that. managrams have a timestamp so i could always ensure that at least x amount of time has elapsed in order to count the loan as repaid.

@crowlsyong It's almost getting to the point where it might be worth asking if Ian can code in some sort of flag/checkbox/boolean in a managram indicating that it is, in fact, a loan so you can more easily differentiate loan from gift.

@Quroe omg dude you're a genius. I don't even have to ask ian; manifold is open source so I could try to code it myself and then submit it. i'm going to toy around with that idea.

it's so simple and obvious, but i didn't think to do this. thank you my friend. thank you very much.

@crowlsyong slightly off topic and obs you don't have to but the cute racoon pic you shared earlier would make a pretty sweet profile pic that would be more aesthetically aligned to your brand than Bob the Builder