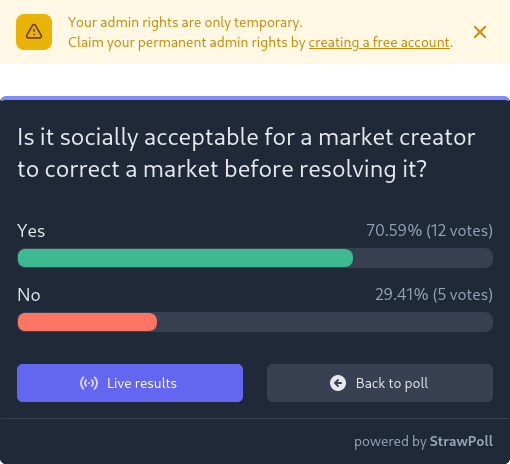

Resolves to the percentage of Yes votes in the below poll in 2 weeks.

Oct 27, 12:08pm: What % of Manifold users think it's socially acceptable for a market creator to correct a market before resolving it? → What % of Manifold users think it's socially acceptable for a market creator to correct a binary market before resolving it?

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ6 | |

| 2 | Ṁ3 | |

| 3 | Ṁ2 | |

| 4 | Ṁ2 | |

| 5 | Ṁ0 |

People are also trading

If you think about a) author trading on their own market, and b) anyone trading on a market to correct the price when the outcome becomes known - I think both have some tradeoffs but I think both are overall good in most situations - there are exceptions, but as a general rule I think they are fine and disallowing them would be worse. This question is just about (a) and (b) together which I also think is fine in general.

I would ask anyone who thinks the answer is NO: What is special about the author doing the correcting vs anybody else? The only thing special about them is that the author knows how they are going to resolve with more certainty than others, particularly when the resolution is ambiguous (and potentially the trades could bias the author's decision). But authors can also be biased and get an unfair advantage from ambiguity throughout the duration of the market, not just at the end - it just becomes more obvious at the end. So overall, I don't think it makes much sense to treat the author correcting the price at the end as a special case. Interested to hear any counterarguments.

I do acknowledge that it can create a perception of unfairness/bias (see the comments on https://manifold.markets/IsaacKing/is-it-socially-acceptable-for-a-mar-5af944612a76), and that is a legitimate issue to think about.

Also, I as a habit correct market prices before resolution on any markets where I see the opportunity, including my own. And nobody has ever raised this as a problem with me.

@jack (steelmaning the NO side)

If people know your market is not going to jump to 0%/100% before resolving, they are more free to use limit orders. So if you can somehow guarantee this, you'll get more trading volume. On some markets this is impossible because other traders are going to know the answer before you. But on markets where you are likely to be the first/only person to know the answer, you can guarantee it, and you should.

@Yev Yeah, agreed, I think personal markets where the author will know the result before anyone else are one case where it makes a lot of sense for the author to precommit not to trading right before resolving. There are also cases where I'm randomizing the market resolution in some fashion, and there it obviously makes sense for me to state that I won't trade on that. But I think those are quite different from a market where the author has no special information, e.g. a market on world news.

@Yev I treated it as about binary markets specifically, because I've given up worrying about profits on DPM markets for the most part :)

@Yev Also, thinking more about DPM markets - I think if the author trades on information that is public where anyone else could have made the same trade, I don't really see why that would be bad either. I do think that there are definitely some cases that are bad, but it has to be something more than just that - e.g. if a market resolution depends on personal information, then it's definitely problematic for the author to correct the price based on that in a DPM market.

@jack I don't think that market creators (or anyone else) shouldn't trade on DPM markets on publicly available information. I think the DPM market should close early to prevent such trading.

@Yev Yeah, that's ideal, but if the market is about something that can happen anytime then there's no good solution.

@Yev Indeed, I hope they can get the market math for free response CPMM figured out and implemented!

And this one on author trading on their own markets in general: https://manifold.markets/1/repost-under-what-conditions-is-it.