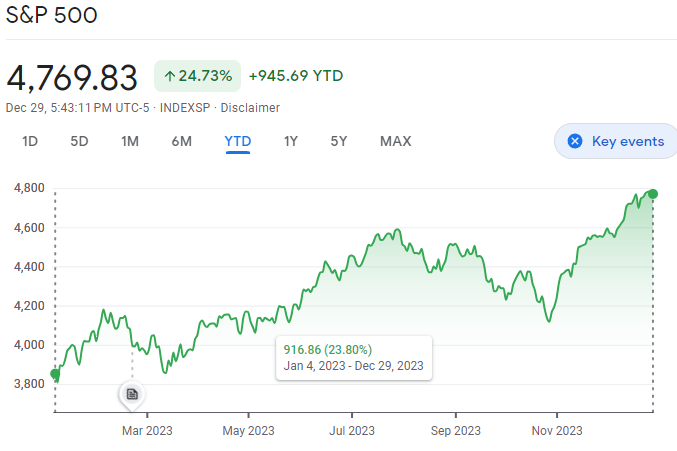

Will S&P 500 increase from open on 3 January 2023 (3853.29) to close on 29 December 2023 ()?

See also: /XComhghall/will-the-sp-500-increase-in-novembe-145f77830ae9

/XComhghall/will-the-sp-500-increase-in-q4-2023

https://www.wsj.com/market-data/quotes/index/SPX/historical-prices

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ457 | |

| 2 | Ṁ163 | |

| 3 | Ṁ134 | |

| 4 | Ṁ133 | |

| 5 | Ṁ110 |

People are also trading

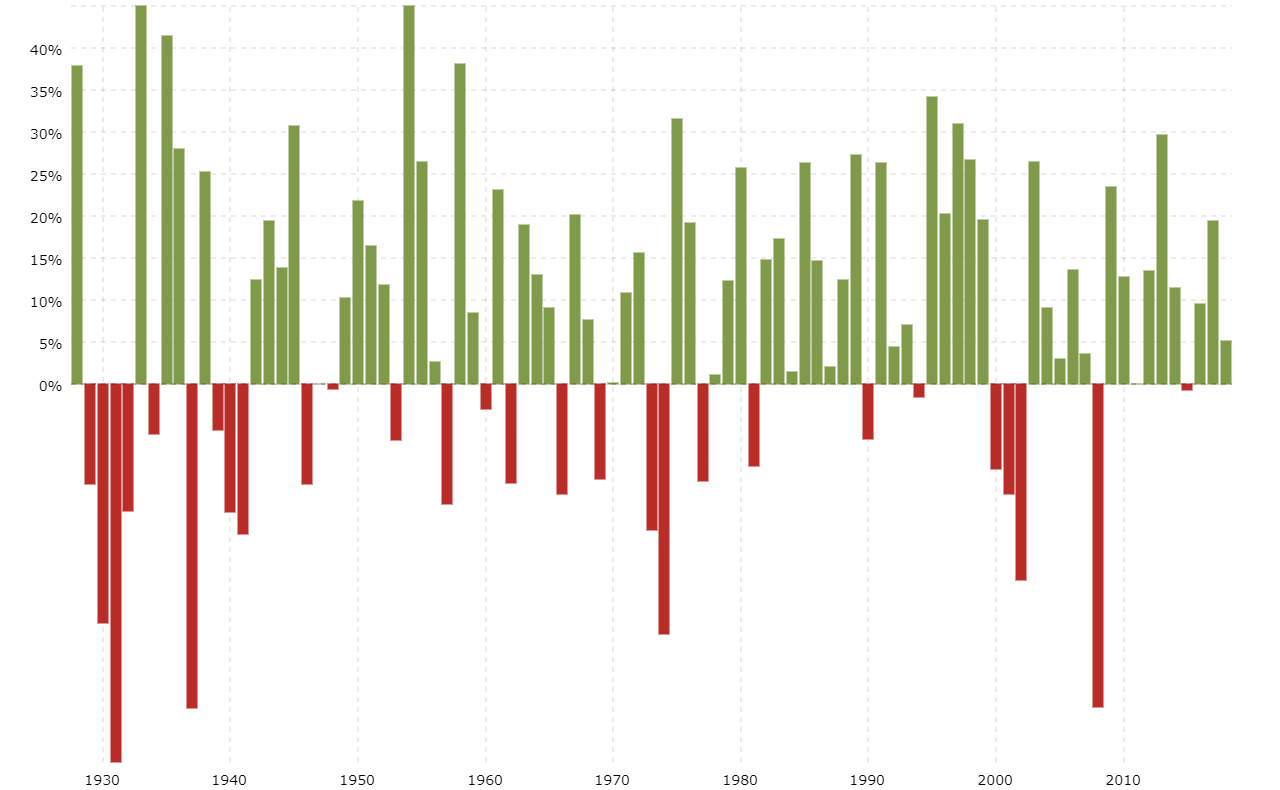

S&P 500 index has a promising outlook for 2023. Based on historical annual returns data since 1928, I calculated the probability of a positive growth rate and the probability of a negative growth rate for 2023 using Z-scores. The Z-score results showed a 34.23% probability of a negative year-over-year change, while the probability of a positive change was 65.77%. Considering the current state of America, with ongoing technological innovation and the recovery of personal consumption, key sectors such as technology and consumer discretionary are showing resilience. Therefore, it is almost certain that this year will demonstrate growth.

https://www.macrotrends.net/2526/sp-500-historical-annual-returns

@d7c3 Hi Yutaro, I totally agree on your comment, I will just add some statistics to make a more solid statement.

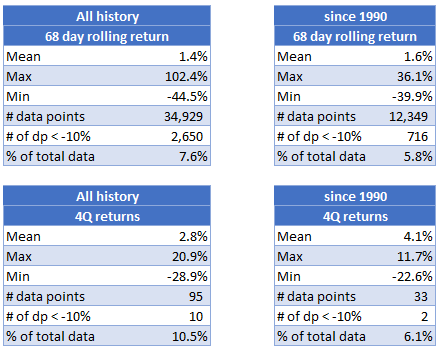

As of yesterday close, October 23th, the S&P is accumulating +9.8% of return year-to-date. This means that in the 68 days remaining until the end of 2023, the S&P will have to fall 9.0% from today’s price.

Statistics:

Using all historical prices of the S&P 500, since 1927, only in 8% of the cases the S&P has fallen more than 9% in 68 consecutive days. If we consider data since 1990, only in 6% of the cases. Also, considering that it is almost the last quarter, there has only been 10 years in all history that have ended with a 4th quarter return lower than -9% and, since 1990, only 2 years: 2008 and 2018.

A fall in the market of close to 10% is called a correction and corrections happen on average every 5 years in the S&P, and the last one occurred last year with a fall of 24% from its peak. Therefore, there is a low probability that there will be a correction in the last 68 days of this year.

Source: https://finance.yahoo.com/quote/%5EGSPC/history?period1=-1325635200&period2=1698105600&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

I disagree with the optimistic forecast for the S&P 500 in 2023. The analysis overlooks the detrimental mix of increasing interest rates and waning consumer confidence, which historically have been adverse for earnings growth within the index (Duggan, 2023). Moreover, the recent earnings reports from the S&P 500 have been inconsistent, with a modest 2.7% growth year-over-year, indicating potential vulnerabilities (Duggan, 2023). For a more accurate assessment, it would be beneficial to apply econometric models that factor in interest rates and consumer sentiment as predictors for earnings growth. A regression analysis could quantify the impact of these variables on the S&P 500's performance. Additionally, scenario analysis could be used to forecast how different levels of interest rates and consumer confidence might affect future earnings. These statistical methods would provide a more comprehensive understanding of the potential headwinds facing the S&P 500, offering a contrast to the current positive outlook.

Reference: Duggan, W. (2023, November 2). November 2023 Stock Market Forecast [Review

of November 2023 Stock Market Forecast ]. Forbes. https://www.forbes.com/advisor/investing/stock-market-outlook-and- forecast/#:~:text=Rising%20interest%20rates%20and%20a,%2Dover%2Dyear%20earnings%20growth.