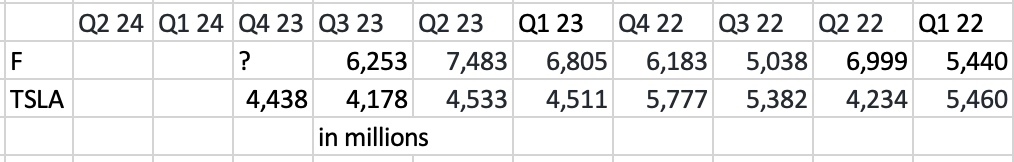

Gross Profit history:

https://www.alphaquery.com/stock/tsla/fundamentals/quarterly/gross-profit

https://www.alphaquery.com/stock/F/fundamentals/quarterly/gross-profit

past 7 quarters, in millions:

Resolves when Ford updates Q4, '23 quarterly gross profit numbers.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ69 | |

| 2 | Ṁ46 | |

| 3 | Ṁ22 | |

| 4 | Ṁ19 | |

| 5 | Ṁ17 |

People are also trading

Resolves yes. $5100 millions. That was close. Why does TSLA have a market cap that is so much higher than F? https://www.alphaquery.com/stock/F/fundamentals/quarterly/gross-profit

@ChristopherRandles Look at the table above. TSLA has 8 quarters of flat Gross Profits. This is not a growth stock.

@TeddyWeverka GP table doesn't show it. Vehicle volume grew 35% YoY but margins down so that doesn't show. Past is largely all M3 and Y which is reaching limits of sales so this next year won't have much growth between two phases.

However, once they have 4680 cell manufacturing working well they can build a few factories to copy their final version of that manufacturing plant. That will give the batteries to increase fixed batteries sales as well as have batteries for cybertruck and semi. Similarly once they have one factory doing model 2 unboxed production they can start to build a few factories to copy that. Then there is possibility of FSD and Optimus further into future.

@ChristopherRandles Gross Profit figures in vehicle volume as well as margins. Cutting prices to increase sales, is a good strategy if it increases Gross Profit. It didn't.

They have lots of stories about what they will do next as you have outlined above. They told similar stories the last eight quarters and those didn't play out.

This is not a growth stock.

@TeddyWeverka Changing the world takes time.

What has been cancelled in last 2 years? ?

What has been delayed? Cybertruck a bit, Mexico gigafactory perhaps but that is more change of plan to do first pilot at Austin.

Do these bits of delays matter much in the long run? Clearly nowhere near as much as cancelling major plans would.

Saying "Those didn't play out" is simply not getting it/Just saying what you want to say regardless of reality.

@ChristopherRandles the things you speak of are not components of Gross Profit. Their recent strategy was to cut prices to increase sales.

What could go wrong with that? If the sales increase does not make up for the lower margin, it is a bad strategy. The direct measure of this strategy is the Gross Profit. This strategy failed.

Current Gross Profit comes from prior efforts effect volume and margin. They have 8 quarters of flat Gross Profit, showing the prior efforts didn't play out. Your optimism about future efforts is noted.

@TeddyWeverka

Are we talking company strategy or blind focus on gross profit? The strategy is to be slightly on the 'maximise vehicle volume that can be sold profitably' side of maximum profit now.

You don't know it is a bad strategy until we see whether Tesla can make money from FSD software. If they can do robo-taxis profitably, then going for more volume and less gross profit now may make sense for future profit opportunity. Even if that doesn't play out there are other effects of grabbing the volume now. It may have hurt margins for them but this also has effects on competitors and if competitors have tighter margins it may hurt competitors more than it hurts Tesla. More vehicles out there might also mean more discussions by customers and future customers leading to potential for more future sales. Unless you take account of these effects you cannot know whether it is a good or failed strategy. I am not sure but ignoring the arguments doesn't look good for your side of the argument.

@ChristopherRandles This is why they were getting a multiple on their valuations:

This is why they no longer deserve it:

8 quarters of flat, tells you that the growth phase is over.

@ChristopherRandles and if you think differently, Bet all you can on NO on these markets:

https://manifold.markets/TeddyWeverka/will-ford-q1-2024-gross-profit-exce?r=VGVkZHlXZXZlcmth

https://manifold.markets/TeddyWeverka/will-ford-q2-2024-gross-profit-exce?r=VGVkZHlXZXZlcmth

@TeddyWeverka :Squints

So your response to my argument that there is more to the story and situation than gross profit, is .... drum roll ... to post graphs of gross profits.

Hmm someone might think it looks like you have run out of arguments so are forced into repetition.

I think the growth this year is going to be low, so I will probably continue to bet on Ford gross profit exceeding Tesla for this year.

If you believe the growth is over, you should short Tesla shares a PE of 45 is way too high if there is no growth to come. There is real money there for you if you believe what you say.

@ChristopherRandles The growth story was good while it lasted. The growth that lead to these multiples are dead and the numbers prove it. You are betting yes on this Manifold question, implying you don't even buy your own rhetoric.

@TeddyWeverka

https://shareholder.ford.com/Investors/financials/default.aspx earnings press release. yes 10k not available yet though it may well have been sent, When "when Ford files" has probably happened but assume what matters is when it is available.