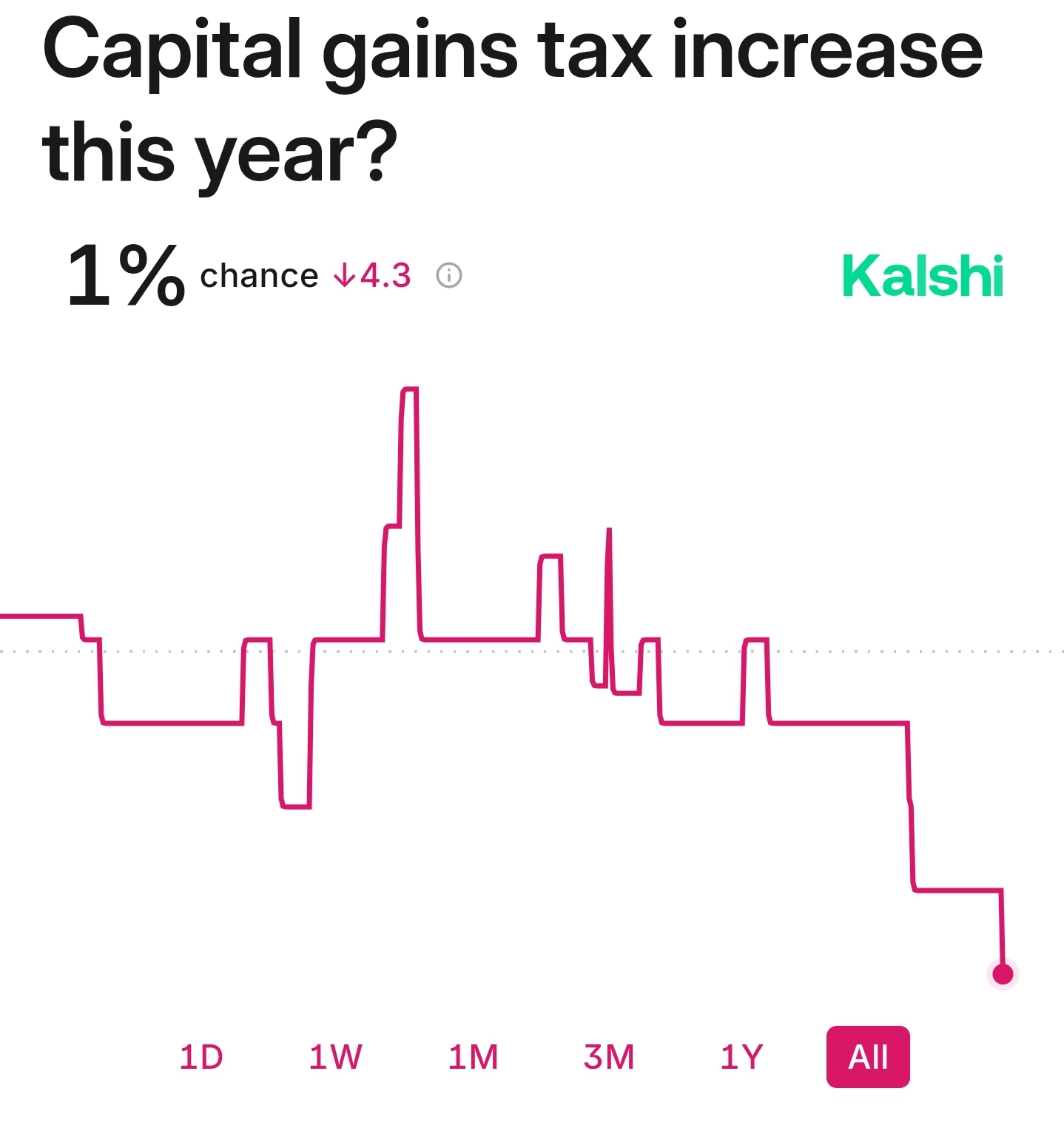

🏛💸Capital Gains Tax Increase Before 2025?

Resolution/Rules

If a bill becomes law before 2025 that the effect of raising the top federal capital gains tax rate on net long-term capital gains to be strictly greater than 20%%, then the market resolves to Yes. Outcome verified from Library of Congress.

About

People are placing bets on the likelihood of a tax increase, as the administration seeks to raise revenue and address income inequality. A capital gains tax hike could have a significant impact on investors and the stock market, making it a closely watched bet.

[Resolves the same as this market on Kalshi]

DISCLAIMER

I DO NOT PARTICIPATE IN MARKETS I CREATE

DO NOT TRADE OFF OF UNCONFIRMED MARKET NEWS OR NEWS YOU MAY NOT UNDERSTAND. I AM NOT RESPONSIBLE FOR MISUNDERSTANDING IF YOU DO NOT ASK FOR CLARIFICATION FIRST.

If Any Clarification Is Needed, I May Temporarily Close The Market To Make Clarifying Statements & Than Re-Open ; Feel Free To Ask For Clarification Through Messages Rather Than Making A Comment. Comments are not a clarification unless posted into the description.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ106 | |

| 2 | Ṁ37 | |

| 3 | Ṁ19 | |

| 4 | Ṁ8 | |

| 5 | Ṁ4 |

Per Bankrate:

In 2024, individual filers won’t pay any capital gains tax if their total taxable income is $47,025 or below. However, they’ll pay 15 percent on capital gains if their income is $47,026 to $518,900. Above that income level, the rate jumps to 20 percent.

For the 2025 tax year, individual filers won’t pay any capital gains tax if their total taxable income is $48,350 or less. The rate jumps to 15 percent on capital gains, if their income is $48,351 to $533,400. Above that income level the rate climbs to 20 percent.

Percentage unchanged. Kalshi will resolve the same.

@traders I made a new copy of this market because SirCryptomind does not want to manage his markets anymore.