Let's look past Trump and Biden for a second. And Kamala.

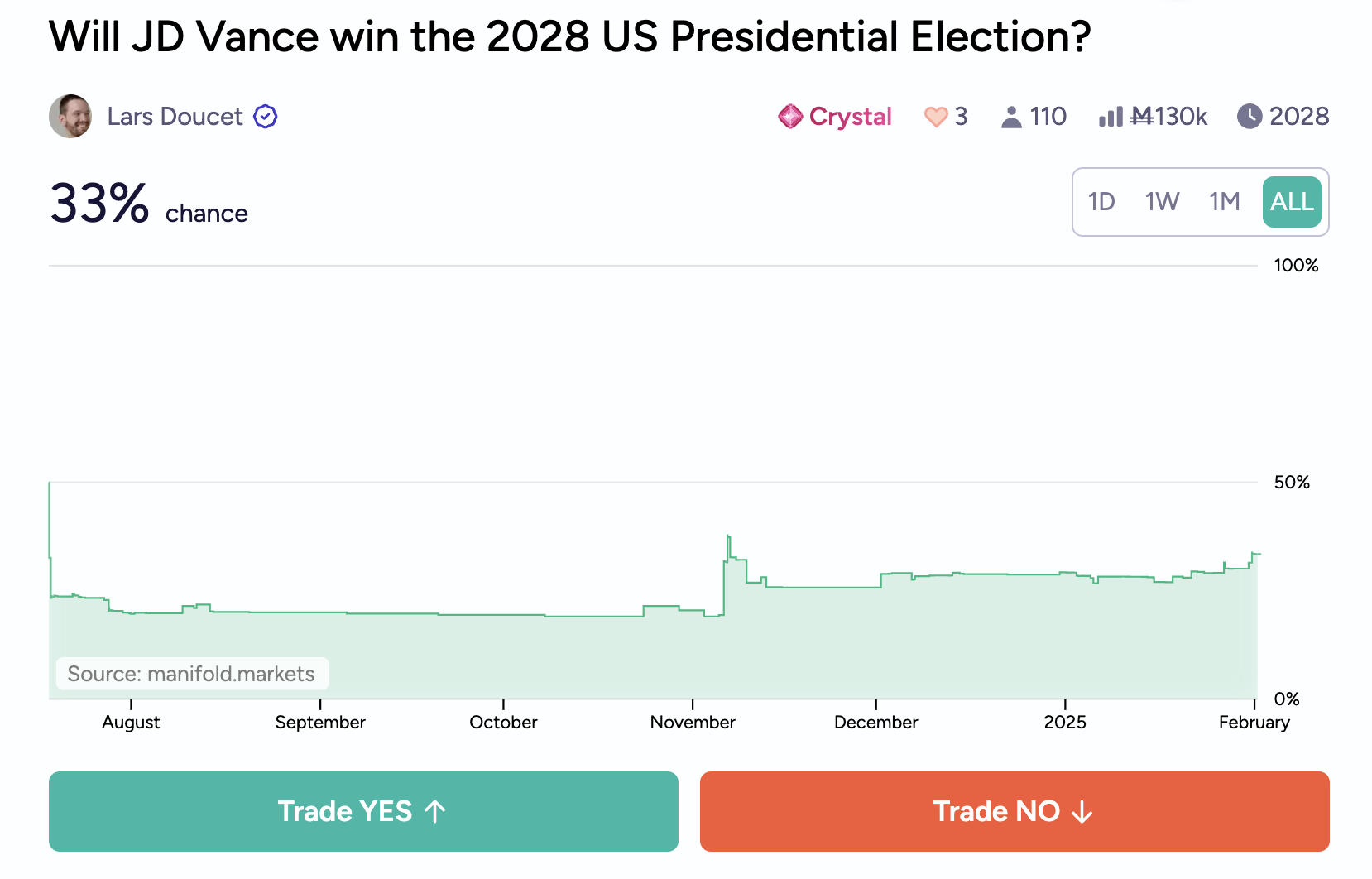

JD Vance is likely to be the next Vice President of the United States. 60%+ according to the latest Polymarket odds, and many markets here.

Ever since LBJ, and removing obvious exceptions [Spiro Agnew, Dick Cheney] the rates at which young "normal" VPs have run successfully for president has been somewhere in the neighborhood of 50/50.

Vance will be 40 years old if he is inaugurated VP in January. He will have 30+ years to run for President after Trump retires, as Biden had from 1988 until finally being elected in 2020.

https://en.wikipedia.org/wiki/J._D._Vance

What will be Vance's odds to become president one day? As of January 31st 2025.

Since this is a meta-market, resolution criteria will be difficult to know ahead of time.

I will pick the best market that we can find, in this priority order

1. Polymarket market with $100,000+ wagered

2. Manifold market with 100+ participants and 100,000+ Mana wagered

3. Other futures markets [we will pick the most robust]

Two other caveats.

Firstly, if we don't have a robust market that looks 10+ years into the future, but there is a good market for "Will JD Vance be President by 2030?" -- then we will use that and simply add 25% to the odds.

For example if the market for "Will JD Vance be President by 2030?" is at 50%... we will use 0.50 * 1.25 = 0.625 for our market.

[If his odds are 80% for 2030... we will use 85% for our market. Since we can only extend by 25% of the remaining 20%.]

Why 25%? No reason but 50% seemed too way too high and we are very likely to get a robust futures market for JD Vance at least for 2028 or 2032 if he is elected VP, and probably also if he is not. We would prefer to find a longer-looking market is possible. But if the best futures markets only look out 4-10 years, we will tack on 25%.

The second caveat is that we will try not to extend resolution past Jan 31st 2025 but we may have to. Remember that this is a meta-market about future markets.

Also if we have two or more very robust markets, we will average those odds. As we get closer to resolution, I will be clear about what markets are in play for resolution, and update this space.

Update 2025-26-01 (PST) (AI summary of creator comment): - The two markets with 1,000 subsidies are very small.

The 100,000 subsidies "Crystal" market for 2028 is the most robust.

The 1.25x adjustment will still be used, though it may be increased to 1.5x or higher.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,109 | |

| 2 | Ṁ884 | |

| 3 | Ṁ700 | |

| 4 | Ṁ213 | |

| 5 | Ṁ91 |

People are also trading

@Moscow25 this was the only large liquid market on JD Vance futures

100K mana bet with large subsidies

other markets were tiny

so 40%???

https://manifold.markets/Khazar_Man_From_Turan/will-jd-vance-ever-be-president

or your 1.25x calculation times 29%? so 37%? (This is probably the fairest as it's the highest volume.)

https://manifold.markets/LarsDoucet/will-jd-vance-win-the-2028-us-presi

or this at 52%???

https://manifold.markets/ZaneMiller/when-if-at-all-will-jd-vance-become

Polymarket or Manifold ain't making a high volume market on this by Janaury 31st.

@HillaryClinton yes doesn't look like Polymarket will oblige us here. Though I can reach out and ask...

@HillaryClinton thanks for the links! I hadn't started to research yet but those look useful. Much appreciated.

@HillaryClinton off hand... yeah those 29-52% markets make sense to me -- I also saw one earlier on 2028

if there are a few that seem equally valid... we will average them

let me see if Polymarket can set up a futures market tho -- I'd be curious to see

@HillaryClinton hmmm... tbh the two markets with 1,000 subsidies are very small -- I threw them a few subsidies to help but the 100,000 subsidies "Crystal" market for 2028 seems by far the most robust of these here.

Dunno if my "1.25x" adjustment is scientific but too late to change the formula now. And I think it's ballpark reasonable. I might go "1.5x" if I chose a number now, or even higher.

@Moscow25 you can't change criteria too much after people have made bets. 1.25x times 33% in the crystal market is 42%.

1.5x is 49.5%

Maybe make another market with more exact criteria.

@HillaryClinton I'm sorry -- where do I say I'm going to change the rules?

What I wrote was "too late to change the formula now" -- how is that unclear?

"make another market with more exact criteria" -- I'm sorry I wanted to make an interesting market months ago. I said 1.25x if there isn't a big all-futures market.

We're intelligent people here. What is unclear? Or you just want to say my market sucks? In which case just don't bet it "next time."

@Moscow25 real money markets won't do that long term because the interest rate issues are terrible. maybe manifold will but the probability won't mean anything. i think metaculus would be fine for this and nothing else would be