Nuno's forecasting newsletter does a great job of breaking down what happened and providing some context: https://forecasting.substack.com/p/forecasting-newsletter-july-2022

PredictiIt's CEO is planning to give a talk on SSG's podcast in a few hours which could be revealing? https://twitter.com/keendawg/status/1556657200256487424

Resolution criteria

It is hard to say what evidence will be substantial enough for this market to resolve to YES. We might resolve it to a partial % if evidence comes out that is "substantial" but doesn't completely prove it beyond doubt.

As described in Nuno's newsletter a Freedom of Information request has been filed so a resolution might be based largely based on the outcome of that.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ186 | |

| 2 | Ṁ163 | |

| 3 | Ṁ73 | |

| 4 | Ṁ40 | |

| 5 | Ṁ20 |

People are also trading

I think there's two reasonable options:

Resolve NO at the close date, end of 2022, or

Resolve once the FOIA request info comes out, because the description says "As described in Nuno's newsletter a Freedom of Information request has been filed so a resolution might be based largely based on the outcome of that."

@NathanpmYoung oops I made this market when I was still dumb at resolution criteria

-David

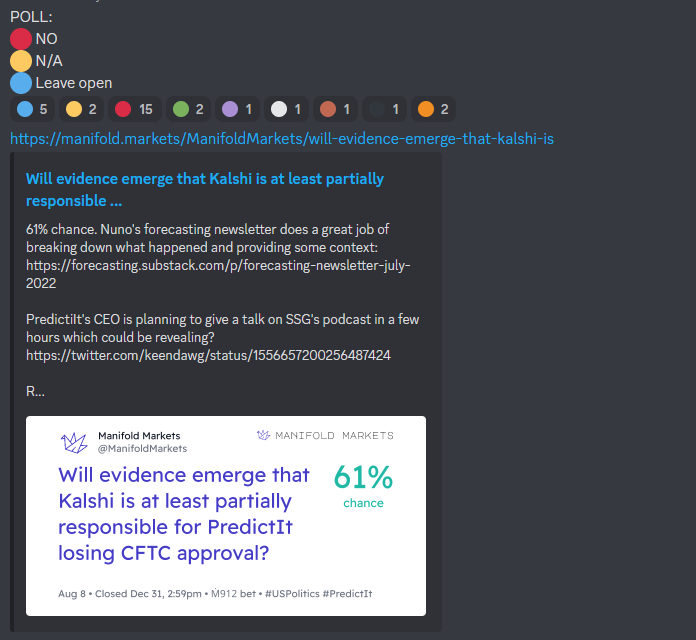

Resolving No from this poll

From the recent Kalshi CFTC application

Contracts on political control of Congress available to US participants have been trading for nearly a decade. Since 2014, a similar contract has been available for trading on an unregistered trading venue that purports to operate under a No-Action Letter that was issued by the Division of Market Oversight in 2014 and granted relief to operate without complying with a number of aspects of the Commodity Exchange Act and Commission Regulations.

The Exchange is proposing to bring such contracts onto a fully regulated exchange operating under the core principles applicable to a DCM, with participant funds safeguarded at a DCO operating under the core principles applicable to a DCO. The Exchange believes it is time to offer these widely used but unregulated contracts on a fully regulated basis so that U.S. persons can hedge risks arising from political control on a market with robust safeguards and transparency.

Similar market with slightly different criteria: https://manifold.markets/jack/will-a-foia-request-reveal-that-kal