If Tesla stops reporting this metric, changes the accounting standard materially, Tesla goes private or any other unpredicted thing happens, this market will be resolved as N/A!

I may bet on this market.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ761 | |

| 2 | Ṁ438 | |

| 3 | Ṁ303 | |

| 4 | Ṁ247 | |

| 5 | Ṁ211 |

People are also trading

"The company's auto gross profit margins, excluding regulatory credits, fell to 16.3%" https://www.investors.com/news/tesla-earnings-slide-37-cybertruck-coming-margins-bottomed/#:~:text=Tesla%27s%20auto%20gross%20profit%20margins,the%2016%25%2D17%25%20range.

@MP from the same article, including regulatory credits : "Tesla's gross profit margin slid to 17.9%, down 719 basis points."

"Tesla's gross margin dropped to 17.9% in the quarter ended September, compared with 25.1% a year earlier, when it had yet to start cutting prices. In the second quarter, Tesla had posted a gross margin of 18.2%." https://www.reuters.com/business/autos-transportation/tesla-reports-lower-third-quarter-margin-2023-10-18/#:~:text=Tesla%27s%20gross%20margin%20dropped%20to,a%20gross%20margin%20of%2018.2%25.

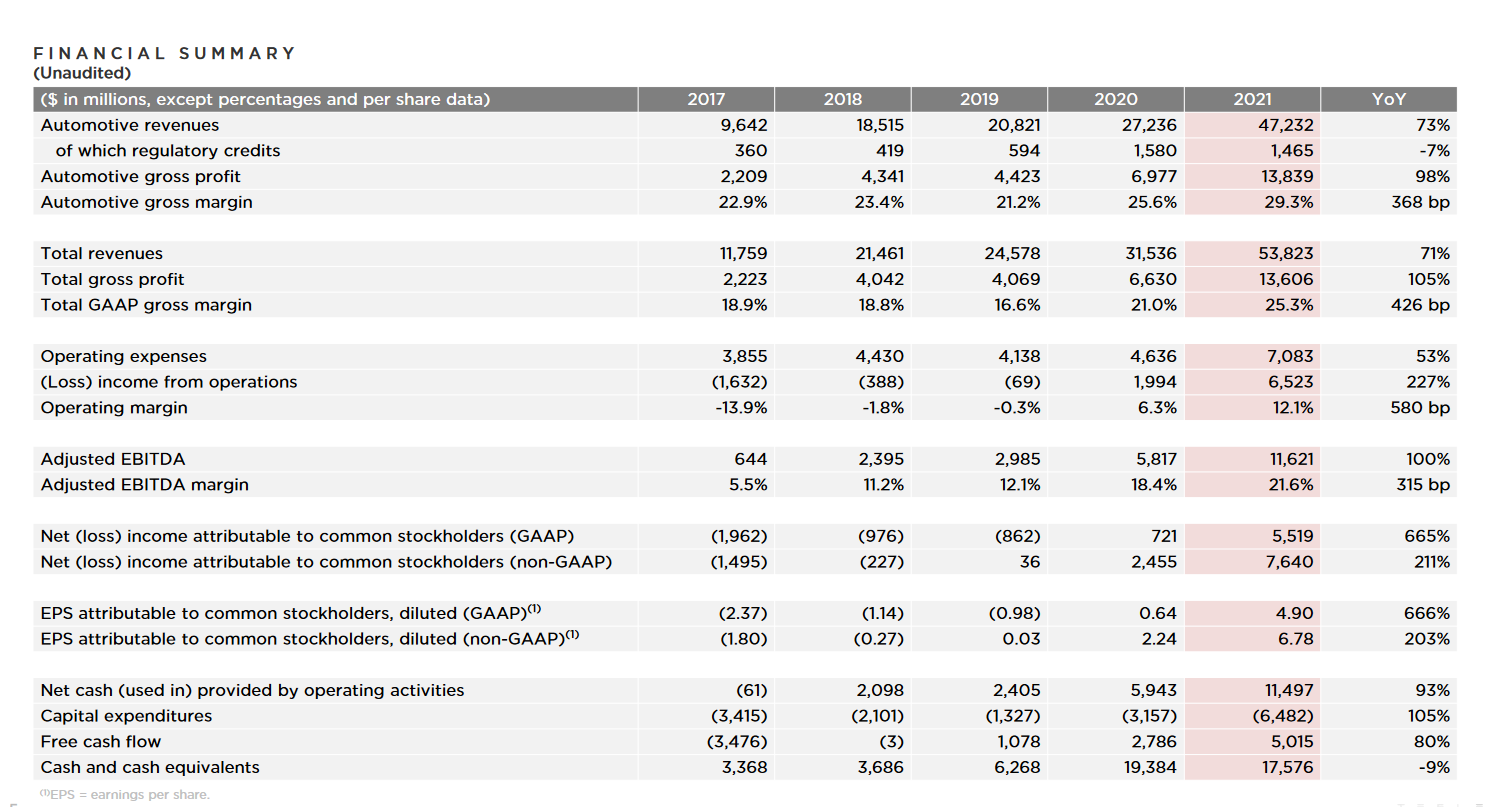

The reason why I do not think that TESLA will have a profit margin of less than 19.5% is because if we look at historical data, those numbers have not been replicated even as far as 2017. Furthermore, their expenditure and profit margins are growing steadily at a rate of around 4% YoY. Furthermore, if we look at it through a macro lense, buyers of EV and TESLA have been given huge tax breaks by the US government in their efforts to become carbon neutral. Therefore, unless there is a drastic change in market, I do not see how it will be a drop of more than 3-5%.