See here for context on "double it and pass it on": https://manifold.markets/Quroe/how-many-manifolders-will-double-it-d9q609ZP6R#pdso5l59f7#

See here for context on combinatorial futarchy: https://manifold.markets/post/futarchy-would-be-better-with-combi

I have to send 1024 Mana to someone in the next 48 hours, they then have to double it and pass it on. I want to choose someone who is predicted to double it, so who should it be?

The candidates were selected partially based on volunteering, and partially by my own choice based on what might be fun.

This market makes predictions over all combinations over who I send the mana to, and whether or not they'll pass it on. One option will resolve YES, the rest NO. I will choose whoever has the highest conditional probability of sending on the mana, i.e. the highest:

P(A is sent the mana and they pass it on) / (P(A is sent the mana and they pass it on) + P(A is sent the mana and they don't pass it on))

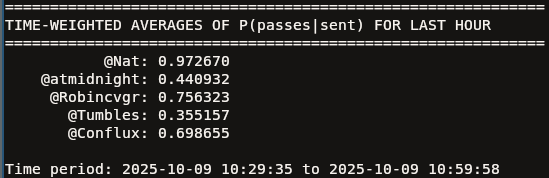

I received the payment at 14:28 (GMT+1) on October 7th, I aim to send the mana shortly after 12:00 (GMT+1) on October 9th, when this market will close. I will choose the person who had the highest time-weighted average conditional probability of passing it on over the preceding hour to make my decision, in order to avoid last minute manipulation.

P.S. Enjoy arbitrarging this market with the related other ones: https://manifold.markets/news/double-it-ep-2, derivative markets encouraged.

Update 2025-10-07 (PST) (AI summary of creator comment): - If I do not send the mana to anyone (due to error or deliberate defection), the option representing no one is sent the mana (e.g., "Nobody") will resolve YES rather than N/A.

Update 2025-10-09 (PST) (AI summary of creator comment): When calculating the time-weighted average conditional probability, the creator will only calculate averages for Robin and Nat, as the other candidates had probabilities that were too low for too long to have a chance of winning.

Update 2025-10-10 (PST) (AI summary of creator comment): The creator discovered an error in the code used to calculate the time-weighted average conditional probability. The code did not properly account for periods with no trades (specifically 10:00-10:29 GMT had no trades/timestamps). The creator will fix the code and re-run the calculation, which may change the winner from the initially announced result.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ563 | |

| 2 | Ṁ363 | |

| 3 | Ṁ306 | |

| 4 | Ṁ123 | |

| 5 | Ṁ67 |

People are also trading

@Jasonb Oh damn!!! I nearly stayed up to do some last minute market manipulation but decided better of it, turns out I didn't even need to to be the recipient!

Now I get to make important decisions teehee

@121 There were no trades 10-10:29, which means there were no timestamps in the data for those times. Ah. Oh dear. I don't think it properly accounts for this... Classic vibe coding whilst on a crunch moment. I will check and fix the code and then re-run it, if the results change then oops.

@121 I've fixed the code. I did notice this oddity when testing but I didn't properly think it through until I saw your comment, so thanks for pointing it out! It hasn't changed who the mana should've been sent to, but the result is much closer as expected. Manifold is being a bit weird and not letting me paste in images but the final fixed average conditional probs for Nat and Robin respectively were 93% and 87% (rounded to nearest %).

@Jasonb It seems the graph isn't displaying the slightly more accurate probabilities at the low end (e.g. 0.6% is getting rounded to 1%). Hopefully this doesn't have too strong of an effect. (I don't think the final result should be sensitive to this, since averaging is taking place over the conditional in probability space not log-probability space.)

@Jasonb I'm also only going to calculate Robin and Nat's averages, the others were too low for too long to have a chance.

@Jasonb I would be interested, in the extract and the script.

Curious if you take the reported market probabilities or the yes no share pools with the k parameter, iterating over the trade history for time weighting.

@ShitakiIntaki It uses the market probabilities, but since it extracts this data via the API it has it to a very high degree of accuracy (as far as I can tell). On a logic level it computes the conditional probability point-wise and then applies the time-weighted averaging to those numbers. See here for the repo: https://github.com/jr-brown/manifold-markets-tools

@121 You certainly made a good effort! This has also updated me that combinatorial futarchy might be a bit more manipulation resistant as no N/Aing makes manipulation more risky.

@Jasonb suggestion average trades during all time trading hours (9:30am-4:00pm et), this market is from 3 to 4 pt where most of the people are asleep

@121 This might be better for future iterations, but I will stick to what I said as trades (especially during that last hour) might be strongly conditioned on this