🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ70 | |

| 2 | Ṁ65 | |

| 3 | Ṁ64 | |

| 4 | Ṁ57 | |

| 5 | Ṁ9 |

People are also trading

@TheBayesian Last month's question was involved in some drama as well and the creator doesn't seem to have the best rating either.

@Lion Report user in Discord if this is a common thing they've done, and there is proof.

Maybe we can find a way to prevent this in the future.

David has been working hard updating Guidelines and such, so this will help I am sure.

@SirCryptomind Thanks, done.

Wouldn't it be the right thing to at least mark the question as N/A? The user bought the "wrong" shares, and other users wouldn't lose Mana on this one. (If this question was resolved N/A, I'd lose Mana as well, so this isn't in my personal interest, as I'd profit from this question regardless of how it's resolved expect N/A.)

@TheBayesian I never understand why they don't do one of these:

240.01-250

250.01-260

Or even simpler

240-249.99

250-259.99

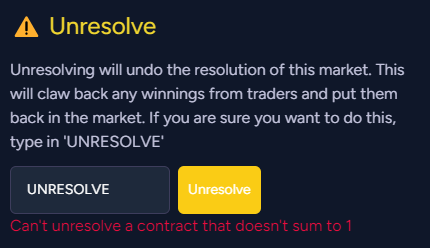

it's up to you, but I would recommend NA'ing this market and remaking it with the options all in order and mutually exclusive (so we can sort by OLD and see them ordered in an intuitive way), and link them so that the total of all the options must add up to 100%. otherwise, myself and others can make a bunch of profits just betting no on everything, since every option being 50% is absurd obviously

@TheBayesian that’s why i originally the rest in percentages adding up to 100% in my previous markers

@JakeJowita I don't understand what the reasoning is connecting the two. but usually the reason we resolve MC to something that sums to 100% is that we know "something will happen" has 100% probability, and then we split off that 100% probability into the probability that singular, mutually exclusive events will occur. this is very convenient because it leads to a bunch of intuitive mathematical structures and greatness. if the market resolves to 100% of the thing that happened, and 100% of other stuff, that means there is 200% weighting total, and that leads to less intuitive weirdnesses, like betting 60% on something that's 40% likely to happen, because in the 60% of worlds where it doesn't happen, in expectation it's like gonna be worth 20%? it's much harder to think about and not the intuitive interpretation of probabilities that people usually use, and isn't as informative to people trying to get info out of these markets. dunno if all of that made sense