At any meeting.

Jan/Feb 31-1

March 21-22*

May 2-3

June 13-14*

July 25-26

September 19-20*

Oct/Nov 31-1

December 12-13*

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,014 | |

| 2 | Ṁ1,122 | |

| 3 | Ṁ864 | |

| 4 | Ṁ642 | |

| 5 | Ṁ586 |

People are also trading

Agree with @MP so Kalshi has this at 15%ish here: https://kalshi.com/markets/ratecut/federal-reserve-rate-cut#ratecut-23dec31

I have been watching the markets which were looking to call the FED's bluff and thought that FED would cut the rates by the end of the year, esp if the economy tanks. On June 27th, they were still at 25-30%, but now they down to 15%ish as well.

A lot of it is because the economy has held up better than many expected. I'm expecting cuts in 2024Q1. Things may change, but leaving some alpha here.

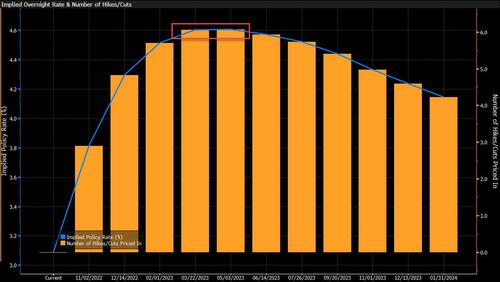

The Fed futures curve is almost entirely removing all cuts from the curve. Right now, markets expect a 4bps cut from November to December. Beware that both predictions are the expected value of many future scenarios, so the current 25% Manifold is pricing seems coherent with market forces.

@MP Ah, but if you did that in 2021 when they said they were for sure holding rates at 0% through 2023, you'd be in bad shape.

https://kalshi.com/events/RATECUT-23DEC31/markets/RATECUT-23DEC31

This real money prediction market is identical. Bought NO on the thesis that real money prediction rates are more efficient than play money rates.

@Gigacasting That is indeed interesting. It could be that the Kalshi market is mispriced. Although, I don't know if this could be arbitraged.