Bad news - you fell into a coma today. You wake up on January 20, 2025 and (for whatever reason) have no access to information about the outcome of the 2024 Presidential election, but would like to figure out which party won solely by looking at financial market data.

You only have access to today's prices (the day you sadly took coma) and the prices on the day you woke up, as the Presidential inauguration is imminent.

You can look at and choose from any publicly traded instruments - stocks, indexes, options, futures, bonds, commodities, interest rates, forex, crypto, etc. But you can't see prediction markets, forecasting platforms or any other non-regulated instruments.

You may construct any comparisons necessary to inform your decision (e.g. the outperformance of one (or more) instrument(s) over another during the course of your incapacitation), but must specify how you would construct the evaluation function in your answer.

Your answer should take the form of (for example): If Stock XYZ's percentage gain between now and inauguration day is greater than x%, then [Party] won. But of course it can be far more complex (e.g. if the gain of the worst-performing of these 5 cryptos and these 2 ETFs is more than x percentage points higher than the gain of the S&P over the same period, then [Party] won.).

Your answer should identify the single most reliable indicator of whether a Republican or a Democrat was elected President. Assume for simplicity that the nominee of one of those parties was elected and that the outcome is not disputed as of Inauguration Day.

The bounty will either be winner-take-all (if one submission is clearly superior to all others) or split evenly if more than one are roughly equally great.

People are also trading

@FlipPidot Who gets the bounty? Was my proposal and follow up sufficient?

Follow up post election:

The average return on the 10 chosen stocks above was -3.42%. The S&P 500 return was 4.68%. (Closing prices for were 1/17/25 used, as the market was closed on 1/20/25.)

This is a difference of 8.09%. Per my criteria above, this gives me a 99.65% chance of Trump being president.

It worked! I know who the president is! The stock market definitely responded to Trump's rhetoric on trade with China. Only one out of the ten stocks outperformed the market, Lam Research (LRCX). My only critique is that it may be a bit overconfident, but overall it worked.

Compare the average percent return of the 10 companies (equally weighted) to the S&P 500 based on the closing prices, on the January 20th.

A normal distribution with a standard deviation of 3% will be used to decide who is elected. You can calculate this yourself, but for ease I did examples by 10% intervals below:

If the companies underperform by:

a) 0.76%, 60% Trump won

b) 1.57%, 70% Trump won

c) 2.52%, 80% Trump won

d) 3.84%, 90% Trump won

e) 4.93%, 95% Trump won

f)6.98%, 99% Trump won

If the companies overperform by:

a)0.76%, 60% Harris won

b)1.57%, 70% Harris won

c)2.52%, 80% Harris won

d)3.84%, 90% Harris won

e)4.93%, 95% Harris won

f)6.98%, 99% Harris won

The theory behind this is that companies that do business in China will suffer as a result of the sanctions Trump is planning. Harris is more trade and China friendly. Currently the market is pricing in about even odds of each winning. Even if all stocks go up, these should perform differently relative to the market as investors brace for tariffs or plan for free trade depending upon who wins.

List of Companies averages to be used:

Company

Sector

Net sales in mainland China as a percentage of total revenue

Corning (GLW.N)

Electronic Equipment & Parts

32.68%

Albemarle Corp (ALB.N)

Specialty Chemicals

30.00%

Intel (INTC.O)

Semiconductors

27.39%

Applied Materials (AMAT.O)

Semiconductor Equipment & Testing

27.00%

Lam Research Corp (LRCX.O)

Semiconductor Equipment & Testing

26.00%

Amphenol Corp (APH.N)

Electronic Equipment & Parts

23.00%

Tesla Inc (TSLA.O) (EXCLUDED DUE TO CONFLCIT OF INTEREST)

Auto & Truck Manufacturers

22.47%

Borgwarner Inc (BWA.N)

Auto, Truck & Motorcycle Parts

21.11%

Microchip Technologies (MCHP.O)

Semiconductors

21.00%

Texas Instruments Inc (TXN.O)

Semiconductors

19.00%

Apple Inc (AAPL.O)

Phones & Handheld Devices

18.93%

Source:

https://www.reuters.com/business/us-companies-with-highest-exposure-china-2024-05-14/

I'll do the math on January 20th to prove this works, and give a percent chance of who my coma self thinks won.

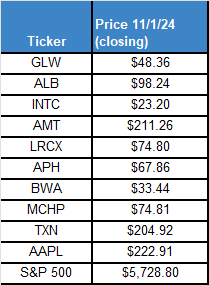

Current Prices (closing 11/1/24)

Weisenthal's asking something similar on Twitter today. Replies there might be instructive.

https://twitter.com/TheStalwart/status/1763618028460130778

USD:MEX was how I watched the early part of the 2016 election, rather than talking heads. Trump has said he wants to increase the tariffs on China to >=60%, so I would think firms with heavy import exposure would be impacted. Not sure about USD:CNY since that's heavily influenced by CCP machinations. (Disclaimer: I'm a boring index fund person irl)

"Bad news - you fell into a coma today. You wake up on January 20, 2025 and (for whatever reason) have no access to information about the outcome of the 2024 Presidential election"

Actually, I bet there are people who would pay money for this option!

Rather than call out specific stocks and justifying them individually, it seems like a statistical approach would be better.

Take every stock in the S&P 500/Various commodities/etc.

Look at their returns over the period from one day before to one day after election day over the past three elections

Run a logistic regression to predict the "which party won" outcome from these returns.

Construct a derivative that gives you a basket equal to the value of the returns weighted by their weight in the regression.

I would probably look at European defence companies gap to US defence. I'm sure this isn't optimal but a simple comparison would be:

If returns of BAE Systems(LON:BA) / Lockheed Martin (LMT) > 1 then Trump won.

A more optimal comparison would be returns of a basket of european defence companies to a US basket, perhaps with currency hedging.

This should reflect increased defence spending in Europe as a result of a Trump win and the implied reduced commitment to NATO/Russian deterrence.

Initial thought: if DWAC stock, hedged with SPX, is higher than it is today, then likely Trump won? DWAC is likely to merge with Trump’s media company. If it is lower, then I would assume a Democrat won. (If Nikki Haley wins, this would be wrong, but that seems unlikely enough that it’s possible to ignore)

Ok, not a finance person, and this is a boring answer, but I'll bite.

DWCREE and DWCCOA are two indexes that track the performance of renewables and coal stocks respectively.

The energy sector saw a lot of price action following Trump's election in 2016. I think there's still a lot of scared money in the market, and that the same thing will probably happen this year.

So, for the sake of simplicity, if DWCREE outperforms DWCCOA over the period, I assume the Democratic party won. If DWCCOA outperforms DWCREE, I assume the Republican party won.

Open to suggestions on other variables to 'control' for in order to make this more of an accurate forecast.