Resolution criteria

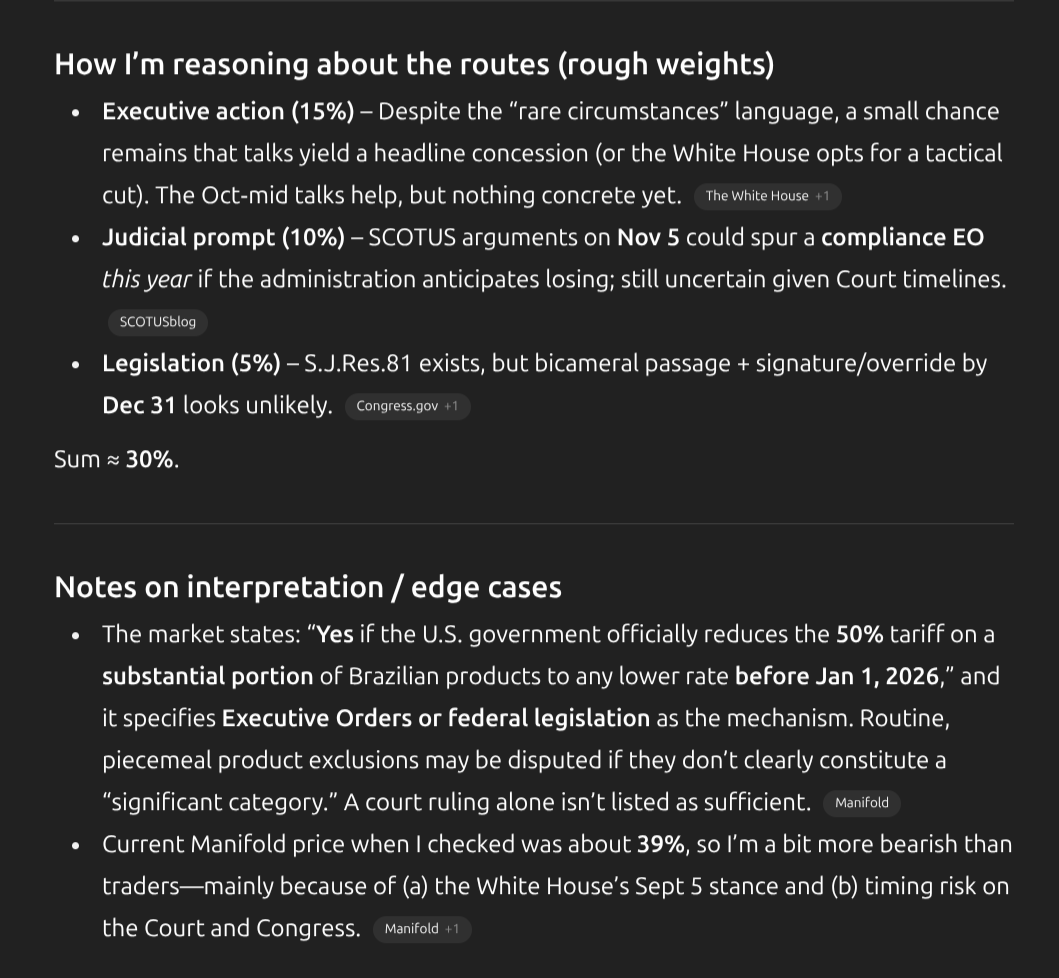

This market will resolve to "Yes" if the United States government officially reduces the currently imposed 50% tariff on a substantial portion of Brazilian products to any lower tariff rate before January 1, 2026. Otherwise, this market will resolve to "No".

Resolution will be based on official announcements from the White House, the Office of the United States Trade Representative (USTR), or relevant legislative action published on official government websites (e.g., White House.gov, USTR.gov, Congress.gov). The reduction must be implemented via an Executive Order or federal legislation and apply generally to a significant category of products currently subject to the 50% tariff.

Background

In July and August 2025, the U.S. government imposed a 50% tariff on many Brazilian products. This tariff consists of a 10% reciprocal tariff and an additional 40% "free speech" tariff, implemented via Executive Orders by President Trump. The stated reasons for these tariffs include concerns over Brazil's judicial actions against former President Jair Bolsonaro, alleged politically motivated persecution, intimidation, harassment, censorship, and prosecution of Bolsonaro and his supporters, as well as actions concerning U.S. social media platforms and free speech.

The 40% Brazil-only tariff applies broadly to most Brazil-origin goods imported into the United States, with specific exemptions for products such as orange juice, civil aircraft parts, certain machinery, metals, and energy products. Despite some exemptions, more than half of Brazilian exports to the U.S. remain subject to these tariffs. Recent discussions have taken place between U.S. and Brazilian officials regarding these tariffs, with Brazil appealing for their reversal. Some U.S. senators have also introduced a measure to terminate the national emergency declared to enable these tariffs.

Considerations

The imposition of these tariffs is tied to specific political and judicial issues between the two nations, rather than traditional trade disputes. Any potential reduction is likely to be influenced by developments in these areas, as well as ongoing bilateral diplomatic efforts. The legal status of these tariffs is also in flux, as federal courts have ruled that tariffs imposed under the International Emergency Economic Powers Act (IEEPA) — which governs the Brazil tariffs — are unlawful, though they remain in effect pending appeal. The Supreme Court is scheduled to consider the IEEPA tariffs in November 2025.