Resolves yes if and only if the closing price of GOOG (class C Alphabet stock) touches or exceeds $150 on any day before 1st January 2024.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ252 | |

| 2 | Ṁ127 | |

| 3 | Ṁ107 | |

| 4 | Ṁ83 | |

| 5 | Ṁ80 |

People are also trading

Given the last 12 months' analysis the average of Google stock is 112.06. While other factors, such as inflation, interest rate, and industrial trends largely influence the stock market. Investors have been committed to investing in new generative technology such as AI with starts up. Although Google has been following the trend of technology, other competitors are innovating, such as Amazon one. Google needs to innovate a new technology to attract investors.

Based on data collection from the last 10 years, we can calculate the average daily return, standard deviation, and a confidence interval for the daily return, and the use them to forecast the the closing price for Google at the end of the year.

Results:

Average daily return: 0.10%

Standard deviation of daily returns: 1.3%

95% confidence interval for daily return: (0.07%, 0.13%)

Forecast for closing price before January 1, 2024: $151.30

The stock market is still unpredictable, but the data seems to indicate the overall positive trend for Google.

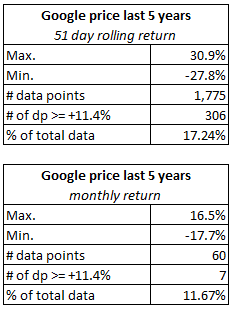

Hi Daniel, although I agree with your calculations, I disagree with your answer and conclusion, mainly because of some statistics on historical data. As of November 10th, Google stock closed at $134.06, this means the stock price must increase 11.4% by December 31 this year (in 51 days). When considering the last 5 years of Google stock price data, we can see monthly returns range from +16.5% to -17.7%. Therefore, given Google’s price volatility, is it possible that the price will increase more than 11% in the last month and half left of the year. Also, considering the historical 51-days rolling return, it ranges between +31% and -29%. So, it is also possible for the stock to reach 150 before year end. Nevertheless, if we look at probability, during the last 5 years, only 12% of monthly returns have been higher than 11% and only 17% of the 51-day rolling returns have been higher than 11%. Then, even though it is possible, history says it is not than probable that this will happen by year end. Also, it is important to consider that stock prices are impossible to forecast and even harder in the short run.