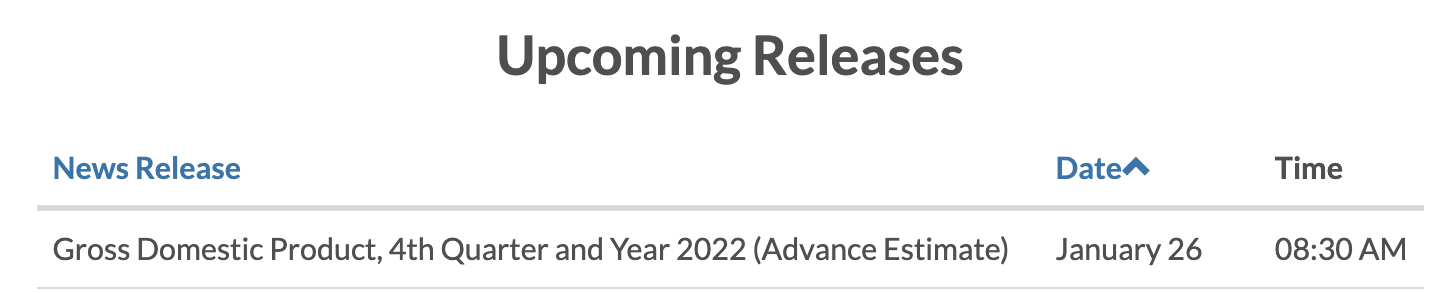

The final outcome will be determined by the BEA's advance estimate for 2022 full year nominal GDP estimate, typically published on the last Thursday in January, 2023. BEA publishes this data at this link (https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2) Table 1.1.7, Line 1. Annual nominal GDP is also posted on FRED in easier to read format: https://fred.stlouisfed.org/series/A191RP1A027NBEA.

Nominal GDP targeting is a proposed monetary policy mechanism to replace specific inflation targeting of the Federal Reserve (see https://www.mercatus.org/system/files/beckworth-ngdp-targeting-mercatus-special-study-v1.pdf).

Please note this is NOMINAL GDP growth, not real GDP growth, which is the typically reported number in headlines. Nominal GDP growth = real GDP + inflation.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ1 | |

| 2 | Ṁ0 | |

| 3 | Ṁ0 | |

| 4 | Ṁ0 | |

| 5 | Ṁ0 |

People are also trading

Resolved from dividing Q4 2022 by Q4 2021 estimate from BEA. Realized in my description I linked both BEA and FRED which calculate things slightly differently when I thought they were the same. FRED takes average of all 4 Quarters estimate from 2022 and compares to 2021. Since I said this would be determined by BEA first in the description, that's what I'm resolving to. I will clarify this better on my market for the 2023 nominal GDP market.

Interesting so Polymarket only has 75% chance US 4th quarter real GDP growth is greater 2.5% https://polymarket.com/event/did-us-gdp-grow-more-than-2pt5-in-q4-2022, but it's only got $117 volume. Atlanta Fed, GDPNow forecast updated January 20th says 3.5% growth in 4th quarter annualized.

HOWEVER, that actually doesn't pan out to a very high overall real GDP number for the year since real gdp was negative in the first 2 quarters. Something like 1.1%. Adding that to the 6.5% december to december CPI change leaves only 7.6% nominal growth...which is about what we've got in this market 😂 .