The Manifold loans system is fantastic, for several reasons. It provides daily liquidity to users, which is good for retention. It helps with capital efficiency on long-running forecasts. When used responsibly, it allows low-risk leverage across diversified markets. It's a feature that makes Manifold much better than other sites in many ways, and Manifold should lean into it.

My improvement suggestions:

Bump the loan rate up a little.

Get a little stricter with the per-market size limits, and especially restrict "lots in each of a couple" even harder than the same max position size but only one large position.

Allow loans against full value of the position including unrealized gains

Allow loans against provided liquidity remaining in markets

Claw back underwater loans at the same rate that new loans get handed out. (Or slower, I guess, if you're feeling generous. Or rebalance in some fancier way to ensure that "click the loan button" always has a positive payout.)

Optional neat feature you could tack on: when positions include a cash equivalent element (NO in multiple MC outcomes, or YES in all of them), immediately loan out the cash equivalent. Don't include this portion in the market risk limit. This would make limit orders in multiple choice markets, especially NO limits, far more powerful and user friendly.

Other neat feature, if you're trying to treat Mana more like $ in a serious way, and promote long term, high certainty, or small-marging bets: pay interest on positions held (similar to Kalshi), but for many reasons pay it in the asset held. This includes cash holdings, shares, and also shares held by AMMs (interest paid to the AMM). This is probably out of scope for the first pass but it would be super neat.

@ItsMe they were, which is part of what prompted me to write this down.

I think a more likely explanation is that SG is back and making changes to improve things (this is good!), kinda winging it, and making some decisions I disagree with. He's been very open to discussion and feedback, which I appreciate, and I currently expect the end result of all this to be good for the site, but with a bunch of arguing and complaining along the way.

pay interest on positions held (similar to Kalshi), but for many reasons pay it in the asset held. This includes cash holdings, shares, and also shares held by AMMs (interest paid to the AMM).

Absent a link to real assets, it is equivalent to making every other mana value (which is apparently "market liquidity threshold", "trader bonus" and "quest reward") decay at the inverse rate. Except when people use round values because they like them.

This is probably out of scope for the first pass but it would be super neat.

Well all mana values would be replaced by a pair (mana value at last access, date of last access) so it is not overwhelmingly complex.

@AnT the most important value it's equivalent to changing is one you didn't include, and also the source of the interest rate to choose: the mana to USD exchange rate, and the risk free USD interest rate.

If there was no purchase price for mana, it wouldn't matter and a 0% interest rate would make sense.

strong agree on interest on investments, in fact i think this should replace the loans system entirely.

have thought about writing a longer post on this but broadly, the loan system currently does not compensate an trader who discounts exponentially properly. the value you claw back is heavily front loaded. it reduces SOME of the opportunity cost, but it is still preferable to not to trade than take a zero EV bet even if you’re risk neutral bc there is an (infinitely long) lag in when you receive the full value of your investment back in liquid cash

interest ONLY on positions (not idle mana) incentivises whales to make use of their balances, and it more cleanly compensates for the actual opportunity cost

@brod This mostly makes a ton of sense to me, but I'm not sure what you mean by a trader who "discounts exponentially"

@brod the two systems (Manifold loans and Kalshi interest payments) are, in my opinion, highly complimentary. Both are good! The Manifold system is a risk managed trickle of leverage, the Kalshi system handles inflation and the risk free prevailing interest rate.

Manifold should use both.

@SimonWestlake With 'discounting exponentially' I was referring to the type of discounting where after each day, payoffs are discounted by the same factor: https://en.wikipedia.org/wiki/Exponential_discounting

I also wrote a longer post expanding on this today:

https://zeroexpectation.substack.com/p/problems-with-manifolds-loan-system

@AhronMaline That is probably a reflection of the underlying theory that more trading on the platform => good for the platform.

@Eliza I mean, if you said we want ppl to be full Kelly betting on every market at once, I'd see why that's good. But zero EV?! What is this, a bank?

@AhronMaline just to illustrate how interest/loans/discounting change the present value of the bet relative to zero. the same points hold for a bet with any EV

@AristotelisKostelenos A loans dashboard would be great! It's really hard to figure out what's going on with loans, even via the API.

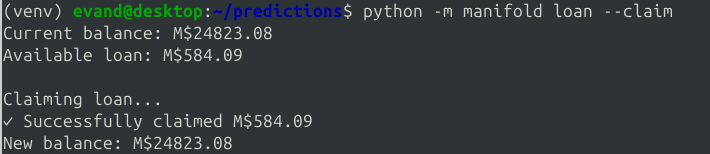

Speaking of which, loans are available via API. Or at least, my bot's loans are ;)

Since it seems a common point of confusion: the 1% per day speed of the loan system should not be thought of as a rate, in the sense of an interest rate. That's a type error. It's just the speed with which you can pile on leverage; no one is paying any interest in this context, and it is not directly comparable to any interest rate. I'd suggest calling it a loan "speed" or something else instead of a "rate", to distinguish from interest rates.