Resolves as YES if Sam Bankman-Fried (aka SBF), founder of FTX, is convicted of a felony in any country. Resolves as YES whether SBF pleads guilty, is found guilty, or is tried and found guilty in absentia.

Clarification: AFAICT, 'felony' is a term only used in the United States. If SBF is convicted of a crime outside of the USA, the crime will be deemed a felony if the equivalent crime is considered a felony in the USA.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,710 | |

| 2 | Ṁ1,202 | |

| 3 | Ṁ913 | |

| 4 | Ṁ671 | |

| 5 | Ṁ510 |

People are also trading

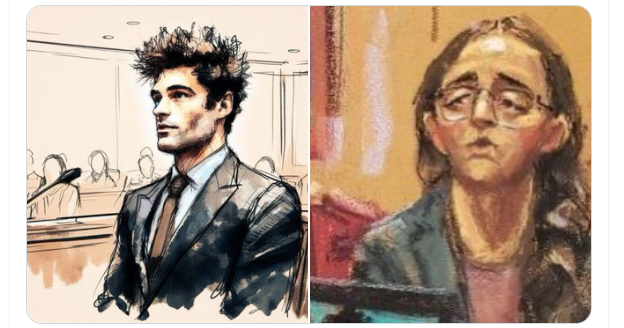

Martin Shkreli's jury analysis (via Twitter):

SBF Jury Analysis - disaster

Summary: It looks like Sam's only chance is to convince the cancer banker, aka "NHL" aka "Hong Kong" to acquit. everyone else in that jury is going to convict him.

9 women, 3 men - i generally view this as awful. i could be convinced it's only slightly bad, but there's no doubt in my mind this is a disadvantage.

"preggers" is the 39 year old physician's assistant who is pregnant. i got a good look at her and i'm convinced she will convict.

no good read on the nurse or 59 year old man.

the social worker will convict.

the non-for-profit fundraiser will convict.

postal service guy is likely to convict but i also see something in him. think he will be vocal in the jury room.

corrections officer is going to convict. you have to be kidding me.

the metro north conductor with five kids has a chance to champion sam. i would focus on her, make eye contact, smile.

Ukranian bloomberg employee is a wildcard. probably will be quiet in the jury room.

special education teacher will convict

the librarian will send SBF to hell - convict

cancer guy is Sam's hope. he has NHL which is very treatable. but this man was a banker and can teach the rest of the jury that Sam might be innocent, if the defense can connect. the rest of the jurors will feel really bad for him, maybe even assume he will die. they will respect his voice. he is a huge possibility for an acquittal, if he buys any of the defense story.

@SG I tried to think of a claim to verify that Shkreli is actually there. I believe it but it seems surprising! Would be super nice to have someone with a clear view and experience giving the inside scoop

Shared without comment:

"Prosecutors had asked Kaplan to revoke Bankman-Fried’s bail after The New York Times published extracts from the private diaries of Caroline Ellison, the former head of the cryptocurrency exchange’s affiliated hedge fund Alameda Research. [Judge Kaplan said] the diary materials were “something that someone who is in a relationship would be unlikely to share with anybody, still less The New York Times, except . . . to frighten” the author, Kaplan said.

Manifold in the wild: A Tweet by Pranav ⠕

@sullyj3 @parafactual https://manifold.markets/mr22222222/sbf-convicted-of-a-felony-before-20?referrer=pranav it’s a lot higher for a conviction before 2026

https://sambf.substack.com/p/ftx-pre-mortem-overview new sam post, likely hints at his intended defense.

@DeanValentine or if he talked so much in his interview circuit that the jury mistries because too many die of old age before the trial's done, hah

https://www.nytimes.com/2022/12/21/technology/ftx-fraud-guilty-pleas.html

Former Alameda research head Caroline Ellison and FTX executive Gary Wang have pleaded guilty to fraud and are cooperating with authorities.

SBF agrees to extradition to the United States, giving up the opportunity to spend years fighting extradition.

The cooperation of two lieutenants with detailed insider knowledge and the rapid extradition to the USA mean that the probability of a conviction before 2026 is very, very high.

The lieutenants can corroborate each other's testimony. Any part of the fraud that was not documented electronically (sometimes on a cryptographically-signed immutable public ledger!) might be explained when Wang and Ellison are cross-examined.

I think the Southern District of New York is playing a very strong hand here. When SDNY tells other FTX executives to come forth and cooperate now, I don't think it's a bluff.

Things are moving fast. Just piled my last M into YES. Any price less than 98% is silly at this point. Nothing short of a presidential pardon or an epic procedural fuckup by the SDNY attorneys will keep SBF out of prison.

90% of people charged with a federal crime plead guilty. 8% have their cases dismissed. 2% go to trial and very few people in that 2% are acquitted.

I don’t think the chance that SBF’s case will be dismissed are very high.

Piling into YES.

@Preen actually I guess your point was your prior was already that SBFs chances of his case getting dismissed

@Preen He’s in custody. He’s safe from harm. He did a “I’m guilty as fuck” press tour in every medium. He will be extradited. Evidence of crimes is on immutable crytographically signed ledgers.

Game over.

https://twitter.com/tier10k/status/1602446815772741632 Claimedly SBF has been arrested.