This market will resolve to YES if, before the end of 2023, a regular user could set a stop order on Manifold markets.

A stop order is an order to buy or sell shares once they have traded at or through a specified price (the "stop price").

*If it is not possible to set a stop order on every market, in order to suffice YES, it has to be possible to set a stop order on at least every newly created yes/no market.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ213 | |

| 2 | Ṁ75 | |

| 3 | Ṁ64 | |

| 4 | Ṁ57 | |

| 5 | Ṁ47 |

People are also trading

I'm worried that stop orders are going to be misleading in markets without a lot of liquidity. Unlike with limit orders, with stop orders you don't have any guarantee of executing at a particular price. I expect a lot of people will not understand this, and end up inadvertently buying a lot of shares at a price close to 0/1.

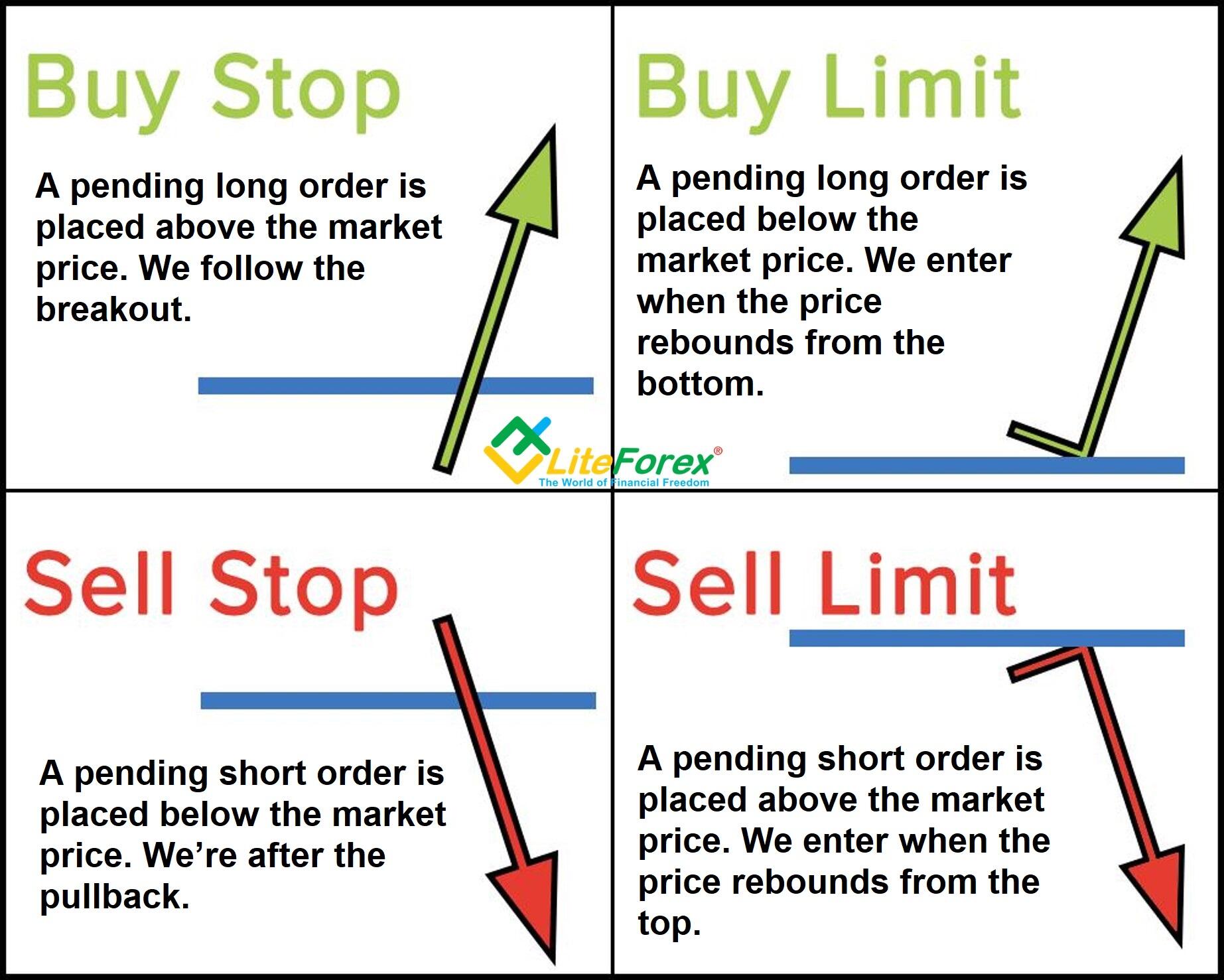

@IsaacKing Stop orders are different from limit orders. They are spot buy/sell orders that trigger when the price hits a certain point. See figure

@jonsimon That graphic is one of the most uninformative graphics I have ever seen, but I looked it up online and it appears that stop orders are inverse limit orders, to buy against market liquidity (or someone else's limit order) once triggered by someone else's bet in the same direction as your stop order.

Seems kinda niche, but I could see why someone might want to use one of those.

@IsaacKing It makes more sense in traditional markets than it does in prediction markets. The idea is that you're following the market momentum. It goes up and you expect it to keep going up so you want to buy, or it goes down and you expect it to keep going down so you want to sell.

@IsaacKing these orders are often used as a "stop loss" order and they make sense in prediction markets. Once new information is available I might want to exit my position and not hold my now worthless shares all the way to 0. The stop limit threshold is a proxy for "new information is available" when someone is not following news all day or sit in front of their manifold app.

@AlexbGoode Very good point, I've definitely had this thought when setting large limit orders at extreme values. "But what if the probability only reaches such a low/high point because something new and important happened that has causal bearing on the resolution?"

@AlexbGoode Seems dangerous when a single user could just buy the market to that probability and then sell out at a profit.

@jonsimon limit selling is not that different from limit buing opposite share. We don't have any triggered on condition orders yet - those i count as 'stop orders'.

So, if limit selling would be "sell when price comes through X" then it would resolve YES

@itsTomekK it's not that different, but I wish there was an easy way to say "I want to exit this market with that much profit". Right now I have to emulate this with limit buying, but It doesn't work well