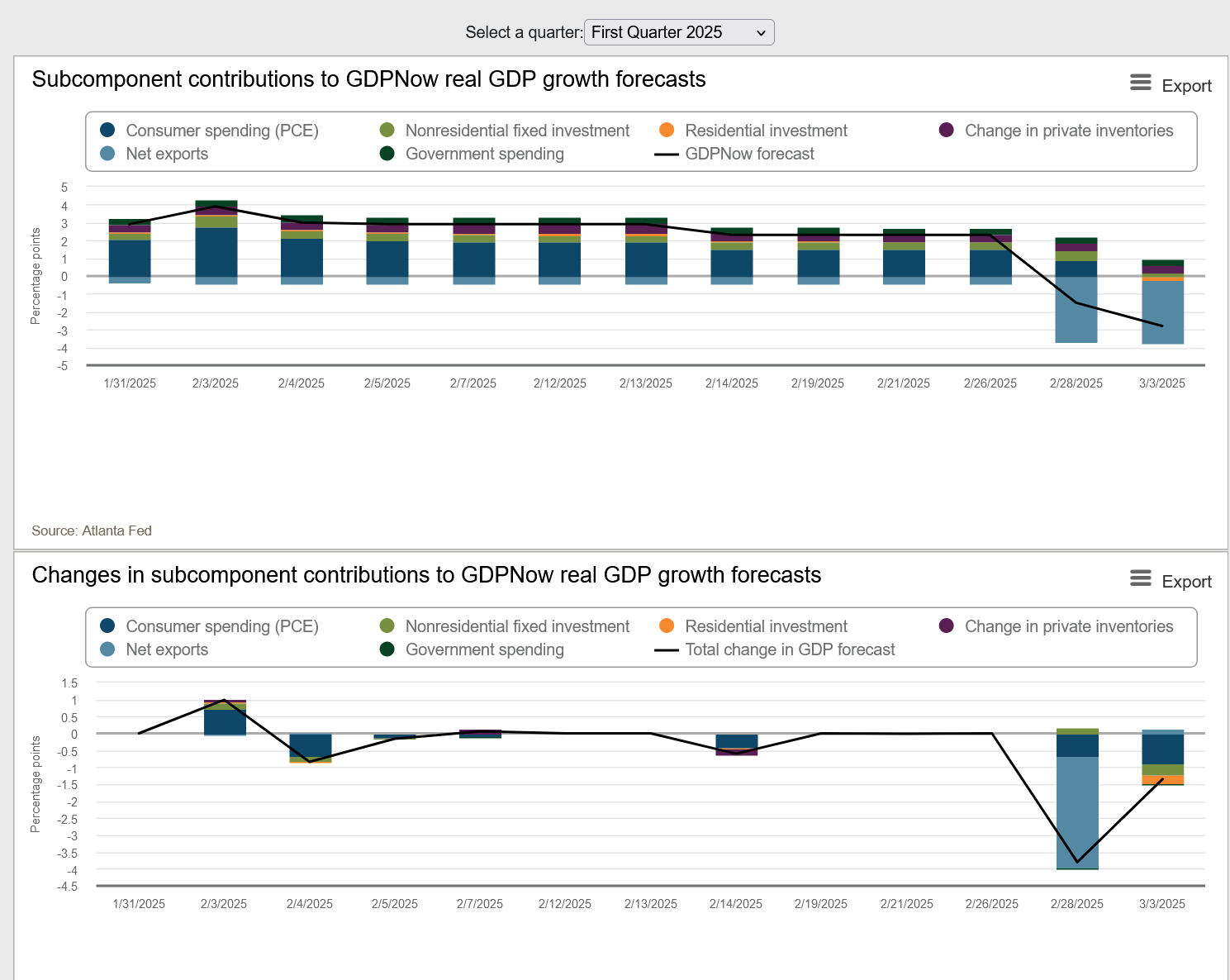

The Atlanta fed is currently forecasting a -2.8% GDP quarterly growth for Q1 2025.

This resolves YES if the Q1 GDP for the United States is broadly in-line with this estimate, which I shall define as -2% or less!

This resolves to the THIRD ESTIMATE, scheduled to be published on June 26th, by the Bureau of Economic Analysis. https://www.bea.gov/news/schedule

HOWEVER, if there is good reason to believe that these numbers are wrong (due to political pressure or other factors), based on a consensus of reporting, I will resolve to the best independent estimate of US Q1 GDP available at that date. Indeed, based on reporting on comments by the US Treasury Secretary, this seems like a distinct possibility that there will be methodological change in GDP determination, which might cause this to be necessary.

Due to the potentially subjective nature of this resolution, I will not bet on this market.

Update 2025-03-03 (PST) (AI summary of creator comment): Alternative Calculation Adjustment:

Government Spending Inclusion: If the official calculation changes to exclude government spending, the alternative estimate used will be one that continues to include government spending.

Consistency of Comparison: This approach is necessary to ensure that GDP figures remain comparable to past measurements.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ384 | |

| 2 | Ṁ309 | |

| 3 | Ṁ252 | |

| 4 | Ṁ168 | |

| 5 | Ṁ141 |

People are also trading

@bens I think it's actually too high. Kalshi has -1.5% at around 10%. Q1 is already over and not impacted by recent tariff rounds announced on April 2nd. GDPNow is working with a lot of out of distribution data and have themselves produced a revised estimate of around -0.8%

Looks like there some issues with gold imports affecting the forecast. The "gold adjusted" estimate is now 0.4%. https://www.linkedin.com/pulse/gdp-forecasters-some-gold-doesnt-glitter-atlantafed-fxb2e/

I believe the vast majority of the drop in the gdp now indicator is due to businesses importing goods before the tariff deadlines, which technically decreases GDP because it temporarily decreases the trade balance, but it doesn't say anything about the actual economy because it's only a change in inventory. The economy is slowing down (the consumer goods indicator also decreased) but is probably not shrinking

@bens I'm basing it off of this, from the imgur link the vast majority of change seems to be from the sudden drop in net exports

@spiderduckpig If all that happened is that business are importing more and stockpiling it in inventory, then it shouldn't change GDP.

GDP = C + I + G + X - M

M, the imports, increases, but so does I, Investment expenditure, which includes Inventory.

That said, I don't know if the FedNow estimate has updated estimates for business inventory.

@DanielTilkin That is a good point. I'm not sure if they update investment data as frequently as export data, if the investment data is delayed then that would explain why there doesn't seem to be a similarly large jump in the investment subcomponent to correspond with the change in the net exports.

https://x.com/AtlantaFed/status/1898126052490133625

Atlanta Fed also recently announced that around 60% of the widening in the net exports measure is due to a gold import, and the gold-adjusted model predicts 0.4% growth. This probably accounts for most of the difference.

@WilliamGunn yes. If the gov calculation changes their basis to no longer include gov spending, I will find an estimate that includes gov spending. Otherwise it makes no sense to compare GDP to past measurements.