This market will resolve to the announced Series I bond Fixed Rate, as decided by the US Treasury.

An example of an announcement, this one from a year ago.

https://www.treasurydirect.gov/news/2022/release-05-02-rates/

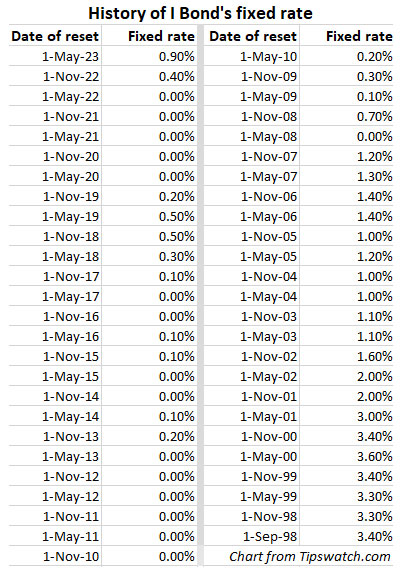

Here are historical rates and background.

https://www.treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

https://www.treasurydirect.gov/files/savings-bonds/i-bond-rate-chart.pdf

More on historical rate / trends

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ1 | |

| 2 | Ṁ1 | |

| 3 | Ṁ0 |

People are also trading

I learned my lesson here, the next set has a cleaner "YES/NO" market structure

https://manifold.markets/YourTreasuryDirect/will-us-treasury-series-i-bond-fixe

Announced: 1.30%

https://treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

I have to round, sadly, to closing market at 1%

https://tipswatch.com/2023/10/08/the-i-bonds-fixed-rate-will-rise-but-by-how-much/

"my current thinking is that the I Bond’s new fixed rate should fall in the range of 1.40% to 1.70%"

Working backwards to a fixed rate with guesswork:

Assuming it’s going to take a while for inflation to go down, that the September CPI U index will be at or slightly above August (two scenarios: 307.2 or 308) and using a guess for what I expect a competitive composite rate (4.57%) for the next year based on the last composite rate difference from the FEDs effective fund rate at that time (5.33 - (5.06-4.3)) (not sure if this is sound), I get a semiannual rate of 1.72 to 2.4%

Edit: I somehow got the wrong calculation for the fixed rate I did previously one so I put it all in a notebook this time after starting from scratch: (Now getting 1.1 or 0.5% with an average of 0.8%)

The FED methodology for setting the fixed rate is a black box and I have never done type of guesswork calculations in this domain before somI am betting conservatively lower.