A time-sensitive (inverse) copy of this market:

This market closes on 1/14/2024.

This is so we can measure Manifold's calibration against Yglesias' at the relative same point in time given enough traders (which I could make a further meta-market on). Manifold will have a 2 week advantage, but I want it to catch on (I also probably won't add the sports predictions which will obviously give Manifold an advantage). I will also resolve N/A if this actually occurs during the period before 1/14/2024.

Why not just use the percentage that day from the original market (since this could just be seen as an arb)?

A.) It creates urgency/a deadline for an actual prediction, its possible bettors are just trying to ride waves for profit, while also potentially drawing early interest/bettors to the topic that might have waited to bet until later.

B.) It will be easier for me to compile later to reference the markets.

C.) The market will close on 1/14 so it won't be clogging anything up market listings with redundancy for long.

D.) It might actually be interesting to see if the markets are Arb'd on 1/14.

Even though it closes on 1/14/2023, it will resolve when the linked market resolves.

Matt predicts 90% (no recession) for this question

https://www.slowboring.com/p/my-2024-predictions

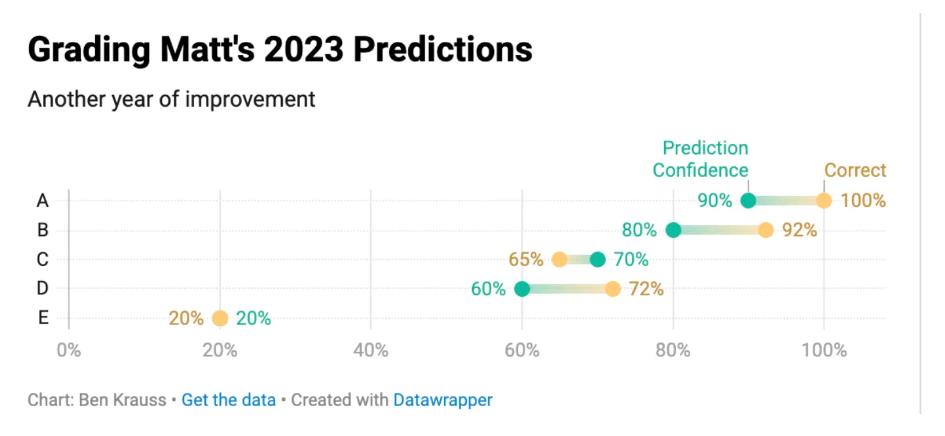

Matt's calibration for reference:

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ44 | |

| 2 | Ṁ8 | |

| 3 | Ṁ0 | |

| 4 | Ṁ0 |

@grofigaszadosijv no it closes on the 14th, but resolved end of year so it's a prediction now to lock in (like Yglesias did)