On June 21, 2023, Wells Fargo bank closed approximately 14 accounts related to me, my employees, and my businesses. They provided no official reason, but one of their employees stated on the phone that upper management was uncomfortable with my legal and compliant involvement in cryptocurrencies.

Wells Fargo also closed additional accounts that had nothing to do with cryptocurrency, including two credit cards. One of the cards had accumulated hundreds of dollars of "rewards points," which Wells Fargo claims they are permitted to seize, even if they initiate account closures without warning.

I sent a demand letter to Wells Fargo, stating that I would not pay them for those rewards points, on the grounds that their contract is legally "unconscionable:"

https://shoemakervillage.org/temp/wellsfargocensored.pdf. A check was enclosed for the balance due above the rewards points.

This market resolves to YES if litigation commences between me and Wells Fargo in any court before the statute of limitations expires on this credit card balance. The plaintiff could be Wells Fargo suing me for nonpayment, or me suing Wells Fargo to defend my credit score. The cause of action is irrelevant; other causes like defamation would also suffice. I plan to do nothing unless Wells Fargo makes the first move by suing me or reporting the account as delinquent to a credit reporting agency.

If no civil litigation occurs within the two-year statute of limitations, the market resolves to NO.

See updates in the comments. I've also included images there.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ4,967 | |

| 2 | Ṁ2,069 | |

| 3 | Ṁ759 | |

| 4 | Ṁ86 | |

| 5 | Ṁ56 |

People are also trading

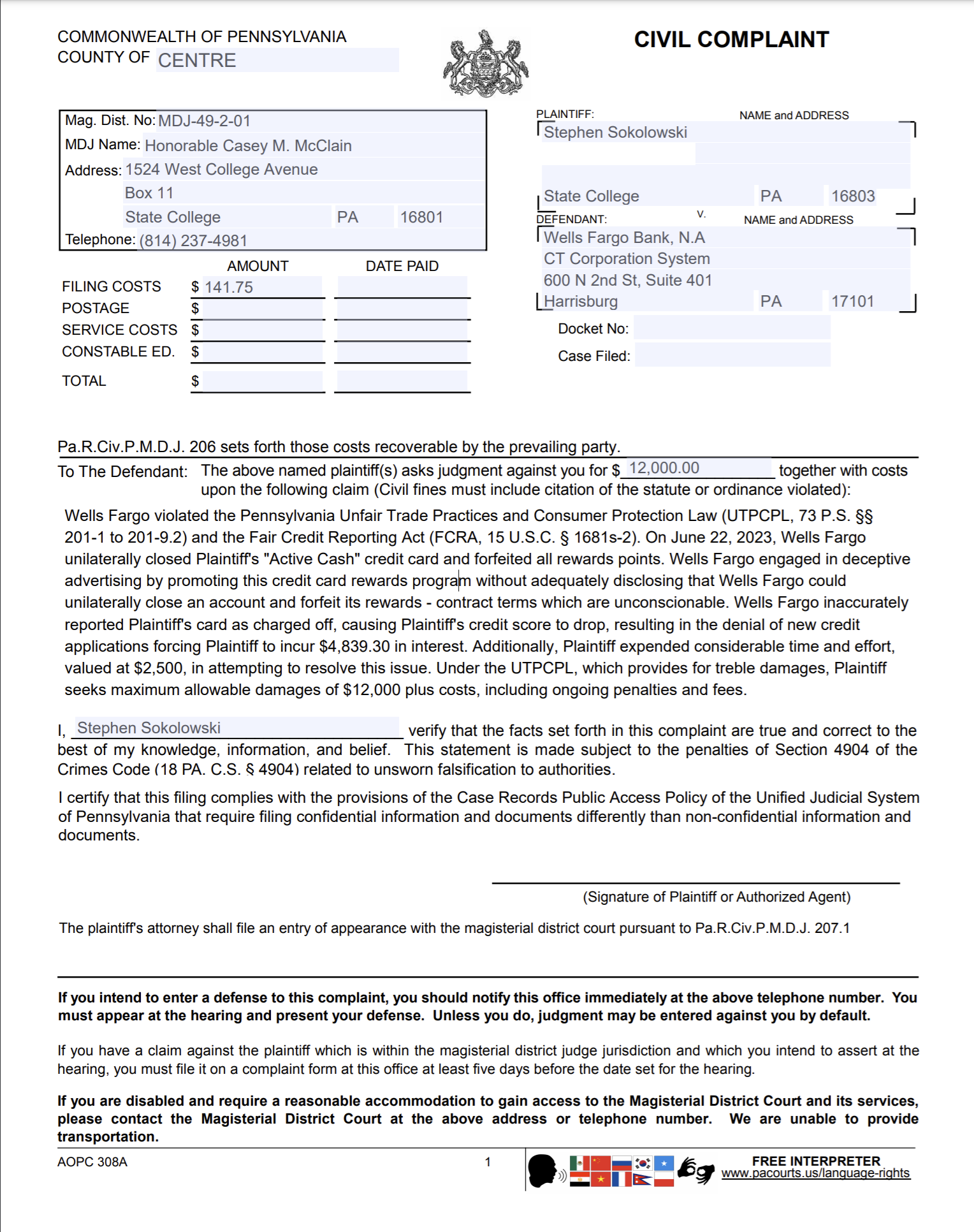

RESOLUTION: This market resolves to YES. I've attached the filing below, which will be mailed in two hours.

SEE NEW MARKET FOR EXPLANATION AND LEGAL THEORIES: /SteveSokolowski/will-i-win-my-lawsuit-against-wells

Update: The deadline has passed, but I haven't had time to deal with this at the moment because of the market crashes. I've been spending every available moment looking for stocks that just crashed to buy, often on margin.

When the market is closed on the weekend, I will review the statements. If they are as expected, then I will write the filing on Sunday.

I checked the bill last weekend, as promised, and decided both that it will be necessary to file and that I have all the information. I also sent one last attempt to Wells Fargo so that a judge couldn't throw it out due to not notifying them, and they declined to settle.

I spent some time yesterday using Claude 3.5 Sonnet to write up a complaint (this form https://www.pacourts.us/Storage/media/pdfs/20210224/220311-civilcomplaint-000771.pdf) and to organize the case so that I can begin negotiations with Wells Fargo when they contact me.

The direct damages are $338 - the interest they charged on the first bill I couldn't transfer to a zero APR card. The remaining research I need to do today is how to value their fraudulent negative credit report. The FCRA values violations at $1,000 per instance, so I can use $1338 plus court costs of $200 as a floor for the suit.

I'll post the final theory of the case along with the full complaint when I file it. It's actually surprisingly simple to file - I just need to write one paragraph in that form and send it to the office in Bellefonte. Most people who are using this small claims system, from what I've seen in my experience suing Coinbase, the City of Tallahassee, Block Inc, and Angi, are not very knowledgable about the law, nor are the lawyers assigned to defend these cases. They just write out why they think something unfair happened to them, so when I've written out multiple pages with statute numbers and legal theories, I've found the lawyers are often on the back foot and willing to settle. Let's hope that happens here.

The next steps are to file the case and then a hearing date will be assigned in one month. Wells Fargo will either contact me to negotiate, or file a continuance to negotiate before a new date a month later. It's extremely unlikely the case goes to a hearing, but I'll go to the courthouse if required.

@SteveSokolowski Great example of accidentally being right:

"It's extremely unlikely the case goes to a hearing, but I'll go to the courthouse if required."

Update: It seems, after some research, that the "promotional period" ends, and then they bill you on the normal statement date, and then the penalties and interest start if you aren't able to pay the first bill after the period ends. It's not, as I originally thought, that the entire balance was due on the promotional end date.

Therefore, the timelines I was discussing below appear to simply be delayed one month. Therefore, I'll provide another update on August 9, rather than July 9, as originally expected.

Update: Wells Fargo sent me a statement for August, the date after the zero-interest card was to start accruing interest and penalties.

The statement does not include any interest or penalties, which is in contradiction to how they would normally charge both.

I'll see whether, for September's statement, they actually charge any penalties. As it stands now, I have very limited damages, because they aren't actually penalizing me for paying the minimum balance. This is a surprising turn of events. As such, I'm not going to sue at the moment. Perhaps they did read the letter and decided to get ahead of the situation?

I forgot to update this market for July.

Out of courtesy just to make sure that they can't say that I hadn't warned them, I sent them one final letter stating I will file on July 10 if they charge me interest or penalties on the large balance, since their false credit reporting on the seized rewards points leaves me unable to roll over the balance to another bank.

I don't expect them to respond; there probably won't be any news for a week.

I sent them the letter, and they didn't respond.

I'm awaiting them to send me the bill for the zero interest credit card, so that I know the penalties and interest to fill out the paperwork with the actual damage amount.

There's been a 10 day delay because a power cable came loose in a RAID 6 array, taking out four disks. The metadata on the disks was destroyed, but no data on the filesystem was modified. I need to use Claude 3.5 Sonnet to write software to recover the array to get the data; I've already used it to write a permutations program to get the disk order. The last backup was made before applications to credit cards were saved on the array, and I need rejection letters as evidence. I applied to two new cards and was rejected, so I need to wait until either those two letters arrive in the mail or I can finish the program to recover the data.

It's not. People who create RAID arrays often calculate the failure rate based on the rate of the disks seizing, when things like this that are not independent are what cause data loss. That's why we created a backup array.

But the backup can't be updated automatically because if it were, then ransomware on the main could destroy all the data. So, it can only be updated in a time consuming process every month where we need to get it from the offsite location and manually compare.

There is one - R-Studio. The problem is that it never completes because it is old and hasn't been updated in a long time. It's single core and compiled for single-core older processors, and can't iterate through all the 12! permutations for today's large arrays quickly enough.

But claude 3.5 Sonnet was able to write a Python program that compiled down to C, parallelized to all cores, using AVX-512 and filling the entire processor's cache, while caching part of the computations in memory to save time, and I was able to find the disk order in 3.5 minutes for all 479 million permutations of disks.

That's what AI can do nowadays. Since yesterday, my plan has changed to just putting these disks on a shelf until next year or the year after, and letting an AGI plug away at the remainder of the recovery process, as it's basically a job designed for AI and it will be trivial for it. That's why there's a 10 day delay for applying to new credit cards.

@patio11 I would advise reading the market criteria. If you understand it fully, then that's fine, but keep in mind that the criteria resolve YES if I sue the bank for false advertising, false credit reporting, or an unconscionable contract.

@SteveSokolowski My inability to model you is why I did not sell this to 2.

@patio11 Well, I did state above that the only way a lawsuit would not go forward is if the bank agreed to acknowledge the rewards points.

I'm not betting on this market, but I don't see more than a 5% chance that Wells Fargo, after having stuck to their line since March 2023, would do so before July 6 when the other card is due.

@benjaminIkuta The resolution would be YES if a court action begins and NO if it does not.

I already sent them a settlement offer, which they declined. My experience with suing the city of Tallahassee, Coinbase, Square, and Angi is that no matter how strong the case, these companies always ignore the problem until well after interest and court costs accumulate, and then only come to the table after a lawsuit is filed.

You can bet NO if you believe Wells Fargo will suddenly turn around and settle. I think the most likely resolution will be that I sue Wells Fargo, and then after that a settlement is reached a month later, which would be YES.

@SteveSokolowski thanks for the reply. Besides them suddenly turning around like that, is there anything else that could realistically lead to a NO resolution?

@benjaminIkuta Not realistically, no, unless the newest models have a negative opinion on the merits of all four causes of action. I used models that are now obsolete, like Gemini 1.0 and GPT-4-Turbo and Claude 2 to perform the initial research.