Disclaimer: If I suspect any injuries are inflicted by someone trying to manipulate the market those bills will not count, you will be banned from Manifold, and your sweepcash/mana confiscated. I also ask no one holds a position of more than 500 shares in the sweepcash market at any given point so incentives aren't too high lmfao.

I am finally working for Manifold as an FTE on an O1 visa!

This means I am now working in person and am currently enrolling for my health benefits.

My health insurance goes into effect February 2025 and this market will resolve based on my health bills for the following 12 months. If I stop being on this health insurance before the 12 months (eg. Manifold runs out of runway and I get made redundant), then I will resolve the market based on how much extra I have spent/saved up until that point.

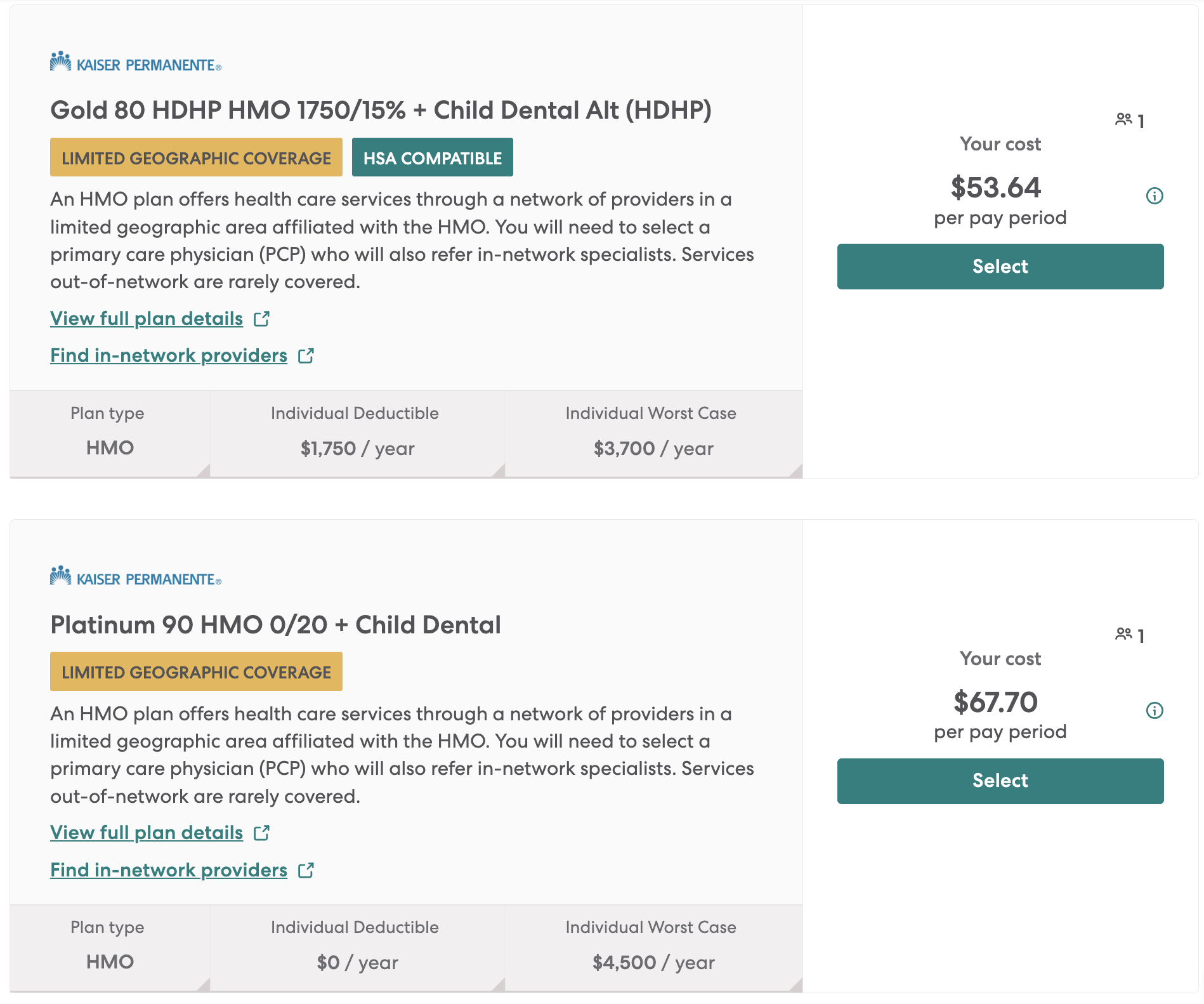

I have two options (link to full plan details):

I'd have to pay around $365 extra for the platinum over the 12 months.

My main savings with Platinum is the difference in deductible. Platinum also has flat copay rates which tend to be around 10-20% cheaper than Gold's co-insurance payments on most low-cost items. However, for certain higher-cost items such as an MRI scan, Gold's co-insurance comes out cheaper than the flat copay rates.

As a general rule of thumb, it seems like:

-No to minimal health needs Gold saves me up to $360

-Low to high health needs Platinum is cheaper

-Very high health needs Gold becomes cheaper again due to the lower individual worst case and lower premium.

Some details about me:

-24, male, healthy, a bit under ideal weight.

-My main hobby is indoor rock climbing (although I would like to do more outdoors too). I enjoy going on hiking routes with graded scrambles. I enjoy snowboarding (although whether I would go in the next 12 months who knows).

-I do have various international travels to visit family/friend's weddings. I don't think one plan is particularly better suited for this though afaik and the usual deductible/copay/coinsurance comparisons apply for claiming reimbursement for international health emergencies.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ741 | |

| 2 | Ṁ418 | |

| 3 | Ṁ320 | |

| 4 | Ṁ49 | |

| 5 | Ṁ48 |

The sweepstakes market for this question has been resolved to partial as we are shutting down sweepstakes. Please read the full announcement here. The mana market will continue as usual.

Only markets closing before March 3rd will be left open for trading and will be resolved as usual.

Users will be able to cashout or donate their entire sweepcash balance, regardless of whether it has been won in a sweepstakes or not, by March 28th (for amounts above our minimum threshold of $25).

I finished reading the EOCs, here's my takeaways of things that could be significantly different. (Some of the services has coins differences of a few percent, or coins vs copay but the amount works out to be roughly the same. I've ignored these.)

Gold ded $1750 plat ded $0

Gold oop $3700 plat oop $4500

Gold ded payments count towards oop

Ambulance: 15% vs $150 (this will depend on which ambulance picks you up. but usually not cheap)

Autism treatment: 15% vs FREE

Emergency department: 15% vs $150

Urgent care: 15% vs $20

Home health care: 15% vs $20

Hospital inpatient (including mental health): 15% vs $250/day capped at $1,250 per admission

Individual mental health eval: 15% vs $20

Group mental health: 15% vs $10

Partial hospitalization/intensive psychiatric program: 15% vs FREE

Residential mental health: 15% vs vs $250/day capped at $1,250 per admission

Office visit: 15% for all vs $20 for regular $30 for specialist $10 for group

Complex imaging: 15% vs $100 per procedure (despite description most of these do not seem to work out cheaper on Gold)

CT chest $1060

CT pelvis w/ dye $1,445 (w/o $840)

CT sinus $1,105

CT stomach w/ dye $1,475 (w/o $860)

CT head/brain review $670

MRI brain stem w/ contrast $1,735

MRI Cardiac w/o contrast w/ stress $2,720

MRI neck w/ contrast $1,580

Basic imaging: 15% vs $30 per encounter

US pelvis $440

US stomach $485

X-ray $135-$210

Nuclear medicine: 15% vs $30 per encounter

Lab tests: 15% vs $20 (labs can be $$$ if accidentally done hospital outpatient vs office or stand-alone lab)

Non-physician diagnostic service: 15% vs $30

Pharmacy tier 1: $15 vs $5 (30 day) $30 vs $10 (100 day)

Pharmacy tier 2: $45 vs $20 (30 day) $90 vs $40 (100 day)

Outpatient surgery/procedures: 15% all vs $125 with monitoring $30 without (this may bite if you accidentally go to hospital or ambulatory surgery center)

Rehabilitative therapy: 15% all vs $20 individual/day-treatment $10 group

Skilled nursing (100 consecutive day cap): 15% vs $150 per day capped $750 per admission

Inpatient detox/residential treatment: 15% vs $250 per day capped $1,250 per admission

Substance use treatment: 15% all vs $20 individual $5 group

Intensive outpatient/day-treatment substance use: 15% vs FREE

Diabetes testing supplies and peak flow meters are one of the few coins items on Gold to not use ded?

Can see outside provider for second opinion/unavailable services if authorized. It is unclear if authorized outside providers can still balance bill you.

Most fine print eligibility seems the same for both.

Preventative care is always free.

Situations where platinum may be better:

If you are not eligible for an HSA (eg claimed as someone's dependent) or don't pay much in taxes already

If you use a lot of inpatient treatment that would hit cap while not hitting OOP

If you become diagnosed as autistic, become addicted or become psychiatrically unstable and pursue treatment

If you need complex imaging

If you accidentally get treatment at a hospital (facility fees go brrrr)

If you have a lot of prescriptions

If you don't plan on getting oon care (eg weight loss, fertility, needing a sooner appointment, wanting to see a specific provider)

You don't strike me as the type that goes to the doctor very often for management of conditions, so I am going to assume that Gold would work out in your favor?

Direct links to plan docs for those who want to read:

https://account.kp.org/business/shared/ca/plans/2024/2024-sample-ncr-small-eoc-gold-80-hdhp-hmo-1750-15-percent-child-dental-alt-16192.pdf

https://account.kp.org/business/shared/ca/plans/2024/2024-sample-ncr-small-eoc-platinum-90-hmo-0-20-child-dental-13297.pdf

Sample fees 2024:

https://healthy.kaiserpermanente.org/content/dam/kporg/final/documents/health-education-materials/fact-sheets/sample-fees-list-ncal-en-2024-ada.pdf

Treatment fee tool (has some stuff missing from sample fees, but prices are from 2021 and are lower than they should be)

http://kp.visualcalc.com/kp_tft/kp_tft.jsp?region=NCA

Okay I've just learnt that when I'm 65 even though I have to pay income tax when taking money out of my HSA, I won't have to pay any capital gains tax on realised gains within my HSA.

This makes it seem like a HSA is probably a no brainer, thus making the Gold plan the better option, although I do want to be careful not to over-index in retirement savings and not have enough liquid cash for when I want to buy a house (plus who knows if I need retirement savings with AGI).

@SirSalty HSA is the best retirement savings vehicle there is and AFAIK has the lowest cap. Fill it up if you can and don't only use it as last resort even for medical bills.

@SirSalty also note that you can pay your medical bills out of your bank account and later reimburse yourself from your HSA account, as long as you had an HSA at the time of the expense. Anytime later, like whenever you need liquid cash. And the growth and withdrawal are tax free if you use it for medical expenses

@SirSalty I was looking for the EOC, but those documents did include a link to where they are kept: https://healthy.kaiserpermanente.org/northern-california/support/forms/documents

I’m assuming your region is Northern California based on where Manifold is but if not let me know

@GleamingRhino What are the key things you are looking for between the two full plans, they are so long haha

@SirSalty if there’s anything that has a tricky catch to coverage, which might result in you paying out of pocket, if there’s any mention of allowable amounts for copay determination, general plan exclusions, if the policy for out of network coverage is different between the two, pharmacy benefits, specific procedure amounts

I’m also just a nitpicker and do this kind of stuff for a living.

@GleamingRhino I will be sure to make sure ur sweepstakes mail-ins are picked up from our PO box and processed faster <3

I'd probably go with Gold if I were you.

That said, welcome to a world-class outdoor risk playground (I'm assuming you're now in the Bay Area) -- I'd strongly encourage you to take advantage of your new home and do some climbing and scrambling in SEKI, Yosemite, and JTree!

If you can take enough time off work, you'd probably love Steve Roper's Sierra High Route [and Adventure Alan's Southern Sierra version] (not to be confused with the High Sierra Trail!) -- they both follow the High Sierra over numerous passes, basically staying as high as possible w/o requiring rope & protection -- lots of 3rd class scrambling! (NB: Scenario is better than the JMT, yet these routes are virtually empty of other people, whereas the JMT is like the trail version of Disneyland.)

@snazzlePop Normally I would go with the cheapest option, but $360pa is such a small difference that it seems like it might be worthwhile. Especially because I'm someone who would avoid seeing the doctor to save money when I really shouldn't, which is a bad habit to have with a $1k+ deductible but not so bad with a $0 deductible lol.

@SirSalty You know ppl say “health is wealth”?

The older I get, the more and more apparent it is that Health > Wealth.

@snazzlePop Agreed! But you said in your original comment I should go with the cheaper option (gold!). Unless you meant go with that so I can max out a HSA.

Also, I will defo have to check out Steve Roper's Siera High Route, thanks for the rec

@WilliamGunn I believe with gold I can contribute to a HSA but with platinum, I can't. I was thinking short term I don't really need an HSA but I guess it's all about the long-term pay-off and tax efficiency. Should look more into it, thanks.,

@SirSalty Think of it this way: do you want to pay more in premiums and lose it if you don't need it or put it in the bank, let it grow, and get tax savings for doing so? Most HSAs allow you to invest the funds (pick a large index-tracking ETF), so it's not just sitting there losing value relative to inflation.

@WilliamGunn Gotcha, thanks for explaining, being from the UK I don't know anything about HSAs lol.

My immediate reaction is what if I don't need it/move abroad (such as back to the UK) before using it? Then it's locked in an account until I'm 65, and when I start withdrawing it for non-health I will have to pay tax on it and at that point will likely be in a higher tax bracket if my trajectory continues.

Or if my life trajectory goes worse than expected and I want to withdraw the money before I'm 65 then I'd have to pay a fine on it. (this seems unlikely, but the moving back to the UK is much more plausible)

@SirSalty Will you have literally zero health expenses if you move back to the UK? Usually the way it works is that you get a debit card and use that not only at the hospital, but to buy stuff in a drugstore like cold and flu medicine, allergy medicine, bandages, stuff like that.

@WilliamGunn If I go through the NHS then I will have zero health expenses other than paying like 10gbp a month for prescription pills if needed + misc things from the pharmacy.

If I go through private care I will have health expenses (and to be honest for certain things I probably would due to speed and convenience). Looks like I probably would make use of some HSA savings but if I had a lot I almost certainly would not need to utilise most of it due to the NHS.

@SirSalty What people usually do if they're not contributing the max (which you'd do if you knew you'd stay) is figure up how much they spent out of pocket in previous years and set a monthly contribution for that amount / 12.