Prediction markets suck at predictions with the timespan of more than a few months because investments in any other asset grow organically with the market, while bets in the prediction markets don't.

There are other challenges for prediction markets, but this is in my opinion the biggest one. @RobinHanson seems to think that prediction market investments should track index funds. The commenters on "/Eliza/recommend-market-structures-that-in" think that there should be some sort of interest on investments.

Will Manifold implement any kind of growth or interest mechanism for invested mana?

The market closes on 2025-06-28 or on the last day of Manifest 2025, whatever comes first.

I do not bet on my own markets.

Update 2025-02-11 (PST) (AI summary of creator comment): Clarification:

Loan mechanisms (including any form of loans) do not qualify as automatic growth or interest for invested mana.

The resolution will focus solely on mechanisms that directly grow invested mana without involving any loan repayment process.

Update 2025-02-13 (PST) (AI summary of creator comment): Mechanism Specification Update:

Only growth mechanisms that accrue interest on invested mana count (no interest on uninvested mana).

The qualifying mechanism should be a direct interest-type growth (e.g., on the order of a few % per year) and not based on any form of loan or repayment process.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,306 | |

| 2 | Ṁ1,038 | |

| 3 | Ṁ780 | |

| 4 | Ṁ765 | |

| 5 | Ṁ718 |

People are also trading

I am a big proponent of paying interest for real money prediction markets, as Kalshi and IBKR do.

But in mana markets (not sweeps/real money), the interest rates you'd need to pay to make this work (assuming it's a replacement for loans) are really high, probably like 5% a month given that's roughly the going rate for peer to peer loans, i.e. that's a good estimate of the discount rate.

Loans solve the problem a different way, by reducing the opportunity cost, by reducing the amount of capital you lock up.

I think interest rate mechanisms are easier to understand and more robust, whereas with loans you have to worry about people going bankrupt etc. But paying that much interest would dramatically change the mana economy, I'm not sure what that impact would look like and whether it would be bad but that is in my mind the key difference between doing it in mana vs real money markets.

@jack I think even a small interest of a few % per year which is paid on the invested mana, but not on uninvested mana would be a good incentive. Like, if someone wants to make long-term predictions but not daytrading, it would make it more viable.

@OlegEterevsky Resolves Yes given loans? I believe they count for the market description here, which is "Will Manifold implement any kind of growth or interest mechanism for invested mana?", allowing you to get a form of interest on your investments (that you have to pay back but I think it counts as "any kind")

@Fay42 i don't personally think that the site giving you a loan (but practically what is happening and also explicitly what the site calls it) is equivalent to paying you interest. those are somewhat opposing ideas? compensating you the cost of locking up your capital vs freeing up that same capital for other uses.

if this question was solely about "incentivizing betting on long term markets", then absolutely loans would count (this discussion was prompted by the removal of loans). but the title is pretty specific that this is about "automatic growth of invested mana"—giving someone a loan is not the same as paying them interest (or growing their investment).

I think it's a kind of interest mechanism, even if it's not the one envisioned? I do think it's not clear either way.

@Fay42 @Ziddletwix Could you guys link the announcement? I think I missed it.

FWIW, I don't think any kind of loan mechanism qualifies as invested mana growth. All of the linked comments describe a fairly idea, which doesn't involve loans.

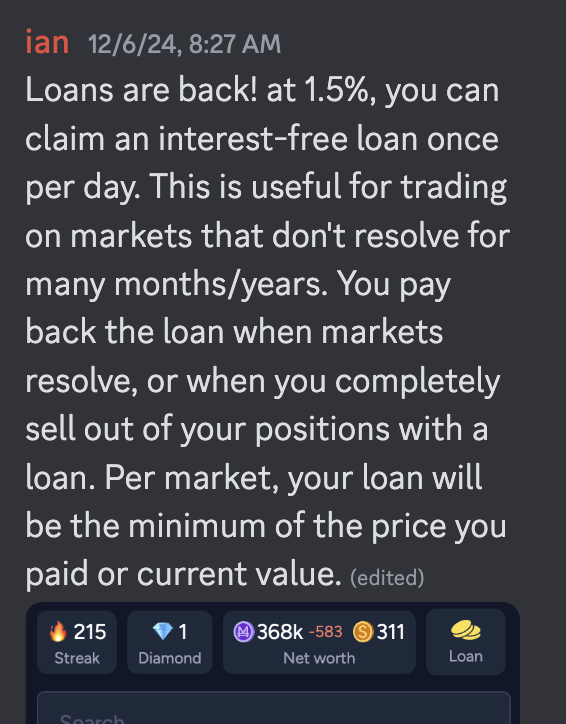

@OlegEterevsky I don't think there was an announcement on the site—in Discord they were announced like this:

(it works basically like loans previously did, but at a slower rate)

Manifold currently prints mana for all users. It also wants to guarantee cash withdrawals based on that mana. I think people underestimate how costly it would be for manifold to offer interest on all of the mana it prints, compared to the typical status quo, where betting sites can help fund their operations with 0 interest on all deposits (typically not including “deposits no customer paid for”).

Simple thought experiment: Manifold currently closely tracks how much mana it prints each day. It views it as a serious/substantial cost. Compare the amount of mana currently printed each day, with the amount that would be printed from interest on all invested mana https://manifold.markets/stats. This is not a trivial hit to Manifold's margin, it would be an enormous change.

Conversely the current state of affairs means that the bets are much smaller than they could be.

Consider this question, for example. It's subsidized by 10k mana. Theoretically it means that it should attract more traders than another question subsidized by just 1k mana, since it provides more returns for the time you spend thinking about it. But the current rules disincentivize substantial bets for the events a year from now and this question so far has attracted only a few hundred in stakes. Paying interest on the investments would make bigger bets much more viable.

Of course, Manifold has to somehow pay its bills, but I assume it could operate the same way as the real-life stock market brokers by taking operation and custody fees.

That's fair! Interest on the mana that Manifold prints is expensive. Paying interest on $ deposits is expensive, relative to the status quo. But if $ deposits massively increased because they paid a bit of interest, & Manifold was able to sufficiently scale up so they are still earning enough of a margin on all deposits (paying users less interest than they receive, taking enough fees from withdrawal, etc), that's a credible theory of how they can accomplish this.

But it requires fairly strong assumptions. And I'm extremely skeptical that manifold could pay "interest on deposits" and avoid being regulated like other financial institutions that do this.

I think we've reached the point you can't say Manifold runs on play money anymore. Prize points are here. Manifold cant treat mana as expendable like they previously could.

There are exploits to turn mana into prize points, so I don't think you can view them as substantially different. I think the bottom line is that implementing automatic growth of mana invested would likely mean coordinating real dollars invested in some bond or index fund to back it up. Otherwise it's exploitable.