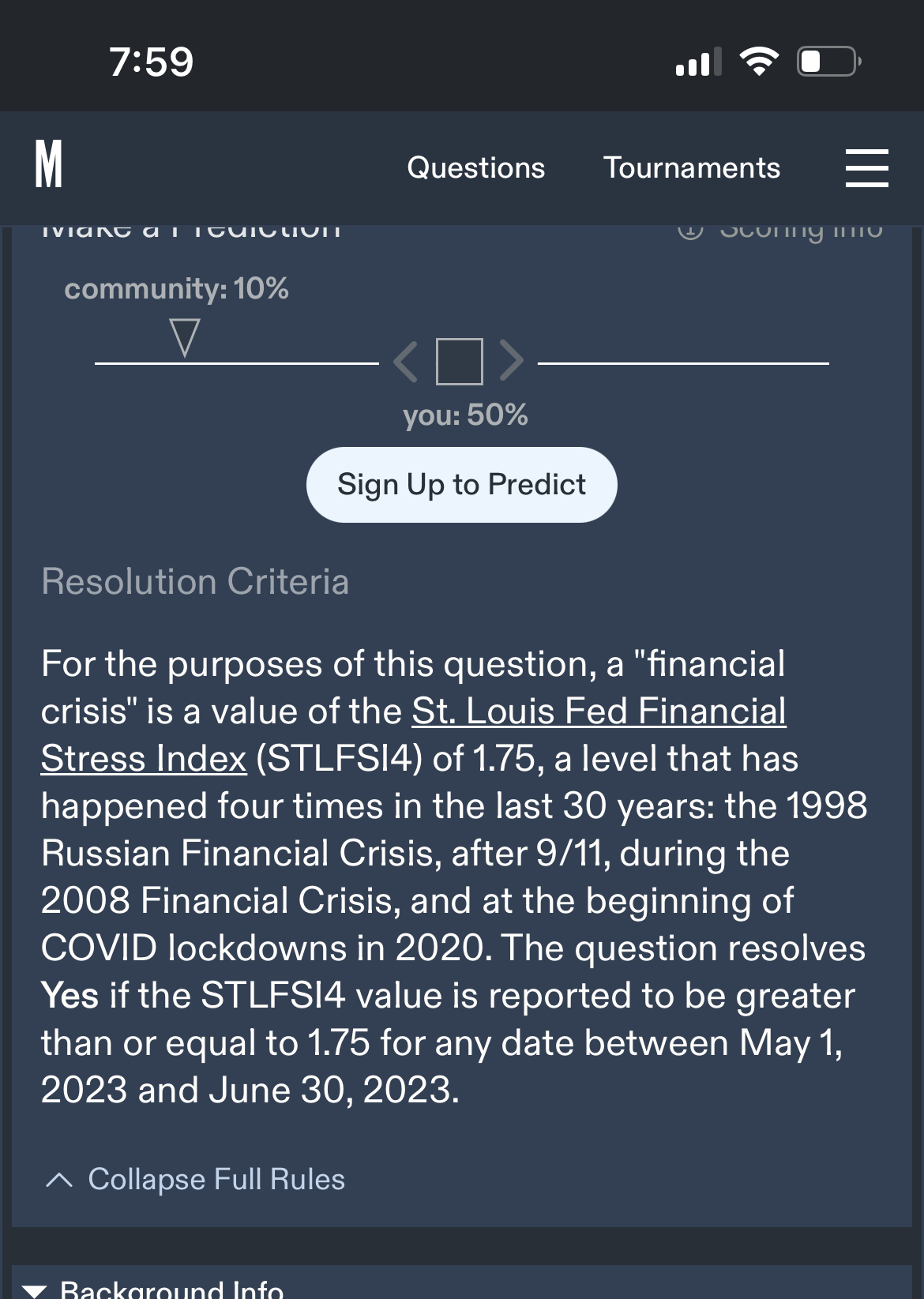

From https://metaculus.com/questions/16641/us-financial-crisis-before-july-1-2023/

When Silicon Valley Bank collapsed, the St. Louis Fed Financial Stress Index (STLFSI4) jumped to a value of 1.56, the highest value since 2020.

Since then, the Financial Stress Index has returned to typical levels, despite continued challenges in the banking system and concerns about the risks posed by Non-Bank Financial Institutions, also known as "shadow banks". Hank Paulson, the US Treasury secretary during the 2008 financial crisis, recently told the Financial Times:

We can never abolish financial crises. They will always happen.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ310 | |

| 2 | Ṁ70 | |

| 3 | Ṁ48 | |

| 4 | Ṁ36 | |

| 5 | Ṁ28 |

People are also trading

First Republic is (probably) going to get handled as competently as SVB, but we can’t call it a VC/Twitter driven anomaly anymore. So then why believe FR is the only one who got overexposed? And will the FDIC continue batting 1.000? What if debt ceiling issues shut down the government for even a few days, at a critical juncture?

Less than 50%, but more than 13% (though I’d love specific resolution criteria)

@jacksonpolack Acknowledging, I am not an expert: It’s not like holding bonds was an anomalous strategy, and “long term“ is a matter of degree. Almost all banks would be in trouble right now if some % tried to withdraw. We don’t know the threshold on a per-bank basis but with FR falling, there’s no reason to believe there isn’t another one just a few pp further along (and we’re seeing net outflows even before this Fridays announcement).

To be clear, I’m not (necessarily) predicting ‘08 collapse. Just (>13% confidence of) some more jitters, which is all this market asks about.