The US provides a Child Tax Credit of up to $2,000 per child. It phases both in and out with income, and its phase-in comes in two parts: only $1,500 is "refundable" (can reduce tax liability below zero), and that refundable element explicitly phases in with income. It also phases out with income.

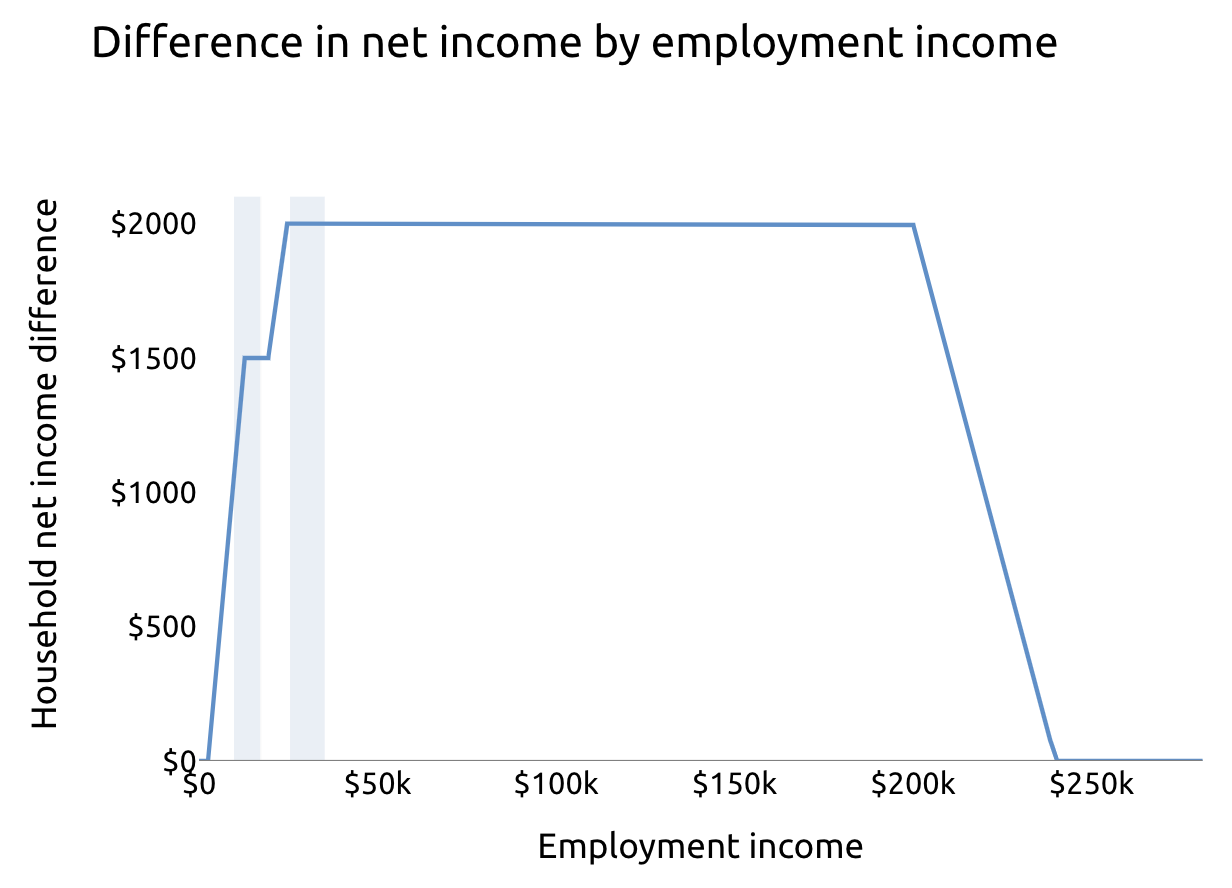

As a result, the value of the credit looks like this for a single parent of one 10-year-old child (source: PolicyEngine):

For the 2021 tax year, the American Rescue Plan Act expanded the credit in several ways, including by making it "fully refundable". The same family's credit looked like this (source):

This market will resolve to YES if the 2023 Child Tax Credit provides the maximum benefit to filers with zero earnings, as it did in 2021 by making it fully refundable and removing the income requirement on the refundable component.

See also the market Will a Child Tax Credit expansion pass by the end of 2023?

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ67 | |

| 2 | Ṁ41 | |

| 3 | Ṁ41 | |

| 4 | Ṁ32 | |

| 5 | Ṁ14 |