Background

María Corina Machado is a prominent Venezuelan opposition leader, known for her advocacy of democracy and human rights in Venezuela and her strong opposition to the government of Nicolás Maduro. Machado has been nominated for the 2025 Nobel Peace Prize by various groups.

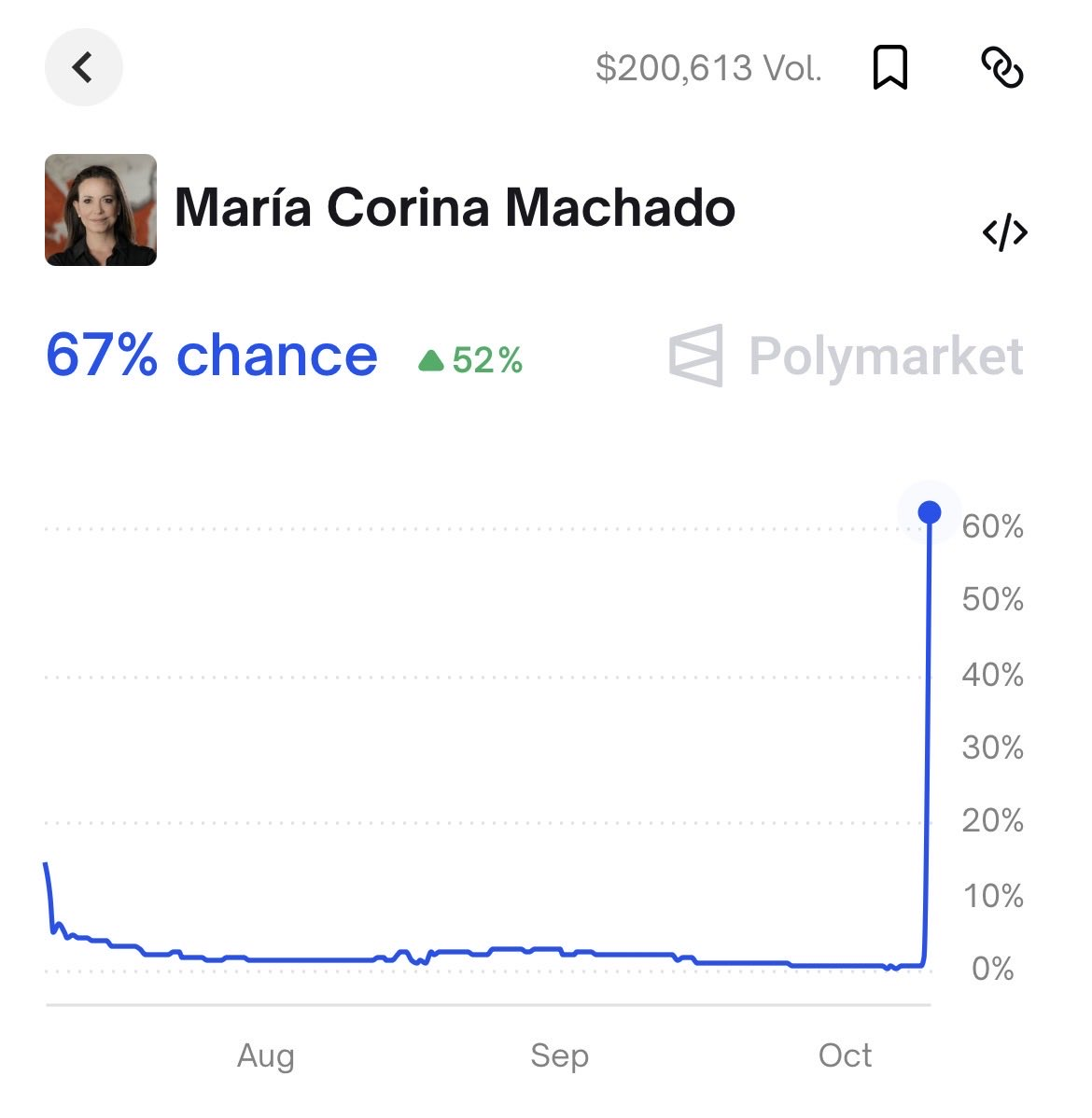

Fewer than 24 hours prior to the announcement of the Prize, she surged on the prediction markets

The question is Why?

This market will resolve to the answer option that—at market close, 31 Dec 2025—is most convincingly substantiated by credible, publicly available evidence as the primary reason for the significant surge in María Corina Machado's odds in Nobel Peace Prize prediction markets.

Only one option can resolve "Yes." If no single option is overwhelmingly supported by evidence as the primary cause, the market will resolve to "Unclear."

Insider trading (leaked information from Nobel Committee): Resolves "Yes" if a reputable news organization (e.g., Reuters, Associated Press, major international newspapers with strong journalistic standards) reports a confirmed leak of information from the Nobel Committee that directly preceded and influenced a notable surge in her prediction market odds.

Market manipulation scheme (for-profit motives): Resolves "Yes" if a credible financial regulatory body (e.g., CFTC, SEC, or equivalent international bodies) or a credible journalism outlet publishes findings that a coordinated scheme, primarily driven by financial gain, significantly manipulated her prediction market odds.

Activism to raise profile of her and her cause: Resolves "Yes" if reputable news analyses point to advocacy efforts being the motivating factor.

Given the high likelihood of a judgment call being needed to resolve, I will not bet on this market.

Update 2025-10-10 (PST) (AI summary of creator comment): Distinction between "Other" and "Unclear" resolutions:

Other resolves if there is a clear, publicized reason for the surge that is not among the listed options

Unclear resolves if we don't know the reason by market close

Update 2025-10-10 (PST) (AI summary of creator comment): Insider trading definition clarified: Almost all uses of non-public information for financial gain would qualify as insider trading for this market. This includes scenarios where the Nobel Committee accidentally releases information early (e.g., mailing a press release too early) and the recipient uses it for financial gain.

Update 2025-10-11 (PST) (AI summary of creator comment): Accidental information leaks (e.g., website source code, early press releases): If someone discovers accidentally leaked information and uses it for financial gain, this would resolve as "Insider trading (leaked information)"

Creator notes that given Machado won the Prize and lack of other information, this market is likely now effectively binary on whether we learn how the information leaked before year-end, with other options representing unlikely surprises.

Update 2025-10-18 (PST) (AI summary of creator comment): Insider trading definition further clarified: The creator confirms that using information from an unintentional leak for financial gain would constitute insider trading for this market's resolution purposes, analogous to how such situations would be treated as insider trading in most Western jurisdictions for stock trading.

Update 2025-10-28 (PST) (AI summary of creator comment): Insider trading definition includes cases where information was unintentionally leaked. For resolution purposes, using unintentionally leaked information for financial gain qualifies as "Insider trading (leaked information)" - this includes scenarios like URL guessing or discovering information through website source code.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ135 | |

| 2 | Ṁ126 | |

| 3 | Ṁ60 | |

| 4 | Ṁ57 | |

| 5 | Ṁ36 |

People are also trading

@traders : My current plan is to resolve 85% unclear and 15% insider trading. Unless I see a strong argument against it, I will do so in circa 24 hours

It reflects my current understanding where insider trading is the most likely explanation, but the evidence is too unclear to call it

It is also close to the distribution between the two options at closing, but tending towards unclear as since October, there has not been any meaningful information on this situation that I can find.

@LoweLundin Unintentional leak is still a leak. Previous discussions already covered the case of mistakenly making a press release public too early and this would be similar to that case.

ChatGPT says an analogous stock trading situation would constitute insider trading in most Western jurisdictions (this also matches my non professional understanding)

@LuisPedroCoelho The example ChatGPT gave involved hacking into a computer system.

This sounds more serious than an "unintentional leak"

@Simon74fe IANAL and this is not a court, but I have consistently answered that—for the purposes of this question—I take the term "insider trading" to cover the case where the information was unintentially leaked.

Side note (as I said, this is not a court, so actually irrelevant): courts have also considered URL guessing to be hacking in the past: https://en.wikipedia.org/wiki/Goatse_Security#AT&T/iPad_email_address_leak

@Simon74fe It would probably resolve like if they had mailed the press release early (which I believe has happened in the past). If the motivation was to make money, it would still be "insider trading (leaked information)"

Given what has happened since market creation (in particular that she did win the Prize) and the lack of any other information so far, I think it is very likely that this market is now a binary market on whether we will learn before the end of the year how that information leaked with the other options constituting a big surprise (which seems well captured by every other option having low probability)

@LuisPedroCoelho Edited description to more clearly state that what matters is the most convincing explanation at market close.

@LuisPedroCoelho So what's the deal, do you promise not to add any answers and not to resolve to Other?

@Eliza Other would be appropriate if there is a clear, publicized, reason that is not one listed (when the market was created, she had not yet won, so uncertainty was higher). Unclear means we don't know.

@LuisPedroCoelho why is "other" trading so low then? I must not be understanding something. Is your insider trading option covering both intentional and unintentional leaks?

@LuisPedroCoelho yes, almost all uses of non-public information for financial gain would qualify as insider trading here. If the academy accidentally mailed a press release too early (which I believe has happened in the past) and the recipient decided to make some quick money, that would be insider trading here

Now that she did win, it does seem hard to imagine a different plausible scenario; but if she had not won, this would be a much more open question