Currently, I don't really know how liquid subsidies get returned when a market is resolved. I would like to know. So, I'm creating this market to incentivize folks to explain it to me/point me in the direction of an explanation!

Resolves YES if at any time before the end of March I understand "what liquidity does" and "how subsidies work." Otherwise resolves NO.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ243 | |

| 2 | Ṁ24 | |

| 3 | Ṁ13 | |

| 4 | Ṁ10 | |

| 5 | Ṁ9 |

Okay, I’m trying to write the formula for how subsidies are returned in Colab right now, but I'm not sure what these two sums are summing over:

Is it over all (l, t) where liquidity was provided? Also, what does s stand for in this case?

LAST UPDATE

Liquidity provision

Market participants often want to provide liquidity in order to subsidize prediction markets they are interested in, or to earn fees.

One of the big benefits of Maniswap is that it makes it easy for traders to inject liquidity efficiently without generating any leftover shares.

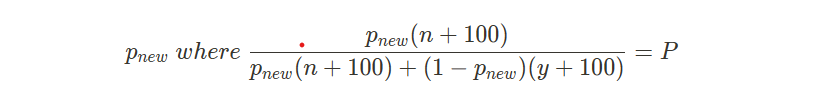

Suppose a trader wishes to inject $100 into the liquidity pool of a market trading at an implied probability of P. The AMM takes the trader’s $100, turns it into 100 YES and 100 NO shares, and adds those shares to the pool. In order to preserve the current probability, we must solve for a new constant value p, while holding the probability P constant:

The more capital we inject at probability P, the closer the parameter p will converge toward it.

If a trader wishes to withdraw their capital from the pool, we calculate the share of the YES pool an NO pool they are owed based on how much capital they committed.

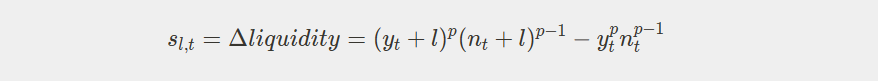

One complication is that the parameter p may be significantly different from when the liquidity was provided. To find the trader’s current share of the pool (for a certain amount of capital $l), we calculate the change in liquidity using the shares in the pool at the time of liquidity provision along with the current value of p:

The trader then receives (Imag1) y YES shares and (Imag2) n NO shares, which are withdrawn from the pool.

(Imag1)

(Imag2)

@Redact yeah, but... where's the formula for how much liquidity you get back as a market maker when a market resolves

@Tripping personally I think it's important because it makes a huge different to the incentives when deciding whether to make a market that might not get many traders

@Tripping hopefully someone better than me will find it or figure it out and I won't loose my Ṁ

@Redact I’ll read this one later on and recreate the formulas in Colab and see how that works out.

Might be sufficient, and if it’s not, I’ll summarize what I understand, and say what else I’d still like to understand (so folks can more focusedly search)

@JoshuaB I will go through this all by the end of Saturday.

I read through the linked post a few times, and from what I remember, it seems likely that it’s sufficient for this market, but before I resolve, I do want to make sure that:

1) the formulas are legit, and describe what they seem to describe

2) there’s nothing else that I would like to know/fail to understand about liquidity/subsidies

I found this Above the Fold: Market Mechanics - by Manifold Markets

"Suppose you want to subsidize a market with a starting probability of 33% with $100. In CPMM, you would first exchange your $100 for 100 YES tokens and 100 NO tokens. Then you would seed the reserve pool with 100 YES tokens and 50 NO tokens, because 50 / (100 + 50) = 1/3. (If you think this looks backwards, remember that in CPMM, the more you buy of a token the fewer tokens there are remaining.) The remaining 50 NO tokens would become a bet in your portfolio.

We were just about to switch over Manifold’s betting system to a CPMM, when Pepe, one of the top traders on our platform, suggested a clever way to improve capital efficiency and solve the subsidy problem. Instead of using a vanilla CPMM, you can parametrize the price equation in terms of the initial probability: k = y^p * n ^(1-p). This allows you to allocate all $100 of your initial subsidy into the reserve pool, which means more liquidity for traders and no awkward spillover bet in your portfolio.

With Pepe’s clever improvement, we’re happy to announce that our new betting system going forward for binary markets will be this CFMM."

What is the liquidity pool? (manifold.markets)

LIQUIDITY

"Liquidity providers cannot withdraw the mana they have spent to subsidise a market, however, they will receive back some of their mana when the market resolves.

The amount of mana you will get back depends on how much the probability has moved from when you subsidised the market. The more it has moved, the less you will get back."

SUBSIDIES

"People used to abuse subsidising markets to increase their profit graph by first subsidising a market, then making their prediction, and then withdrawing their subsidy.

To combat this, you can no longer withdraw mana used to subsidise markets. Additionally, whenever a market is subsidised (either by a user or by the house), it is slowly and randomly added over a period of time."

@JoshuaB How's this "The amount of mana you will get back depends on how much the probability has moved from when you subsidised the market. The more it has moved, the less you will get back"

@Tripping Yeah, seconded. For YES resolution, I'd like to have a concreter sense of how exactly liquidity is returned