Hello market math nerds. I have a problem I can't figure out, and I need your help.

I had this idea about simplifying linked multiple choice. Instead of answers that have yes and no shares each, we could specify just yes shares for each answer.

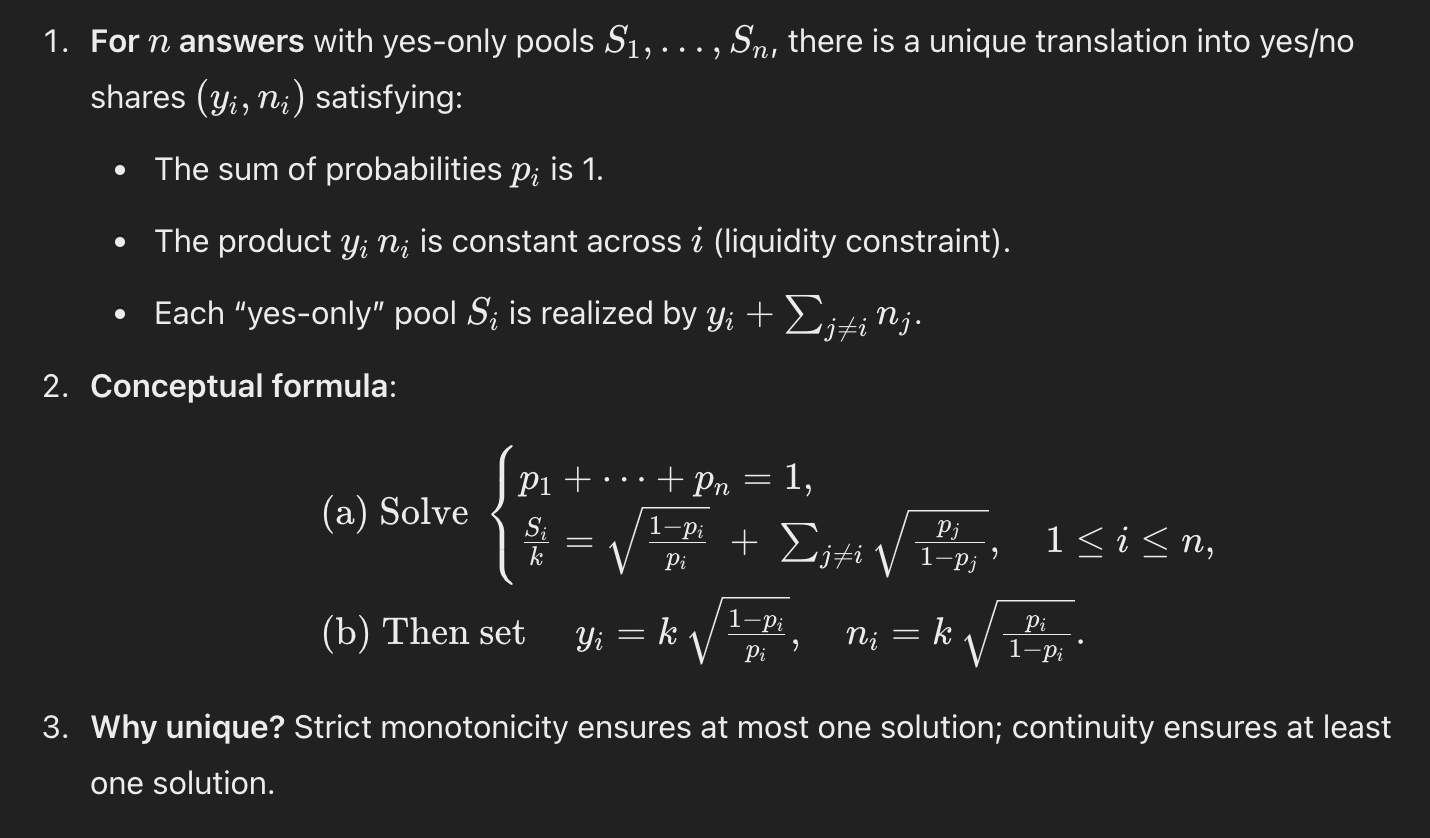

I'm trying to prove for any set yes-only pools, there is one unique equivalent version with yes/no pools.

For example, for 3 answers with equal Yes pools:

8

8

8

This is equivalent to (Yes, No) pools of

4, 2

4, 2

4, 2

Where each answer has No / (Yes + No) probability = 2 / (4 + 2) = 1 / 3.

In addition to the probability sum constraint (all answers probability sums to 1), there's also the constant liquidity constraint (each answer has the same liquidity, which mean yes shares * no shares is constant across answers).

Here is my notion doc with scratch work: https://manifoldmarkets.notion.site/Multiple-choice-with-only-yes-shares-a849532cc4bc4d7192f1a4652c56c7b1?pvs=4

Can we solve the general case? If I have yes-only pools of n answers, can we compute the equivalent yes/no pools? And is the solution unique?

I will award a bounty of at least 10k mana (perhaps more) for a solution or proof that there is no solution.

Here are the equations in the 3-answer case:

A = Ay + Bn + Cn

B = By + An + Cn

C = Cy + An + Bn

Ap = An / (Ay + An)

Bp = Bn / (By + Bn)

Cp = Cn / (Cy + Cn)

1 = Ap + Bp + Cp

AyAn = ByBn = CyCn

If you want to learn more about our multiple choice mechanism, check out my Substack article: https://news.manifold.markets/p/multiple-choice-markets

People are also trading

@JamesGrugett I've written a program that can compute the (approximate) solution to any set of YES pools. The link to it is here: https://github.com/pawn142/Multiple-Choice/blob/main/multiple_choice.py

The variable named "pools" stores the yes-only pools for each answer/index. The code converts the information into a set of yes pools and a set of no pools that satisfy the constraints, and those are stored in the variables "ys" and "ns", respectively. They are stored as Decimal objects, but they can easily be converted into doubles through rounding. I used the "decimal" module to allow high accuracy calculation. "getcontext().prec" controls the number of significant digits in the calculations, and "acc" controls the accuracy of the results.

The program will not work if:

"pools" is not an array of at least 3 positive real numbers

"acc" is set too high relative to "getcontext().prec" (but normally this will never be a problem)

Holy. o3-pro just demolished this problem!! Amazing.

It proved there is a bijection between the yes-only pools and the cpmm pools.

7. What we have shown

A simple two‑scalar reduction (N,K) completely characterises any multifold CPMM under the “NO→other YES” identity.

There is always exactly one positive solution, so the mapping yes‑only ↔ yes/no is bijective.

The conversion can be computed in milliseconds with only monotone 1‑D root‑finders—no matrix inversion is required.

Read the whole proof:

https://chatgpt.com/s/t_685507d565508191b152692c9fc6ef96

I don't think there's anything left to solve. Congrats o3-pro!

Except I do want to ask it about the practicality of maintaining the data structure in this form. Theoretically, it could be the basis of all our prediction markets. Although, I'm not sure if it's actually simpler than our current system.

Say you’ve got three answers with 8 yes-shares each. You want to figure out how many no shares each one should have.

There’s this constraint baked into the Manifold math: the probability of each answer is based on how many no-shares it has, compared to the total shares (yes + no). And all the answers have to share the same liquidity, which in this context means:

yes × no = same number for everyone.

So if you know the yes shares, that tells you the no shares must be some constant k divided by the yes shares.

Then the rest is just plugging that into the probability formula and solving one equation:

You add up all the answer probabilities, and they have to equal 1.

You’re solving for k. Once you’ve got that, the no-shares are just k / Y_i, and you’ve got full yes/no pools that match what the market should be doing.

o1 pro has solved this problem!!! https://chatgpt.com/share/677789d6-9840-8011-97e3-55361bff20ec

Edit: actually this is not the solution just a rewriting of the equations...

can you please formalize this problem in Coq or Lean?

Ok, I thought about it some more on another plane flight.

One nice property is that the yes-only shares are proportional to liquidity. I.e. if you double all the yes-only shares, you have double the liquidity.

Let k = sqrt(Aiy * Ain) for answer Ai with Aiy yes shares and Ain no shares.

Let N = Sum_i Ain

Then Ai = Aiy + N - Ain

If you scale liquidity k by c, then kc = c * sqrt(AiyAin) = sqrt(c^2AiyAin) = sqrt((cAiy)(cAin))

This means the yes and no shares scale with liquidity. Since Ai is a linear combination of these yes and no shares, it also scales proportionally.

If the magnitude of the yes-only shares determines liquidity, I think then that the probability is determined by their ratio.

A second idea is that the analysis might be simpler by also keeping track of the "purchased shares" which are outside the AMM and you can track separately.

By that I mean that for any set of Ai from i = 1 to i = n, and given liquidity k, you can first construct the "starting pools" where all Ai are equal:

sqrt(AiyAin) = k

1 / n = Ain / (Aiy + Ain)

=> AiyAin = k^2

=> Aiy = k^2 / Ain=> 1 / n = Ain / (k^2 / Ain + Ain)

=> 1 / n * (k^2 / Ain + Ain) = Ain

=> k^2 / Ain = (n-1)Ain

=> k^2 = (n-1)Ain^2

=> k = sqrt(n-1)Ain

=> Ain = k / sqrt(n-1)

=> Aiy = k sqrt(n-1)

=> Ai = Aiy - Ain + N = Aiy + (n-1)Ain = k sqrt(n-1) + (n-1)k / sqrt(n-1)= 2k sqrt(n-1)

Then, for any yes-only shares set, you can make one bet on each answer except for the largest Ai to get from the starting pools to the current pools (Proof not included).

The bet operation is to exchange b_a mana for b_a Yes shares of each answer, add them to the pools, and then withdraw shares in one answer such that the probability and liquidity invariants hold.

WLOG let Ai be in decreasing order.

Let (bia, bis) be a bet on Ai of amount bia in exchange for yes shares bis.

Then the total amount bet Sum_i bia is equal to the largest Ai minus the starting pool amount:

Sum_i bia = A1 - 2k sqrt(n-1)

Also, bis = A1 - Ai

I'm not sure how to calculate individual bia. But knowing bis, the "missing" yes shares that are held by the bettors, and the sequence of operations to transform the starting pools into the current pools seems like it could be useful.

@JamesGrugett just simply ask ChatGPT and it will guide you through the question. Hope this wins me the mana lol.

It should be possible to first find a solution of the last 5 (N+2) equations:

Ap = An / (Ay + An)

Bp = Bn / (By + Bn)

Cp = Cn / (Cy + Cn)

1 = Ap + Bp + Cp

AyAn = ByBn = CyCn

…and then scale it to satisfy the first 3 (N) equations:

A = Ay + Bn + Cn

B = By + An + Cn

C = Cy + An + Bn

As starting values for Ap, Bp, Cp, … I use:

Ap = A / (A+B+C)

Bp = B / (A+B+C)

Cp = C / (A+B+C)

…but I realized that's probably a wrong assumption.

Is there a way to compute Ap, Bp, Cp from A, B, C only – or is that part of the question, too?

I appreciate the call-out in your Substack article: https://news.manifold.markets/p/multiple-choice-markets. Thanks @JamesGrugett

Thanks everyone! I appreciate the time and effort you've put into solving this problem so far.

Looks like there's been some good progress and insights, including an almost-solution from @HarrisonNathan, a clean writeup of a partial solution from @BoltonBailey, analysis and an edited-away proof of a counter example from @Pepe, @gregrosent's clear framing of the solution given L and N, and the sketch of a proof that a solution exists from @LinusTang! Nice!

I'll refrain from awarding bounties while we are still making progress. It's likely I will give some partial credit bounties, especially if a full solution eludes us.