FED pivot being any lowering of the target federal funds range (interest rates).

This market will resolve to the quarter that the Fed decides to decrease interest rates.

Resolves based on https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ4,289 | |

| 2 | Ṁ3,697 | |

| 3 | Ṁ3,116 | |

| 4 | Ṁ1,722 | |

| 5 | Ṁ1,654 |

How so? They can cut in September, and are expected to.

They'll be cutting because inflation is approaching target - I doubt very much they want to favour a presidential candidate - but nonetheless this seems soon enough to potentially affect the election. Stock prices will rise, borrowing costs will start to drop, people will feel a bit richer - assuming the apparent soft-landing continues and there isn't a recession before then, as those tend to be a bummer.

Chris -- I left some orders on this market and a couple related ones to take some profits on these questions, in case you are looking to put more mana to work here.

Financial markets have 1.13 cuts priced for September. I'm not sure whether thats 99% chance of at least one cut at 14% chance of 50bp cut, or 95% chance of at least one cut and 19% chance of 50bp cut, but its up there somewhere.

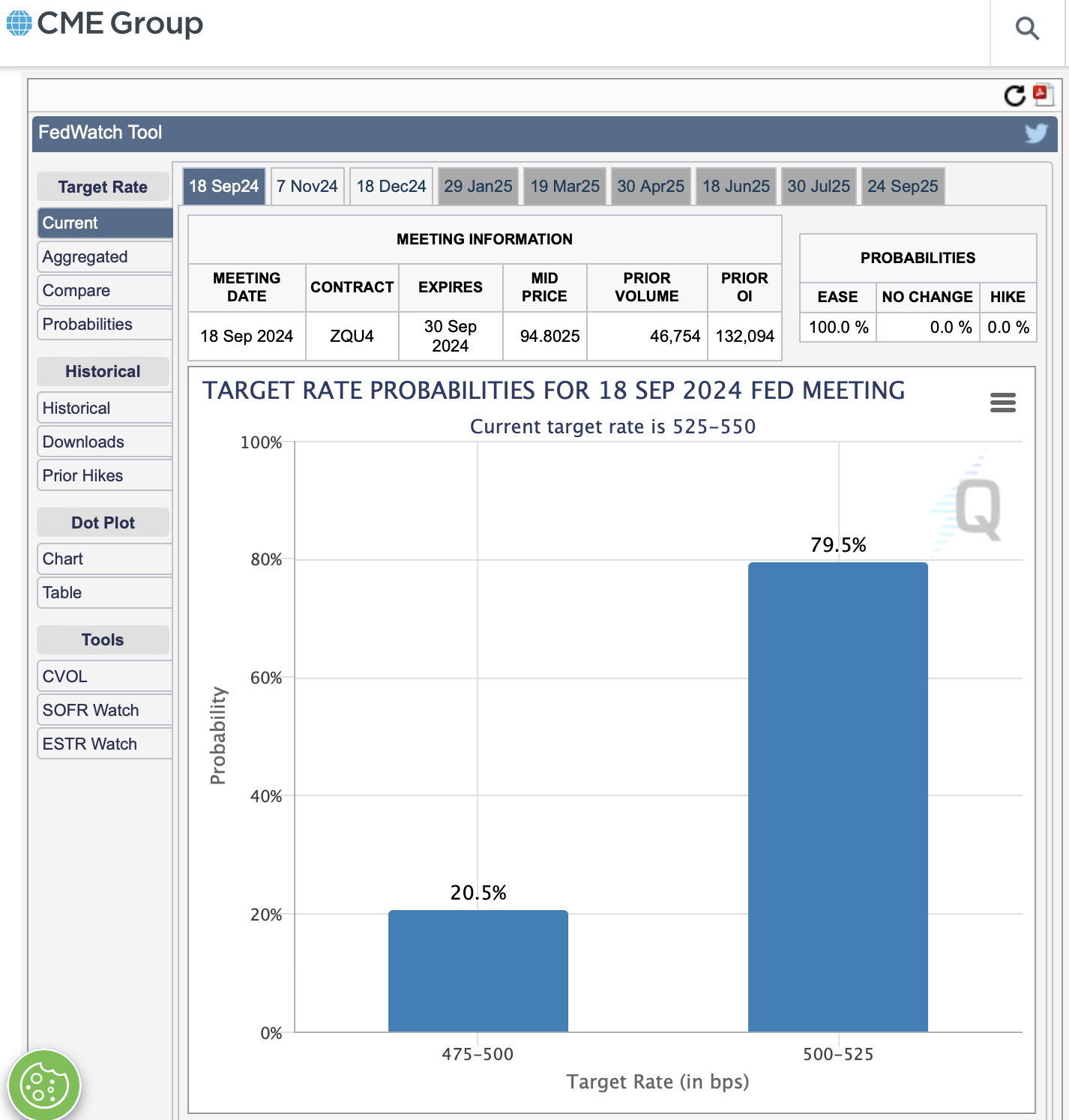

From the CME FedWatch tool, it's currently 79.5% 25 bps and 20.5% 50 bps for September, and you can see all the other meetings implied probabilities.

Edit: take it with a grain of salt, as these do shift quickly and significantly.

European Central Bank signals it will begin to cut rates

https://www.semafor.com/article/04/11/2024/european-central-bank-signals-it-will-begin-to-cut-rates

Q4 or never: christmas is coming, they need those numbers for election purposes. Amazon and the retail sector will throw a shitfit if they don't, but when everyone said they'd lower at the last three meetings, I said they'd raise or hold.

If anything they're gonna raise right before Q4, so they can say they lowered in Q4, when the net outcome will be a virtual hold.

Between deflationary bust and eye-gouging inflation, after the last three meetings which I called despite the market saying otherwise, we can safely say they'll choose inflation, hell they'll choose rationing under hyperinflation, before they choose to lower.

2024 FOMC Meeting

January 2024: January 30-31

Statement: PDF | HTML

Implementation Note

Statement on Longer-Run Goals and Monetary Policy StrategyRATES: HOLD

--

NEXT MEETINGS:

March 19-20 (End of Q1)

Apr/May 30-1

June 11-12 (End of Q2)

July 30-31

September 17-18 (End of Q3)

November 6-7

December 17-18 (End of Q4)

@SirCryptomind march, but I am just playing a discount to CME futures. I had a very strong hawkish bias over the last 2 years and it's hard to overcome that.

JPow admitted they are talking about cutting and absent any substantial shock to the upside, I'd expect inflation to continue to moderate

@MP I'm still sticking with my June or July for the first cut.

If it is June than we get 3 cuts (June/September/December).

If it is July, than we get 2 (July & November).

The stock market is crazy wrong I believe right now, it has a projection of 6 cuts in 2024 from CNBC Data from this past Friday.

Q2 may be possible. I just cant fathom anything for Q1 2024 unless it is to signal a possible recession after Q4 2023 data comes in.

"A March rate cut is premature and market's have priced in too quickly, says IBM's Gary Cohn"

SOURCE (CNBC Mobile Alerts)

For Q1 2024 there are two FOMC meetings:

/marketwise/fed-interest-rate-decision-in-janua

/marketwise/fed-interest-rate-decision-in-march