At EOY 2026, I will get S&P 500 YTD stock returns from yahoo finance. I will also get YTD company returns from the same source, (e.g.). I believe both are adjusted for splits and dividends. A market resolves YES if the company outperforms the S&P and NO otherwise. I have added the top 50 companies in the S&P as of 2025-12-29. I am not planning to add any additional companies.

Note that I have added 2000 M limit orders at 40% and 60% for all options on the market. These expire before the open on Jan 2 2026.

People are also trading

@benmanns as mentioned in the description, I’ll be using the YTD returns from Yahoo Finance after the last trading date of the year. So however they calculate it is how I’ll resolve.

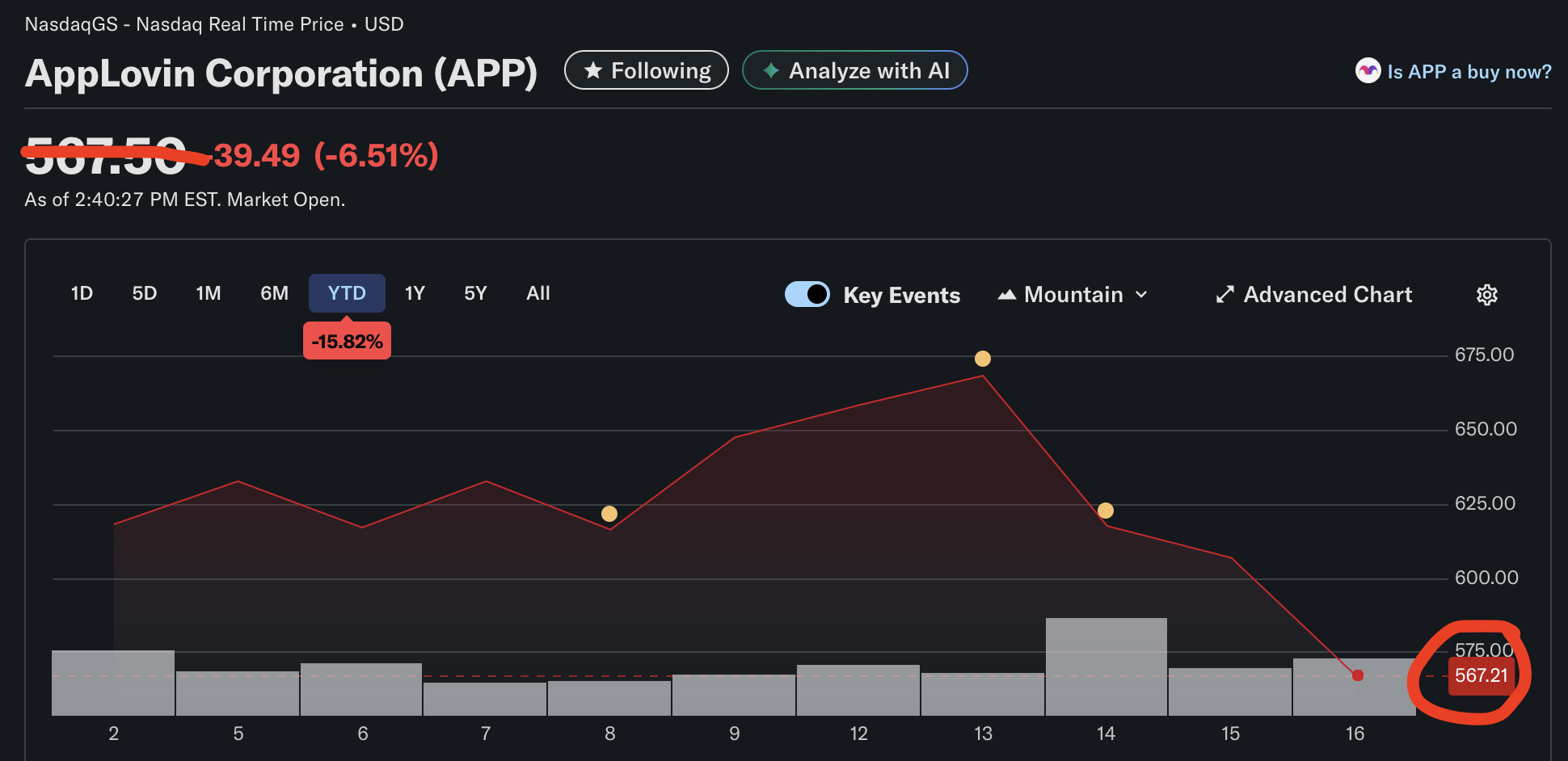

@MingweiSamuel e.g. for APP

Last close price in 2025, Dec 31, 2025: $673.82

Current price (in chart, realtime price updates w/o updating chart & YTD%): $567.21

$567.21 / $673.82 - 1 = -0.158217328 = -15.82%

.

@Bayesian You may be interested in the NVDA and GOOG/GOOGL markets here if you want to bet more on those or related AI stocks.