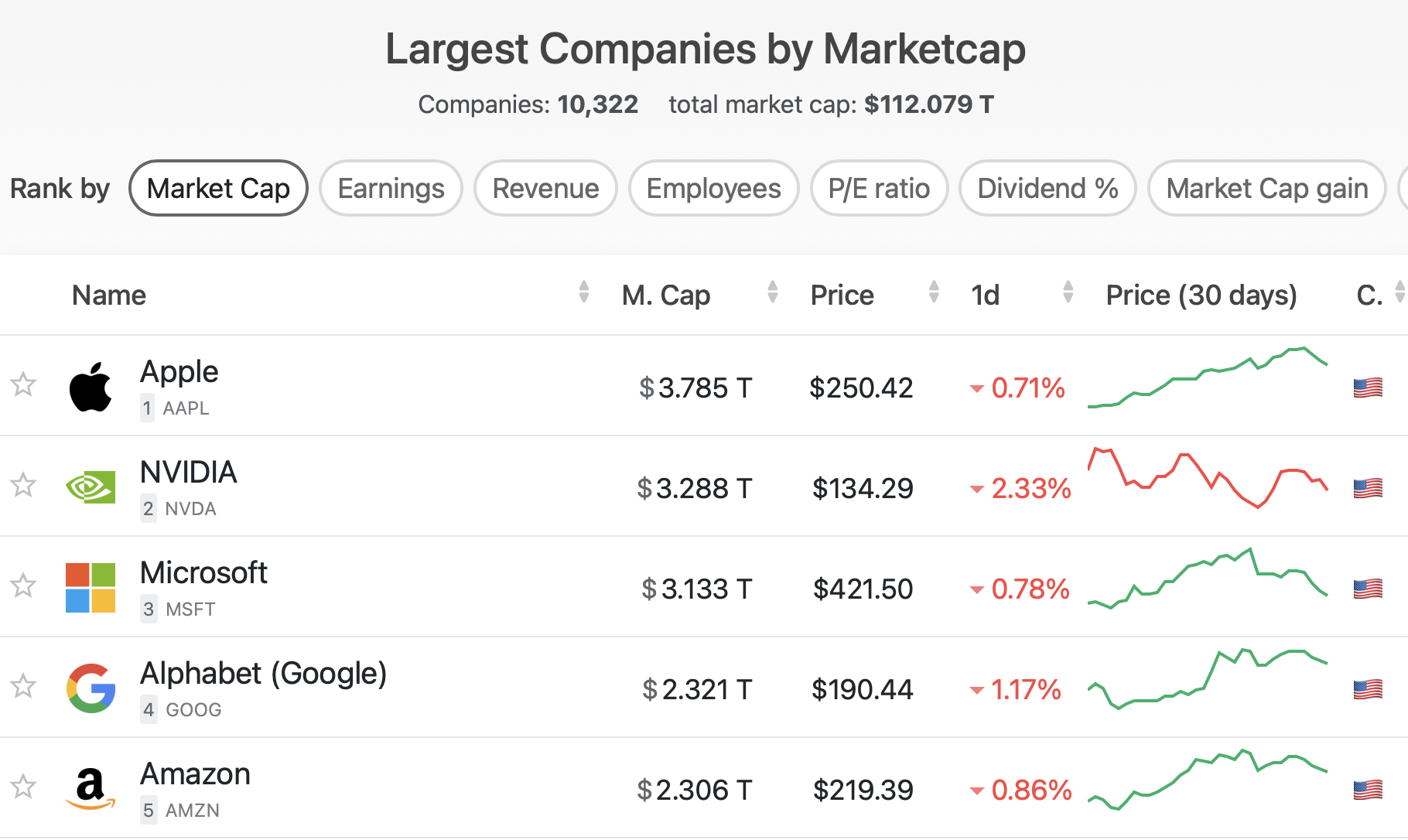

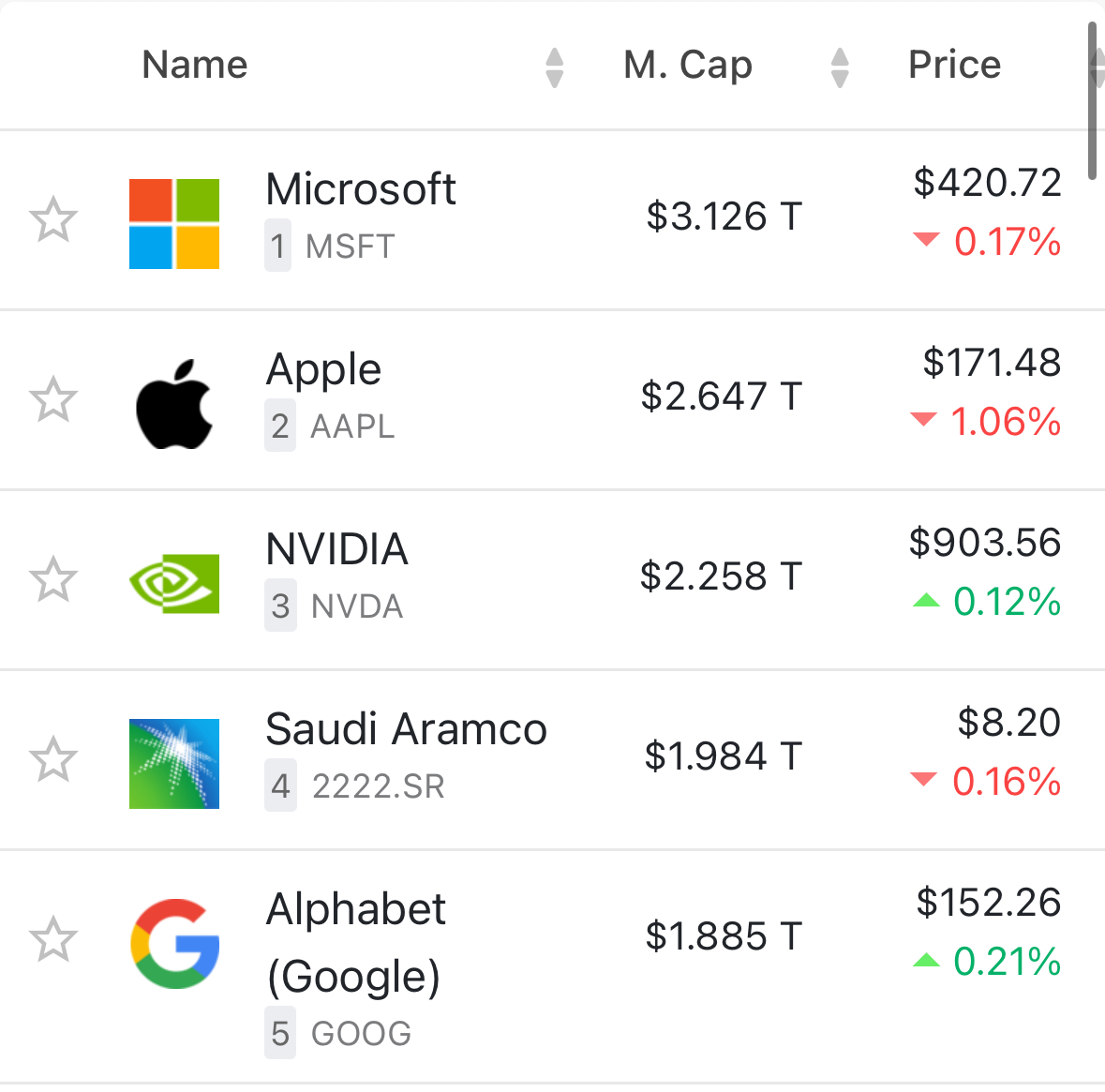

This market will Resolve as follows, according to CompaniesMarketCap after the final trading day of 2024:

1st place: YES

2nd place: 80%

3rd place: 60%

4th place: 40%

5th place: 20%

6th place and lower: NO

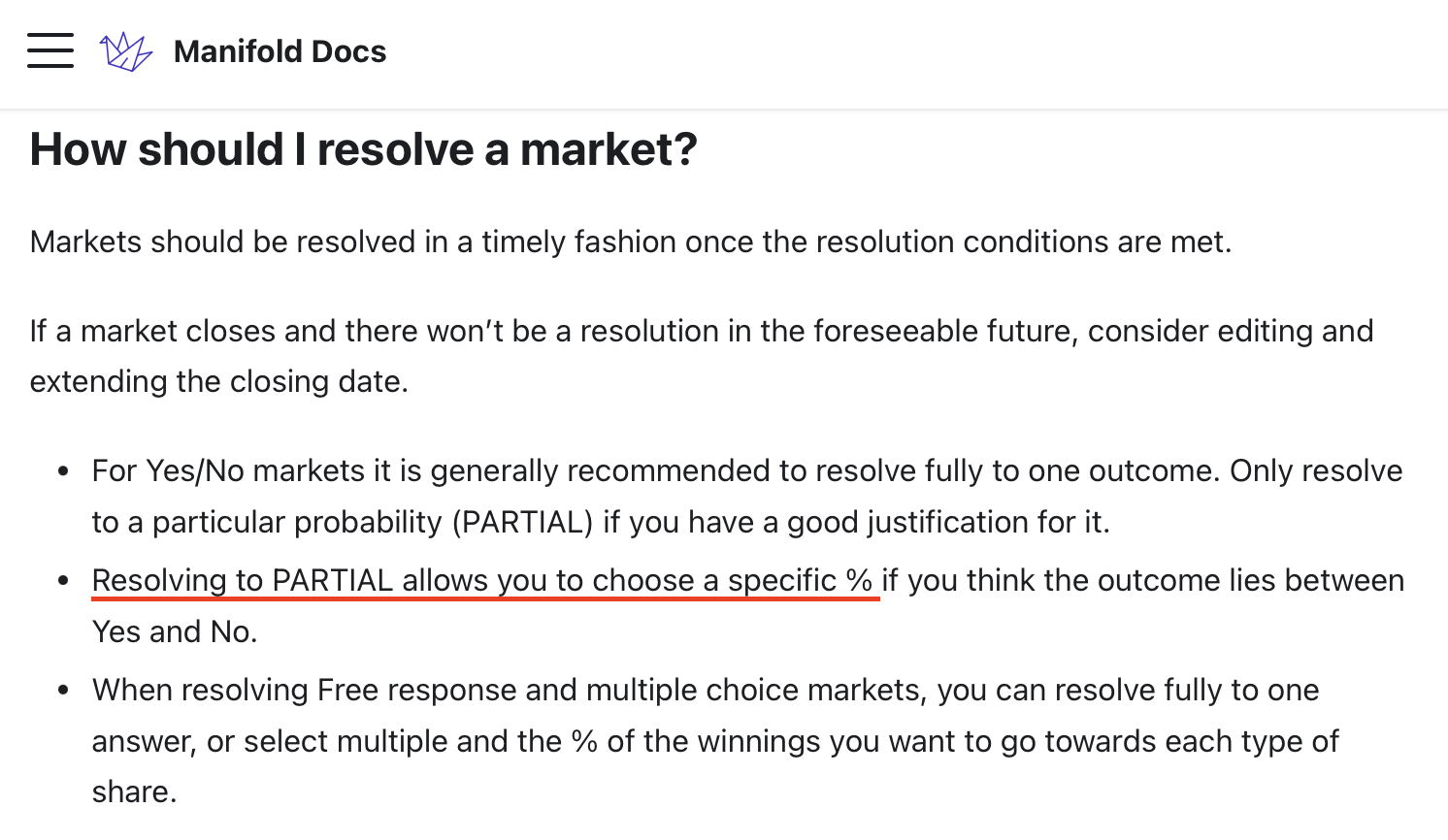

See the FAQ for more info about “Resolves to %”

If you add any non-public companies, you will need to provide a reliable data source to assess their value. Any non-valid answers will be Resolved as N/A.

You can also bet on other related markets:

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,214 | |

| 2 | Ṁ1,433 | |

| 3 | Ṁ276 | |

| 4 | Ṁ61 | |

| 5 | Ṁ57 |

People are also trading

@SimoneRomeo that’s how it will resolve, to YES for the top company and to PROB= those percentages for 2nd to 5th, and to NO for all others

@deagol also, suppose that company X has a probability of 87%, I vote no, probably goes to 82%, market closes, Company X is second. Does it mean that I win?

@SimoneRomeo the PROB resolution option has always been there in the resolve interface, try it with your own test market.

If you bought NO shares at say avg 85%, and that option resolves to 80%, you profit 5% or M$0.05 for each NO share you got, since the payout would be 0.8 to YES and 0.2 mana to each NO share that cost you 0.15 mana.

@deagol just to clarify, so in the example above if Company X has a 85% probability, I vote yes, and it turns out that it is Second Place I actually lose mana, right?

@deagol thanks again for the clarification! 🙏🙏 Do you think it could be useful to explain this in the description too? Other users might not familiar with how resolving to a probability works and might think they can simply vote for all the companies that will be in the Top 5

@SimoneRomeo I agree a simple clarification can be useful to some but there’s always some impulsive betting, sometimes even from veteran users, that will fall through the cracks no matter how explicit one makes things in the description. The balance between clarity/complexity and usability is age old, and I tend to prefer clear, simply stated criteria with rich underlying complexity for the user to discover, But of course those compromises fall on each market creator’s style and preferences, not me to decide, and still, I feel many don’t think about these aspects too much.

In this case, a clarification in the title might be more effective, adding something like “[diminishing payouts]”

@deagol actually the way this market is made is really counterintuitive. It's not really about guessing the right 5 companies and not even about diminishing returns, it's about getting the right probably figure. Suppose on Dec 31 company Y is well positioned to be on fifth place. I'd assume people would all vote yes making the probability spike to 100%, just to realize that they actually had to vote no in order to bring the probability to 20%.

@SimoneRomeo well then a few of us would profit from that, but I can almost guarantee you that on Dec 31, or even on Dec 1, the probabilities will be mostly aligned with the companies ranks, and only the top will be anywhere near 100%.

There’s a lot of smart arbitrageurs with easy access to huge liquidity on this site, and they (we?) tend to raid and dominate markets that are about to resolve for which the probabilities are pretty much known. Like shooting fish in a barrel if you can keep an eye out for them, and limit walls can take care of the occasional stray.

@SimoneRomeo I rather see it as ensuring noobs mistakes aren’t too costly. Letting markets go crazy misaligned is how people lose their shirt, when they bet with the crowd on the wrong side paying irrational prices.

@GabeGarboden fight for 4th (40%) with two others, and even if Aramco tanks, you realize 3rd place pays off 60%? of course it could topple #2 but seems a bit of a stretch to me.