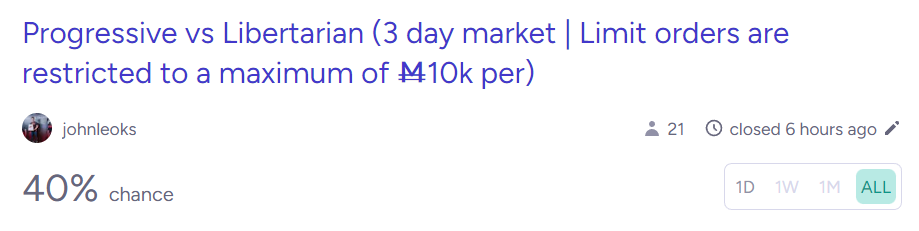

Yes = Progressive

No = Libertarian

I will resolve the market in favor of the side that has the higher percentage, which would be at least 51% for YES and 49% for NO.

Rules

The largest single limit order you can put down is Ṁ10k. You can make multiple limit orders but they have to be at least 1 minute apart. This is to:

Prevent whales from sniping the market last second by creating a limit order that is too large (Ex. a Ṁ100k limit order) for most traders to overcome.

Prevent whales from putting down multiple Ṁ10k limit orders in quick succession right before the market closes to guarantee a win.

Make the market a more even playing field for those with less mana while still letting those with more mana have an advantage, just not an insurmountable one.

Give all traders a reason to actively participate during the final moments before the market closes since you can't just put down a Ṁ50k or Ṁ100k limit order and automatically win.

If someone breaks the rules and wins as a result, I will resolve the market as N/A or in some cases, resolve the market against them.

After the market has closed, I will push it all the way up to 100% or all the way down to 0% in favor of the winning side before resolving it. I will not be participating at all while the market is still open.

Market closes on 5/1/23 8 A.M. PST

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ46,384 | |

| 2 | Ṁ26,171 | |

| 3 | Ṁ4,438 | |

| 4 | Ṁ2,719 | |

| 5 | Ṁ2,145 |

@johnleoks

There's a problem here. When you reopen the market to buy No shares, I was not given the opportunity to cancel my no limit orders. You ended up draining all my money when you betted 100000 on NO after you temporarily open the market again.

Please return those mana to me.

This market resolves No.

@DeadRhino did not break any rules.

Limit orders are restricted because they are passive/automatic. With no restrictions, Whales can simply put down large enough limit orders and automatically win without having to pay attention. Traders could lose their entire balance instantly to someone putting down a Ṁ100k limit order last minute, swallowing up every bet against them.

Manually trading with a high amount of mana is perfectly fine because you're not guaranteed a win. If someone had bought Ṁ1k Yes shares 1 second after @DeadRhino's Ṁ25k short, he would have lost all that mana. Him throwing down Ṁ25k was not an auto win. He simply won because he timed his trades better than others.

@johnleoks

@johnleoks @DeadRhino @optimusprime are a same team of people. DO NOT TRUST THEM.

@42irrationalist

@johnleoks @DeadRhino @optimusprime are a same team of people. DO NOT TRUST THEM.

@DeadRhino If johnleoks allowed you to win from a 25000 sniping this time, I think it will damage his reputation as market creator and discourage people from participating in his market in the future.

@oxygen I think it won't damage his reputation, since the rules are very clearly stated in the market description, and he would just be following them. Also, he has a lot of markers that aren't self-resolving, and there is no reason why this would affect whether or not people brt on those markets.

@DeadRhino I am curious, why did you think johnleoks didn't mention in the rule whether snipe buy order with over 10k is allowed, when he wrote so much about why he does not allow for over 10k limit order? (He is explicit that the 10k limit order rule is to prevent sniping) Did he not think of the possibility of sniping with simply buy order?

I'll also wait for @johnleoks to tell us what are his thoughts when he wrote the market description

@oxygen The reason that John banned limit orders over 10k and not regular bets is that massive limit orders cannot be overcome with relatively small amounts of mana. Someone could have bet 1000 mana on yes right after the 25k bet and the market would have jumped above 50%

@oxygen John also says that he is banning >10k limit orders to 'Give all traders a reason to actively participate during the final moments before the market closes....'

This heavily implies that he banned big limits (passive order type) so that people use market orders instead (active order type). This market will clearly resolve NO

@optimusprime So it's just a game of setting up a bot to place a massive buy order at the very last second?

@oxygen Yes. Based on the resolution criteria, that would be the optimal strategy. Easier said than done though. The bot still needs to determine which direction to push the market, and if people started using these bots frequently, traders would develop strategies that involve 'tricking' the bot into pushing the market in the direction that benefits the trader - Then we get robot wars! The same thing has happened in 'real' markets with HFT - Robots battling other robots at the microsecond level.

@oxygen Also, there's so much information that needs to be incorporated into the final buy/sell order to determine order direction and size; The state of the order book, the positions and portfolio sizes of other traders, whether there is liquidity in the liquidity pool, etc... So it's not really as simple as just 'setting up a bot'.

@optimusprime But its a game of setting up a bot afterall? As long as the bot is the last one to place the buy order, human hands cannot beat it

I'll wait for @johnleoks to clarify whether it's a game of setting up a bot afterall

@oxygen This is true of any sort of trading. In US equity markets, 60-75% of trading volume is driven by bots, and that number is only going up. Machines trading better than humans is a feature not a bug.

@optimusprime I'm not talking about the US equity market. I'm talking about this market, and the question of whether johnleoks want it to be a market where sniping with bot is how you win it