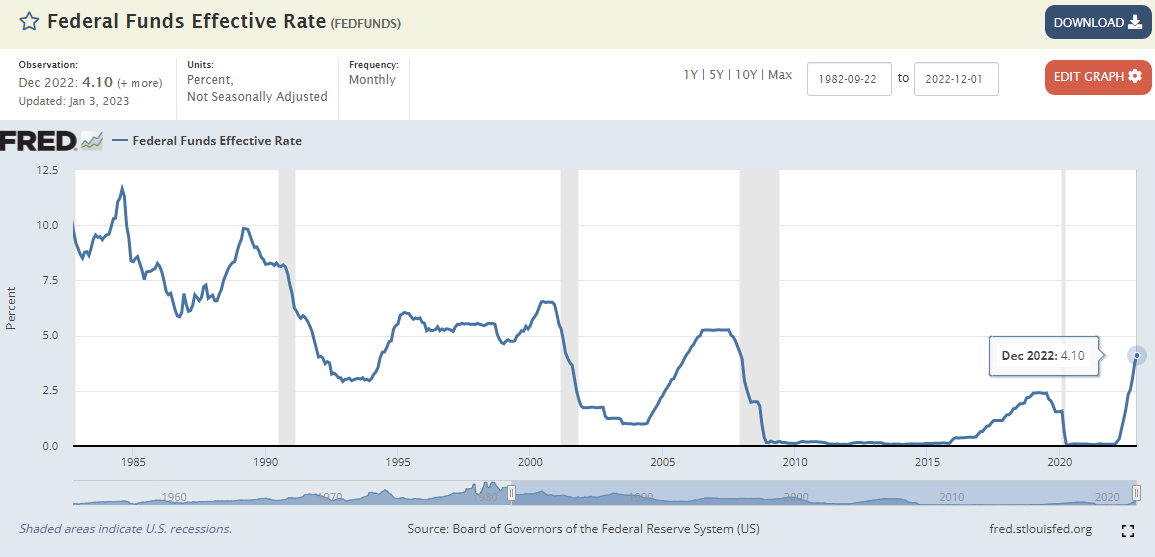

FED pivot is defined as the change in the approach of defining the upper bound of the target federal funds range, so-called 'interest rates'. The decisions on the target federal fund range are made by the Federal Open Market Committee (FOMC) meetings.

This market will resolve to "YES" if in 2023, the Federal Open Market Committee decides to decrease interest rates (over the level it was prior to the meeting), on any of its meetings.

The level and change of the target federal funds rate is published at the official website of the Federal Reserve at https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ920 | |

| 2 | Ṁ899 | |

| 3 | Ṁ714 | |

| 4 | Ṁ595 | |

| 5 | Ṁ519 |

People are also trading

@SirCryptomind There is still a possibility of outstanding extra meeting when they cut the rates, right?

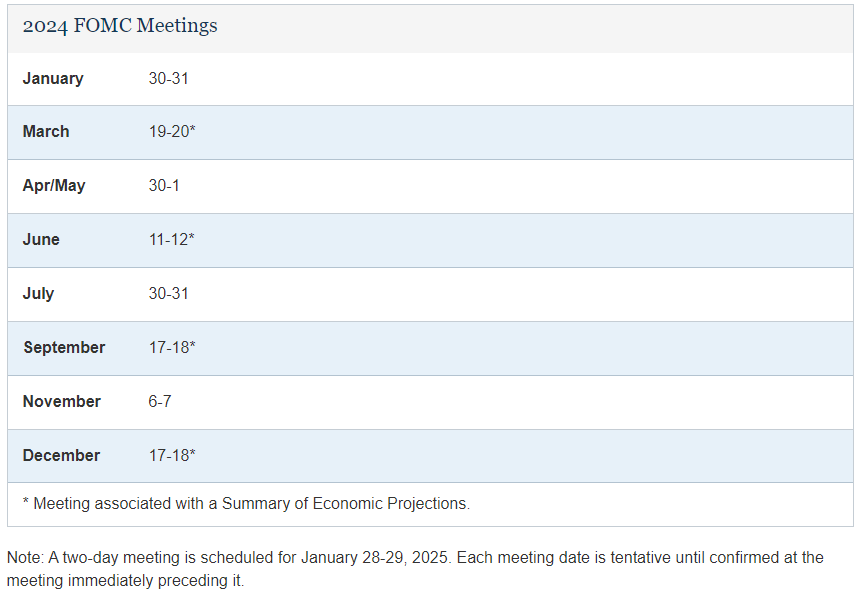

@itsTomekK one can never rule out emergency meetings, this was merely the last scheduled one.

@chrisjbillington You are right, it is not 100% It happened in 2 times in the last 5 years of tracking provided by Fed Reserve website:

March 2020 (Covid)

October 2019 (Statement Regarding Monetary Policy Implementation - Vote To lower Interest rates for Oct. 30 2019 meeting).

No other history of such prior is seen or available on Federal Reserve website as it only stores 5-7 years of data.

Next Official Calendar @itsTomekK

@SirCryptomind It happened in the GFC as well, and I think it's reasonably likely that it would be on the cards if there were signs of a sufficiently severe recession in the coming months.

I feel like the GFC taught the Fed that they should go harder, sooner, on rate cuts when the first signs of a recession show themselves, and whilst it's true they want a slowdown, if there's signs things are overcooked compared to what they were going for, they may intervene without waiting up to six weeks for a regular meeting.

Like, when SVB collapsed the Fed responded immediately. Not with rate cuts. But they respond quickly when there are crises.

Given that policy is in restrictive territory, it's more likely than at other times that we might see a slowdown that's more severe than what the Fed would be happy with. So far, there's been absolutely no sign of that, which is pretty amazing. But these things tend to be a surprise when they do happen!

@SirCryptomind Oh yeah I'm definitely < 2% on this. But end-of-year rates of return are something like 10-15% so no more bets here from me :)

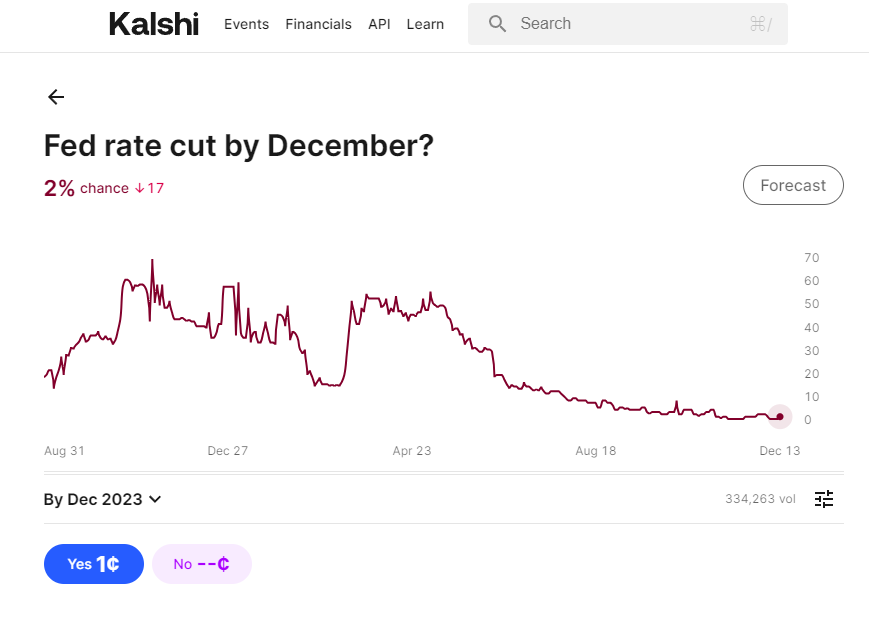

@TylerColeman - so Kalshi has this at 15% here: https://kalshi.com/markets/ratecut/federal-reserve-rate-cut#ratecut-23dec31

I have been watching the markets which were looking to call the FED's bluff and thought that FED would cut the rates by the end of the year, esp if the economy tanks. On June 27th, they were still at 25-30%, but now they are down to 15%ish as well.

A lot of it is because the economy has held up better than many expected. I'm expecting cuts in 2024Q1. Things may change, but leaving some alpha here.

@PC you seem quite confident in driving the % down. (Most of the market is, in fact.) Is there something I'm missing, or are people just trusting the FED's reassurances more, over time?

@TylerColeman First, isn't this an equivalent market to the one below? (you can get a better price there)

TBH, I don't really want this position, but yes I am quite confident

@TylerColeman I guess this kind of rhetorical, but why should we not trust the FED and expect them to cut rates?

@TylerColeman This might be misleading, but my description is "moved profit-maximizing after leagues came out"

@PC because the Fed incentives are totally different from yours. If economic agents believe they will not cut, they behave accordingly and anticipate the effects of them not cutting, which could accelerate the desinflation process and the possible recession. It's reflexive. In 2021 they also said they would not hike until 2025, which says a lot about their incentives and prediction acumen

@PC I'd buy YES on the other market at a slightly better rate, except that I (currently) prefer selling to buying, in order to have more uninvested funds.

Thanks for the reply. I expected people to either trust the fed, or have some other view, but not change so much in the middle of the year. So I'm wondering why the steep decline over time.