If we implement limit offers I will divide the limit offer volume by the limit order volume after 6 months of usage and resolve this market to that number * 100. N/A if I don't implement limit offers.

I'm thinking about implementing limit orders that only fill once both parties have agreed to the fill. This is inspired by Ernie's doc on finding counterparties:

Example: I might believe a market is fairly priced at 50.5%, but anything under 50% is wrong, and be willing to back it up with 100k mana. Someone else might believe that the right price is 49.5% max and want to match my 100k to keep the price down to match their belief. Note: we both believe this about NOW but not about TOMORROW or next week.

Note: this example has two people with tons of mana and very firm contradictory beliefs. If they spoke to each other they'd realize they both want to spend 100k each.

In today's manifold, will we find each other and trade all that mana, granting the creator volume? Likely, NO. And so, everyone misses out.

Why not? Slippage.

The other guy may have pushed the price down to his preference, 49%. When I log on later, and see the price being wrong from my POV, I'll spend a tiny amount of mana to move it up.

Contrasted to limit orders:

it's adding an additional step where the original party certifies "yup I still agree to this".

Currently, I put up a limit order for the next week. Until I take it down, if anyone wants to fill it, they can fill it instantly. (bad for me if news breaks and I'm not online to cancel my order)

If I put a limit offer up for the next week, and someone wants to fill it, instead it gets punted back to me and I agree "yup I still want to fill it".

Update 2025-05-01 (PST) (AI summary of creator comment): The calculation

(limit offer volume / limit order volume) * 100will use filled volume only for both the numerator and the denominator.Limit offer volume refers to filled limit offer volume.

Limit order volume refers to filled limit order volume.

People are also trading

Thanks for making this guys!

I'm wondering if there's a way to test this idea without major UI / uptake required, first, to validate it.

The key idea: Tell traders when the market violates their implied prices!

We could show users things like: yesterday they paid 40% for Y but today it's 20%. If they use this UI to buy more, then it's a good proof of the claim that "price/value violations" are interesting. If they don't, that's a strike against this idea. If the bare info itself isn't used by traders, then a complex UI won't be either, most likely.

This seems easier than a complex UI and new internal limit/bid system which would require lots of traders to use before knowing if it worked! Just as a test.

How could it be done?

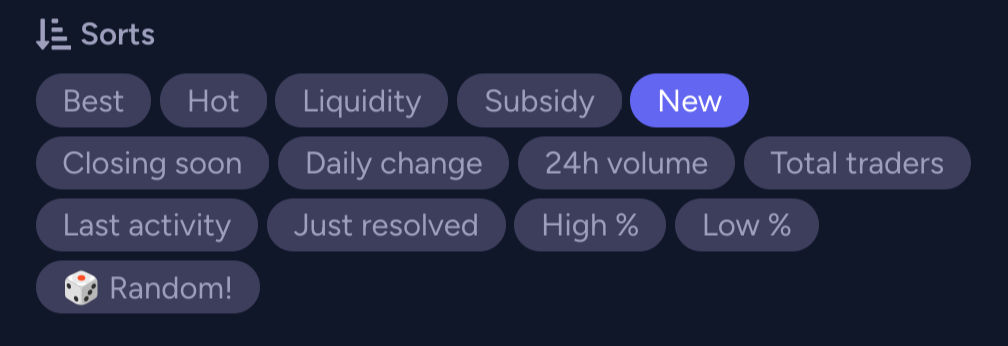

When I view "my trades" I need to be able to sort by something that would highlight how different my demonstrated price is from the market price now!

Sort by percent discount I could get now over my last single trade price, clearly distinguishing the Y from the N side. It has to be percent. Just like how in real money trade platforms, sorts show percent gain (or absolute value gain) but nearly never show "nominal share price change in usd". I'm not interested in how the share I paid .75 mana for now can be bought for 0.74m but I am very interested if the 0.02m share is now available for 0.01m

Just show me!

Imagine a sort for "change% since your last trade"

It'd be so great

Even a special purpose page I could get to... I'd use it a lot.

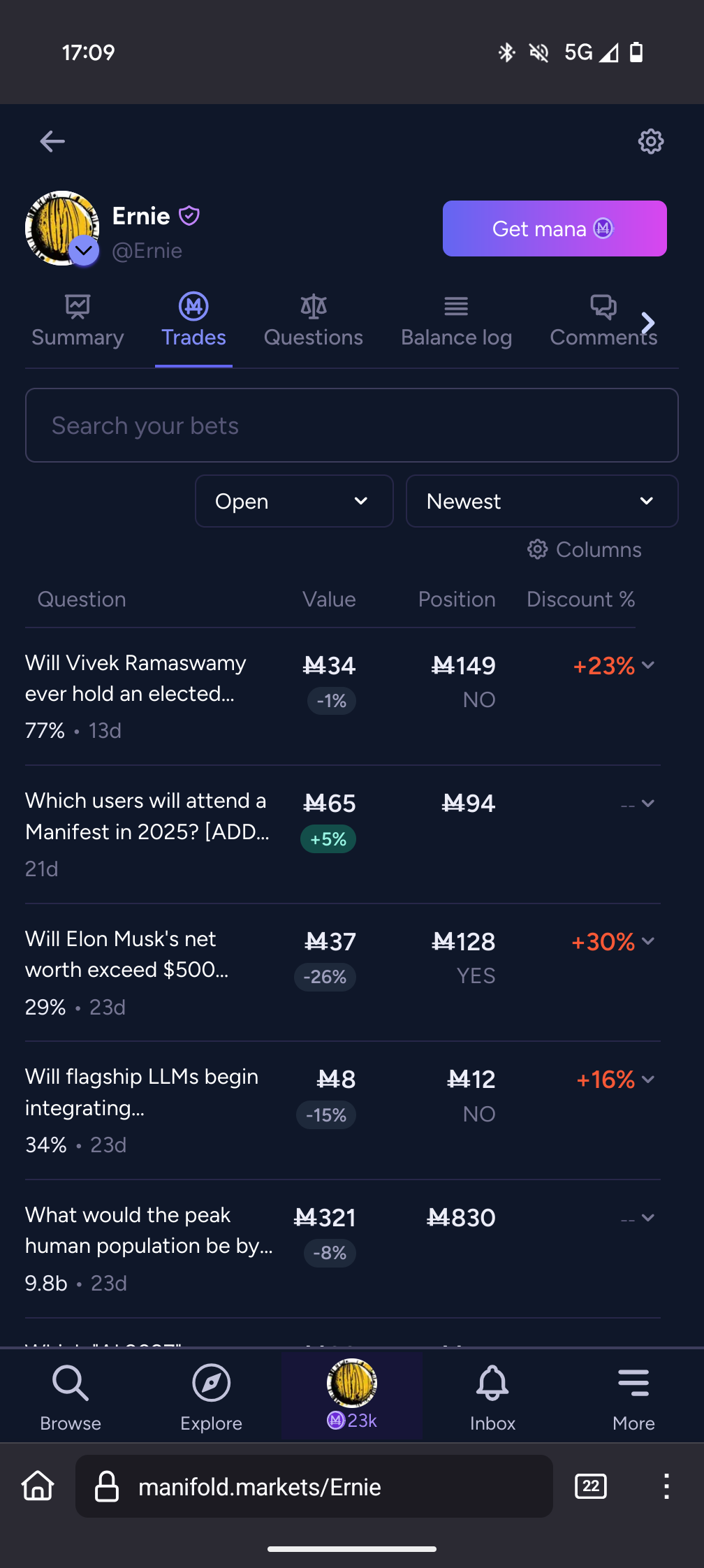

@Ernie I just added this sort & column to your trades tab and am updating the lastProb on your metrics going forward when placing a bet. Not sure if the psql script I have will be able to backfill the metrics, it's taking a while...

@Ernie I'm not sure how to color the discount %'s though. currently red if it moves against you (but shows +%, which is weird) and green if it moves with you (and negative %)

@ian wow this is super interesting. Yeah coloring is hard because the general notation issue is still the hard for me to visually parse.

I feel this page's name being 'trades' makes this hard too since the column "discount" needs to refer to a market not a trade.

To have this make sense I keep looking for "what was my last price", did I buy Y or N. With that plus the current price the coloring and meaning of "discount" would be interpretable.

Without that it feels like very few people will know what "+16%" in red means.

Given that until now market prices are always given in terms of Y for clarity it guess discount might follow that as well? Unless a broader refactoring of market views into separate "Y holder" or "N holder" is done

@DanielTilkin I think this would be a great feature, too! But not exactly what this market is about. The other person might not be willing to place the limit order at 49.5% because they're afraid of news breaking out. So they place a limit offer there, ideally you get notified or someone sees the offer and agree to fill the offer, which shoots the offer back to the original original party to agree or cancel the offer.

@ian If someone is afraid of news breaking out, wouldn't that also apply to making an offer like this? Any time one person has confirmed an offer, while it's still waiting on someone else, news could break out.

@DanielTilkin yes, although I think the assumption is that the timing would be more constrained. I might want to leave open a limit offer for months, since I’d take that price as long as there isn’t breaking news that the event happened. If someone accepts, maybe I have a day to respond, and while they still take on that risk, that step in the exchange is much shorter.

But yes it’s a real constraint and it’s why none of this is SO far from the current practice of just dropping a comment saying what price you’d accept

@TheAllMemeingEye it's adding an additional step where the original party certifies "yup I still agree to this".

Currently, I put up a limit order for the next week. Until I take it down, if anyone wants to fill it, they can fill it instantly.

If I put a limit offer up for the next week, and someone wants to fill it, instead it gets punted back to me and I agree "yup I still want to fill it".

The logic is that it is dangerous to leave limit orders up when they might only get filled when there's breaking news. Instead, this is functionally similar to me posting a comment "I'd be willing to bet at X%" and someone saying they'd take the other side and agreeing on the bet. But it's built into the site.

There are many situations where this would be useful. The downside is just whether the site is active enough to really support this (i.e. would building that functionality into the site actually make it happen more or would it still be too hard to arrange)

@Ziddletwix right, thanks for explaining, maybe a more descriptive name might be "limit notifications" or something

@ian In your opinion, does this open prediction markets to manipulation much like a stock market? It could potentially be used to create inflated trade volume, but I'm uncertain if the systems we're envisioning are the same.

32 minute video

@Quroe What I'm talking about is just a limit order but with a chance for the creator to cancel the limit order before it fills at the time when someone wants to fill it

@ian Got it. I think I understand better now!

One side effect this might have is that it might entice users to goad or taunt each other into an uneven trade.

This might have a toxic byproduct on the community discourse, especially during an election season. Sharing misinformation might even be rewarded with these systems in play.

That being said, I think some friendly competition could be healthy. It certainly adds to the feeling that you're wheeling and dealing, and I do like the feeling of agency in games.

@Quroe I wouldn't agree with them! If you're willing to put up that offer that's a straightforward good thing

@ian yes! it seems better than limit orders for markets where news could drop and massively swing the odds at any time

I would use it conditioned on it being easy to understand :)

I've been just placing limit orders and committing to check the news etc but obviously that's dangerous. There are however many cases where I'd still use plain old limit orders. My favorite being on linked markets which don't resolve in a while (who will win 2028 election) I place the limit order and every time anyone bets yes on a different option I get to fill some at my preferred price. So, I don't think it'll take over limit orders but it'll be useful