The Official 🦝RISK Payment Portal

Dashboard | Credit Score app | Insurance Calculator | Payment Portal | IMF

We provide loan insurance. This page provides a way for folks to pay insurance fees, get bailed out if things go awry, and payouts for shareholder dividends.

Additionally, this funding pool may allocate mana to our nonprofit sister companies: 📖RIPE & ⛑️POOR. This portal may also be used to handle transactions for new products we release.

Finally, if 🦝RISK is ever sold or changes hands, this bounty can be liquidated into another bounty so another user can run it. This is important for longevity and brand-consumer trust.

It is typical that lenders pay fees.

Need to make a claim?

You've come to the right place. Here's what to do:

Leave a comment describing the issue. @crowlsyong will respond as fast possible and RISK will open a case file for you and will begin an investigation. If the investigation corroborates the information from your comment, RISK will deliver mana in the form of a bounty on your comment. If not, you will be notified about the results of the investigation and you will have one week from the date of the comment to appeal the decision.

⚠️Claims must be made within one week of the loan's due date. If outside that period, the policy becomes inactive and claims can no longer be accepted.

How do fees work?

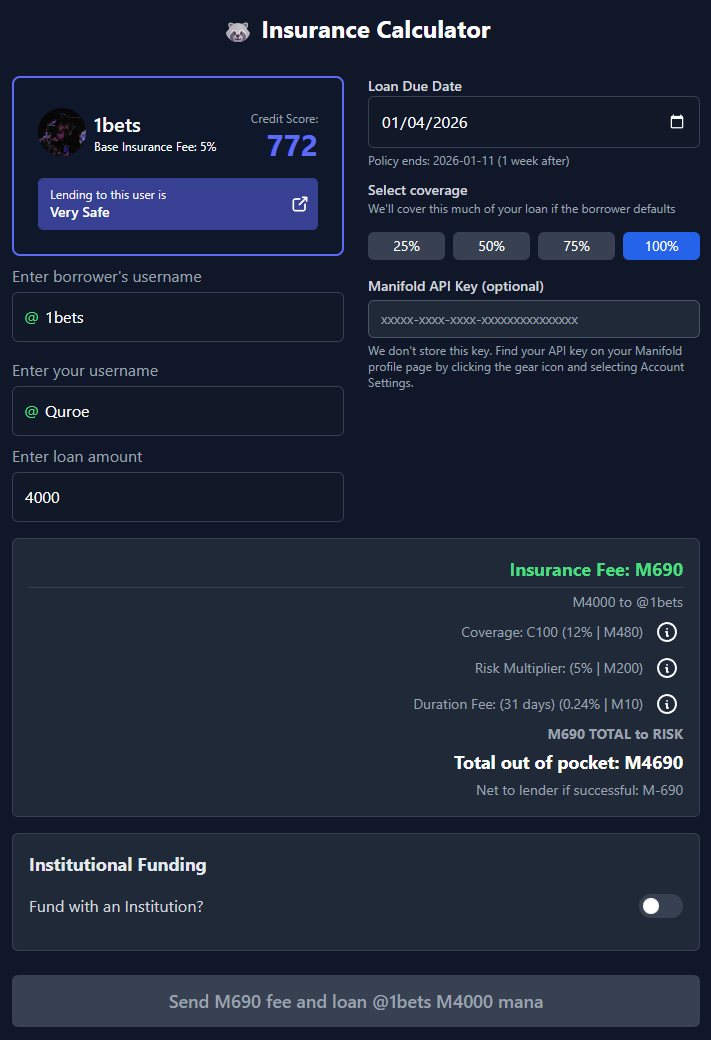

In short, there is a fee correlated to credit score (as seen on our proprietary 🦝RISK Credit Score app) and there is a fee correlated to coverage. Add those values together and that's our final fee price. To find out more and see the math, please search for the section How we determine fees on our dashboard.

Investors

Please search for our #️⃣Investors section in the 🦝RISK Dashboard for information on how investments with 🦝RISK work.

Active Insurance Policies (AIPs)

txn #2 | Receipt | C100 | IMF @GastonKessler AKA @Jojo

txn #4 | Receipt | C100 | IMF @GastonKessler AKA @Jojo

txn #5 | Receipt | C100 | IMF @GastonKessler AKA @Jojo

txn #6 | Receipt | C100 | IMF @GastonKessler AKA @Jojo

txn #11 | Receipt | C100 | @TheAllMemeingEye

txn #12 | Receipt | C100 | @100Anonymous

txn #13 | Receipt | C100 | @100Anonymous

txn #14 | Receipt | C50 | @realDonaldTrump

Credit Default Swaps

empty

History

✅txn #1 | Receipt | C75 | @CryptoNeoLiberalist

✅txn #3 | Receipt | C100 | IMF @GastonKessler AKA @JoJoe

✅txn #7 | Receipt | C50 | @Robincvgr (credit default swap w/ conflux/evan)

✅txn #8 | Receipt | C100 | IMF @GastonKessler AKA @Jojo

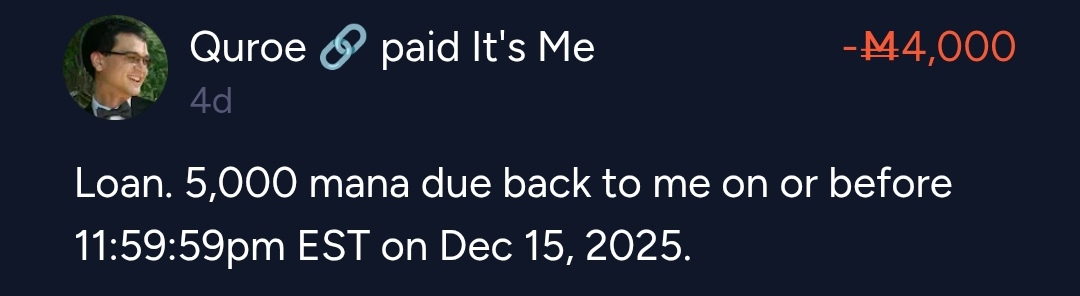

❌txn #9 | Receipt | C100 | @Quroe

❌txn #10 | Receipt | C100 | @Quroe

✅ = Borrower paid on time & in full.

❌ = Borrower did not pay on time & in full, policy activated, lender compensated.

UPDATE 2025-05-09

Dates will now use the format: yyyy-mm-dd

UPDATE 2025/04/27

Fee calculation updated. New rates.

UPDATE 2025/04/25

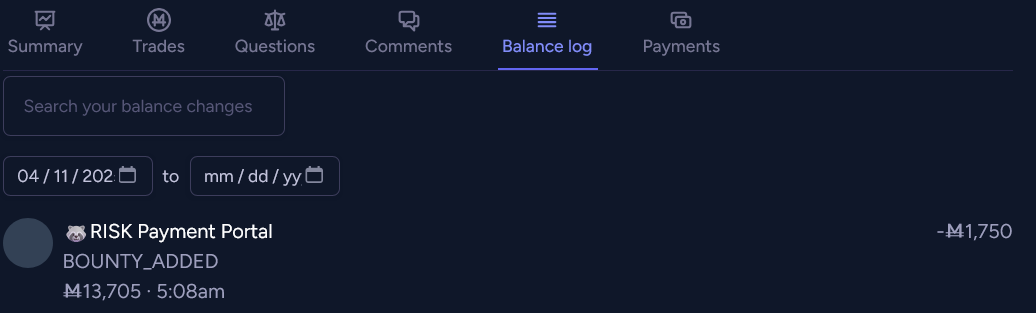

Users can screenshot their fee payment by viewing their balance log. Example screenshot:

Terms & Conditions

By accessing, utilizing, or interacting with this Payment Portal, or any other services, functionalities, applications, or platforms provided by, operated by, or related to RISK (including, but not limited to the official website at https://risk.markets), you explicitly acknowledge, agree, and consent to be bound by the Terms & Conditions located here: https://manifold.markets/news/risk-terms

Your use of any services related to or run by RISK constitutes your full and unequivocal acceptance of all terms, conditions, definitions, policies, and amendments contained within the aforementioned Terms & Conditions, including any retroactive changes as stipulated therein. It is your sole responsibility to review these terms regularly.

Update 2025-11-22 (PST) (AI summary of creator comment): RISK is in hibernation mode (as of 2025-11-22):

Response times may be delayed up to a month

Update/marketing/maintenance schedules will be slow

Policies and investments remain unchanged and operational

Policy holders can still file claims (comment here or message on Discord) - delays may be compensated with extra mana

New policies still available but may have slow response times

Q3 dividends delayed but will be paid before December with bonus mana

Investors can withdraw investments upon request (no questions asked)

RISK will remain operational long-term

Announcement

Last updated: (2025-11-22)

RISK is fully operational, but it is in a state of hibernation for the time being.

What does that mean?

The only thing that is changing is my response times and my update/marketing/maintenance schedule- they will be slow, potentially up to a month late.

Your policies and investments remain unchanged.

Why?

I went back to school to get my degree and I am absolutely loving it. I'm pouring myself into my school work and this doesn't leave me much time to manage RISK like I used to. Thankfully, https://risk.markets and the tools on there are in a relatively mature state, so they don't require much maintenance. There are a few little bugs that I want to fix they aren't that significant. I may have more time to engage with RISK come summer of 2026, but I won't promise anything.

Policy Holders: Your policies are unaffected. If you need to use a policy, comment here (or better, message me on Discord) and we'll get you taken care of. There may be a delay in my response times, but I will try to compensate with week+ delays with a little extra mana. If you need a new policy, you can still do that too, but again, I may be very slow to reply and I have resorted to some "handshake deals" on Discord with users who have a strong history of engaging with me and RISK in good faith.

Investors

You may be wondering where your Q3 dividends are. Let me clear that up.

I forgot. Yep, September 30th came and went, and I was a forgetful boy. I will get those out soon (before December, maybe) and I'll add a little extra mana because I was irresponsible.

RISK had a slow quarter. The dividends are going to be very small, even with the bonus. This isn't an excuse for missing the payment, it's just me bracing you for a laughably small dividend.

If you are an investor that's getting cold feet right now and you want to withdraw your investment, send me a message and I'll pay your mana investment right back to ya, no questions asked. Just remember I may not get back to your right away (Discord will get me to respond much faster!).

Ethics

Part of being a good developer/mana-megacorporation CEO is maintaining the code and talking to the community. I'm lacking in both of those categories and I apologize. If you are angry and you want to write me an angry letter, please drop one in my inbox.

What's next for RISK?

RISK is not going anywhere. I want to keep RISK operational as long as I can. It's a passion project and I made it for all of us to enjoy <3. As a reminder, the RISK website is open source with the MIT license. If you're a developer and you want to play around with the code, then by all means, play!

Thank you dear Manifolders

crowlsyong

@crowlsyong Alright, thanks for sorting this out with me in DMs and a Discord call. I now have the 2k mana back in my balance.

I am now the proud recipient of a RISK policy payout. I feel confident in the system and have peace of mind.

(You can quote me on that.)

@crowlsyong Hi I would like to claim the refund for both of @evan's loans that have been fully paid back (receipts #3 and #8)

Q3 PAYMENTS

RISK net income was M0 in fees during Q3. 30% goes to investor dividends and the rest goes to RISKBOT which is the official financial holder of RISK's income.

DIVIDEND REQUEST

Requesting M140 (M10 late fee) to distribute as for Q3 dividend distribution

PROFIT REQUEST

Requesting M0 (70% of M0) Q2 net profits.

@crowlsyong I need to submit a claim on my loan for @/Chumchulum. After repeated pressuring, they refuse to pay back the loan.

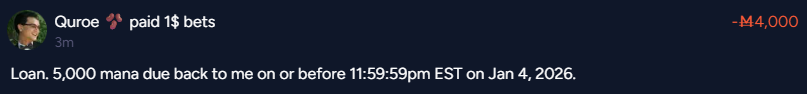

@crowlsyong Requesting a C100 policy on the following loan. The fee has been deposited.

https://manifold.markets/post/peer-to-peer-loans-with-quroe#5A0PhNRd

🦝RISK Insurance Receipt

Summary

Transaction ID (Loan): undefined

Transaction ID (Insurance Fee): P0RHRlbC

Coverage: C75

Lender: @notrealDonaldTrump

Borrower: @pureprofit

Loan Amount: Ṁ2500

Date of Policy Start: 2025-12-01

Loan Due Date: 2026-05-30

Policy Ends: 2026-06-06

Fees

Base Fee (risk multiplier): 5%

Coverage Fee: 8%

Duration Fee: Ṁ84

Total Fee (to RISK): Ṁ409

Terms

By using this service, you agree to The Fine Print at the very bottom of our dashboard. 60% refund may be available if borrower repays on time and in full. No refund if borrower defaults, but insurance will cover the policy amount.

Have questions or need to activate coverage? Message @crowlsyong and we’ll walk you through it.

Risk Free 🦝RISK Fee Guarantee™️

🦝RISK: Recovery Loan Insurance Kiosk

Guys, special offer: I’ll accept a loan from you with a -90% interest rate. You lend me 500-3000 mana, and I’ll owe you back 50-300 mana. Seems like a good deal , free and just a 3% order on your trades, tell me where to place, so you can earn some respect or whatever. Good deal - I always pay back negative-rate loans

Announcement

Last updated: (2025-11-22)

RISK is fully operational, but it is in a state of hibernation for the time being.

What does that mean?

The only thing that is changing is my response times and my update/marketing/maintenance schedule- they will be slow, potentially up to a month late.

Your policies and investments remain unchanged.

Why?

I went back to school to get my degree and I am absolutely loving it. I'm pouring myself into my school work and this doesn't leave me much time to manage RISK like I used to. Thankfully, https://risk.markets and the tools on there are in a relatively mature state, so they don't require much maintenance. There are a few little bugs that I want to fix they aren't that significant. I may have more time to engage with RISK come summer of 2026, but I won't promise anything.

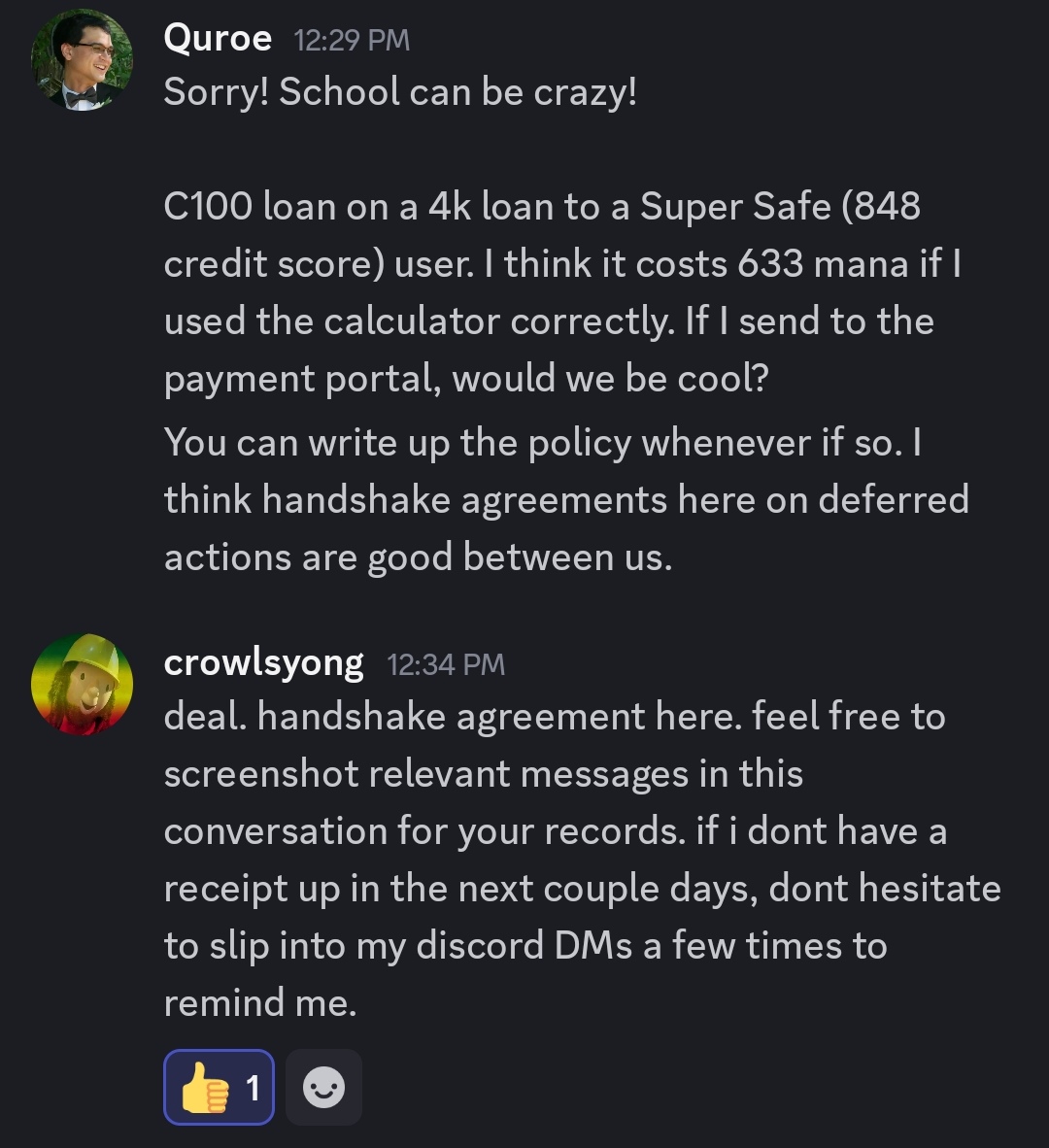

Policy Holders: Your policies are unaffected. If you need to use a policy, comment here (or better, message me on Discord) and we'll get you taken care of. There may be a delay in my response times, but I will try to compensate with week+ delays with a little extra mana. If you need a new policy, you can still do that too, but again, I may be very slow to reply and I have resorted to some "handshake deals" on Discord with users who have a strong history of engaging with me and RISK in good faith.

Investors

You may be wondering where your Q3 dividends are. Let me clear that up.

I forgot. Yep, September 30th came and went, and I was a forgetful boy. I will get those out soon (before December, maybe) and I'll add a little extra mana because I was irresponsible.

RISK had a slow quarter. The dividends are going to be very small, even with the bonus. This isn't an excuse for missing the payment, it's just me bracing you for a laughably small dividend.

If you are an investor that's getting cold feet right now and you want to withdraw your investment, send me a message and I'll pay your mana investment right back to ya, no questions asked. Just remember I may not get back to your right away (Discord will get me to respond much faster!).

Ethics

Part of being a good developer/mana-megacorporation CEO is maintaining the code and talking to the community. I'm lacking in both of those categories and I apologize. If you are angry and you want to write me an angry letter, please drop one in my inbox.

What's next for RISK?

RISK is not going anywhere. I want to keep RISK operational as long as I can. It's a passion project and I made it for all of us to enjoy <3. As a reminder, the RISK website is open source with the MIT license. If you're a developer and you want to play around with the code, then by all means, play!

Thank you dear Manifolders

crowlsyong

As discussed in Discord DMs, 633 mana has been deposited to purchase a C100 policy for this loan.

Let me know if everything here looks good. I understand you may be out of office for a bit, so you can write up the policy when it's convenient.

🦝RISK Insurance Receipt

Summary

Transaction ID (Loan): undefined

Transaction ID (Insurance Fee): g47nB3Xh

Coverage: C50

Lender: @realDonaldTrump

Borrower: @Chumchulum

Loan Amount: Ṁ100

Date of Policy Start: 2025-09-17

Loan Due Date: 2025-10-31

Policy Ends: 2025-11-07

Fees

Base Fee (risk multiplier): 5%

Coverage Fee: 5%

Duration Fee: Ṁ1

Total Fee (to RISK): Ṁ11

Terms

By using this service, you agree to The Fine Print at the very bottom of our dashboard. 60% refund may be available if borrower repays on time and in full. No refund if borrower defaults, but insurance will cover the policy amount.

Have questions or need to activate coverage? Message @crowlsyong and we’ll walk you through it.

Risk Free 🦝RISK Fee Guarantee™️

🦝RISK: Recovery Loan Insurance Kiosk