This question resolves YES if the University of Michigan's Index of Consumer Sentiment is less than 90 points in every month from November 2023 to December 2024.

Consumer sentiment was regularly above 90 points from December 2014 until February 2020. The most recent figure for October was 63.8 points.

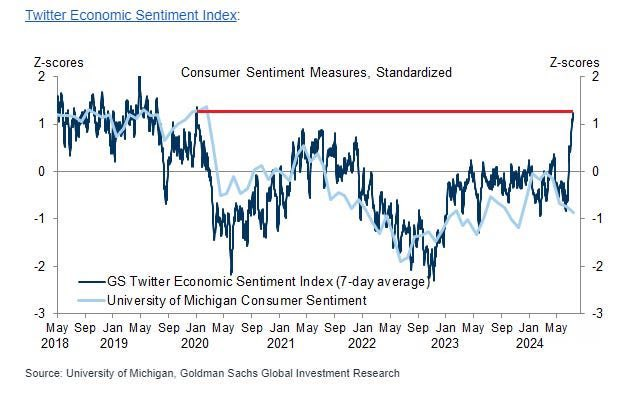

Will consumer sentiment remain below pre-pandemic levels every month until the end of 2024?

See also:

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ885 | |

| 2 | Ṁ313 | |

| 3 | Ṁ239 | |

| 4 | Ṁ214 | |

| 5 | Ṁ199 |

People are also trading

It's now looking less likely the vibecession will end this year, so I've made a follow-up question extending the timeframe to the end of 2025:

Consumer sentiment number for March is 79.4, up two and a half points from February. Feb was down a couple points from Jan, so after the big increase between Dec and Jan, consumer sentiment has been relatively stable.

Wall Street Journal published a simple primer video on consumer sentiment yesterday.

@cash I love this market, it's remarkable it's trading at 50%. I wonder how much the market would have for other thresholds besides 90. Would you consider making some other markets with different thresholds, or maybe a multimarket? A conditional on this and the election could be good too.

University of Michigan's consumer sentiment index rose 9.1 points to 78.8, the biggest monthly advance since 2005.

https://twitter.com/BloombergTV/status/1748369992968540597

Here are the questions on the ICS: https://data.sca.isr.umich.edu/fetchdoc.php?docid=24770

The first two are about your household, and the last three about the country as a whole. I think Republicans' negative feelings about the economy will keep this fairly low for most of the year, though if Trump wins that could change for November/December.

From the linked chart consumer sentiment looks to be at about 67, so it would have to rise by 23 points to end the vibecession as defined here. The most recent times the index has increased that much in 12 months were in 2011-2012 and 2003-2004. The only recent time I spot that it increased that much in a calendar year seems to be 1990.