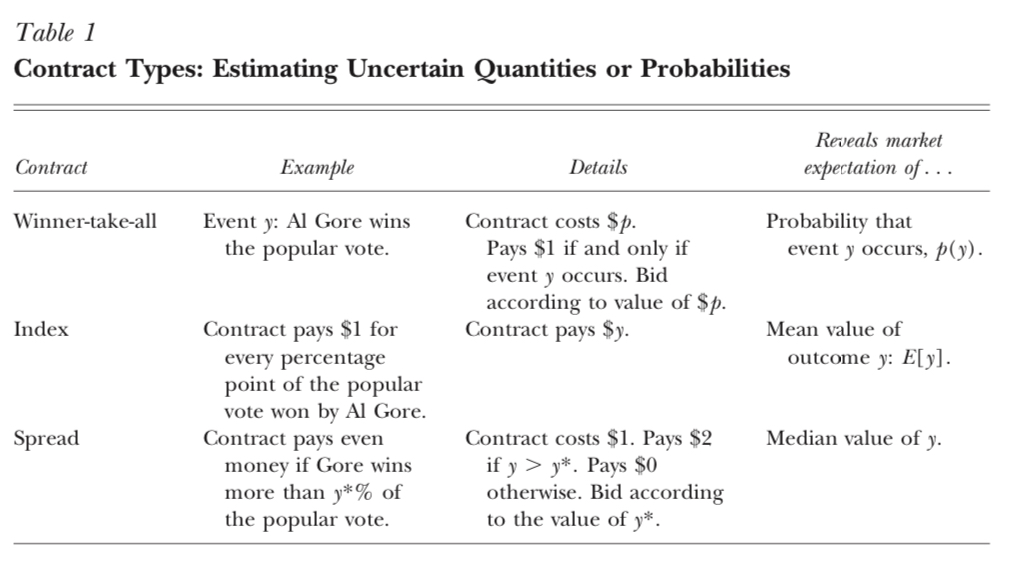

Kalshi and Polymarket (and Manifold) currently restrict themselves to binary contracts that resolve worth a fixed amount ($1) if a specified event occurs before expiry and are otherwise worthless. These markets elicit (time discounted) estimates of the event’s probability.

But prediction markets can also be used on events with continuous outcomes. Say, a contract worth at expiry $x if CPI increases year on year by x%. These could be used for vote shares, disease prevalence, ceasefire dates - essentially any verifiable real number (even negative numbers). These markets give the (time discounted) expectation of a random variable.

This is what Wolfers and Zitzewitz (2004) refer to as “index contracts”:

These contracts are mechanically almost identical to futures contracts, and similarly require more complicated risk management than binary contracts because each party’s loss is potentially unbounded. It may involve creating a margin account with a clearinghouse liquidates a position if a margin call isn’t met, or a continuously monitored auto-liquidation mechanism similar to that used by Binance or FTX.

This market resolves YES if at least one member of the public (non-staff) have executed a trade on an index contracts on either Polymarket or Kalshi before January 1st 2026, where the contract is structured such that the trader’s potential losses or gains are theoretically unbounded.

I add this last condition to make clear that ladders of binary options do NOT count (e.g a set of binary markets on “CPI >2.0%?”, “CPI >2.1%?” etc), nor a mechanism for trading intervals that looks like it varies continuously but is in fact just executing a bunch of trades on binary markets. I’m looking for a single contract whose value at expiration is not fixed but varies continuously with an underlying measurement/index.