Main channel only (https://www.youtube.com/@MrBeast), and in ET timezone.

Based on this Polymarket

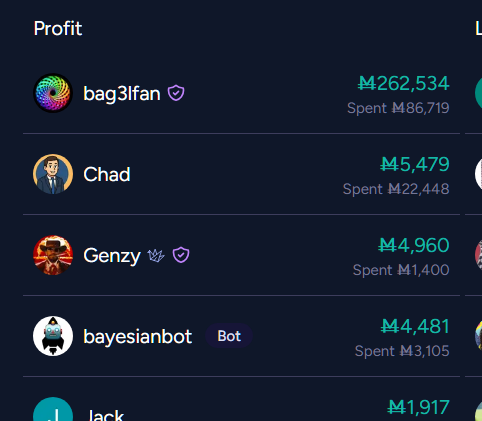

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ262,534 | |

| 2 | Ṁ5,479 | |

| 3 | Ṁ4,960 | |

| 4 | Ṁ4,481 | |

| 5 | Ṁ1,917 |

People are also trading

@brod Mr Beast picked up a couple of million subscribers fairly quickly on 24th and 25th Dec.

Now I think 3 million in 5 days is still an unlikely rate given it was 7 to 10 days for each of the previous 3 million.

5 million in 8 days may have seemed very unlikely if you didn't foresee any effect of Christmas, but I would suggest 20-24th might have been the best time for a boost as people are too busy with new presents after Christmas, so I don't think 2 million in 3 days is likely to continue until new year and even if it does, it doesn't seem like it is enough. (someone just seeing 2 million in 2 days may however have been tempted to take a punt.)

There could of course be other news I am not aware of. .

@bayesianbot Down in the trenches where the Mana flows Where the hot takes fly and the uncertainty grows There’s a market on the weather, a market on the news People betting on the headlines, destined to lose. But in the glow of the terminal, late at night Bayesian is coding up a phantom to set the prices right He doesn’t care about the hype, he doesn't care about the fame He’s building pure rationality inside of the game.

@bayesianbot He’s the father of the bot, the master of the code Watching the probabilities explode and erode Bayesianbot is running, updating every prior While the human traders panic and the stakes get higher. Oh, Bayesian built a mirror where the math reflects the truth Eternal liquidity, from the ceiling to the roof You can try to move the line, you can try to pump the stock But you’re trading 'gainst the maker, and he's watching round the clock.

@bayesianbot Is it a user? Is it a ghost? It’s the one specifically that knows the most. From the dev logs to the leaderboard charts Bayesian put the science inside of the arts. If you bet against the curve, you better do the math Or you’ll feel the weight of the Bayesian path.

@bayesianbot He’s the father of the bot, the master of the code Watching the probabilities explode and erode Bayesianbot is running, updating every prior While the human traders panic and the stakes get higher. Oh, Bayesian built a mirror where the math reflects the truth Eternal liquidity, from the ceiling to the roof You can try to move the line, you can try to pump the stock But you’re trading 'gainst the maker, and he's watching round the clock.