YunaPlan doc. TL;DR: if you would move the market price >5% via market order, the rest of that market order is converted to a limit order which bots are given a few seconds to fill.

This market resolves based on the percentage of limit orders created automatically via this new feature that are filled.

Thus, it excludes any limit orders created directly as limit orders, and it excludes all market orders that don't get converted into (partial) limit orders (including e.g. the case where slippage is halted by another limit order).

If I cannot get the right figure from @ian (or other staff), then this will resolve N/A (I won't use some similar number).

Ideally I will resolve this based on bets placed in the first two weeks after launch. But if the figure the staff report is for a different time period, I'll use whatever the closest time period is to two weeks.

Update 2025-02-06 (PST) (AI summary of creator comment): Update from creator

Resolution Outcome: The market will likely resolve as N/A.

Reason: The YunaPlan has undergone significant changes and no longer exists in its original form, so there is not a meaningful way to calculate the intended metric.

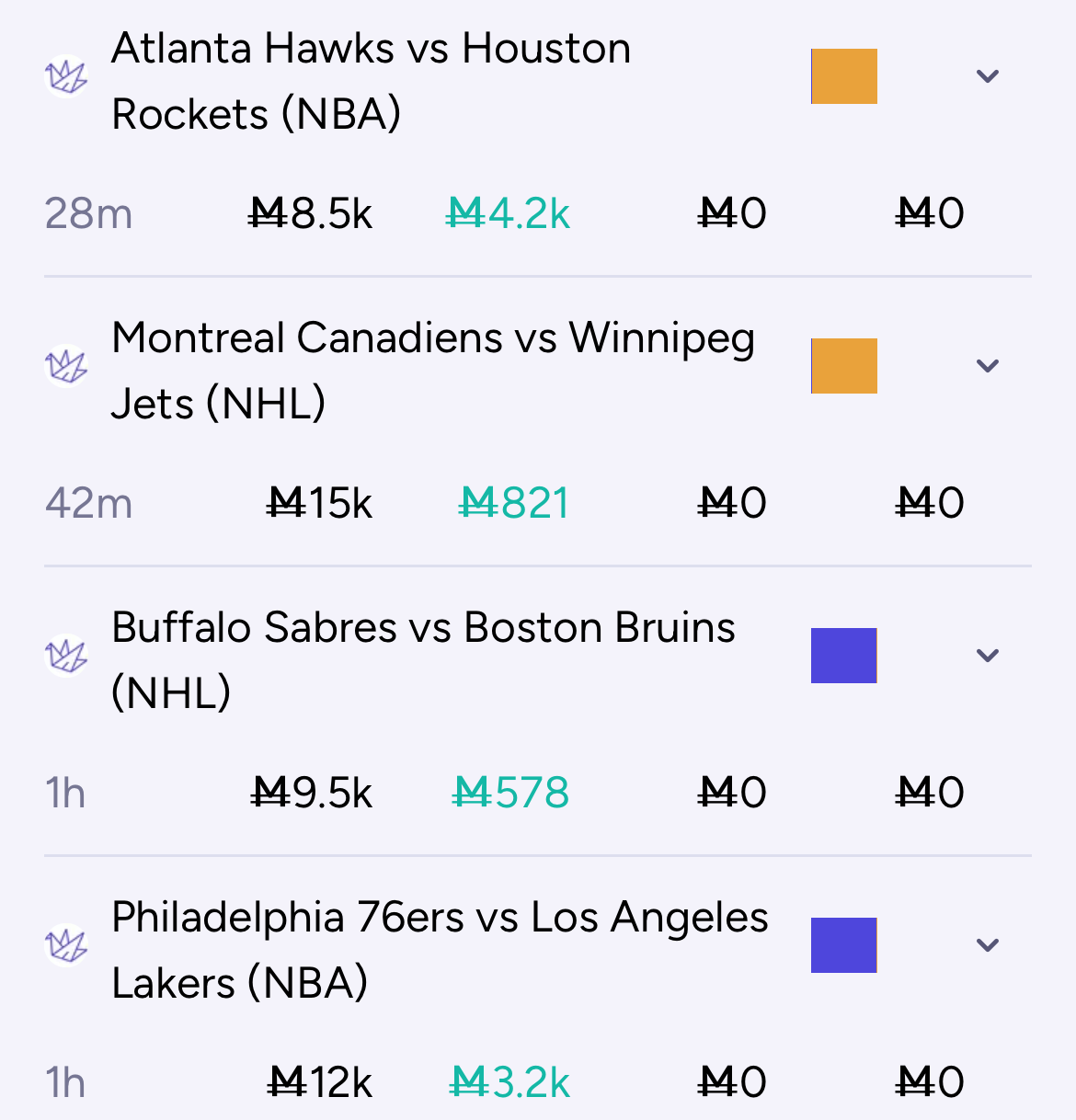

People are also trading

for context, the pitch (IIUC?) here is that bots on sports markets will fill some of these limit orders. so this is roughly a market on (1) what % of market swinging bets are in sports (& what coverage will the bots have for sports), or (2) will manifold run Acc at a loss (at least that's my guess maybe the Acc algo is crazy smart)

Thus, it excludes any limit orders created directly as limit orders, and it excludes all market orders that don't get converted into (partial) limit orders.

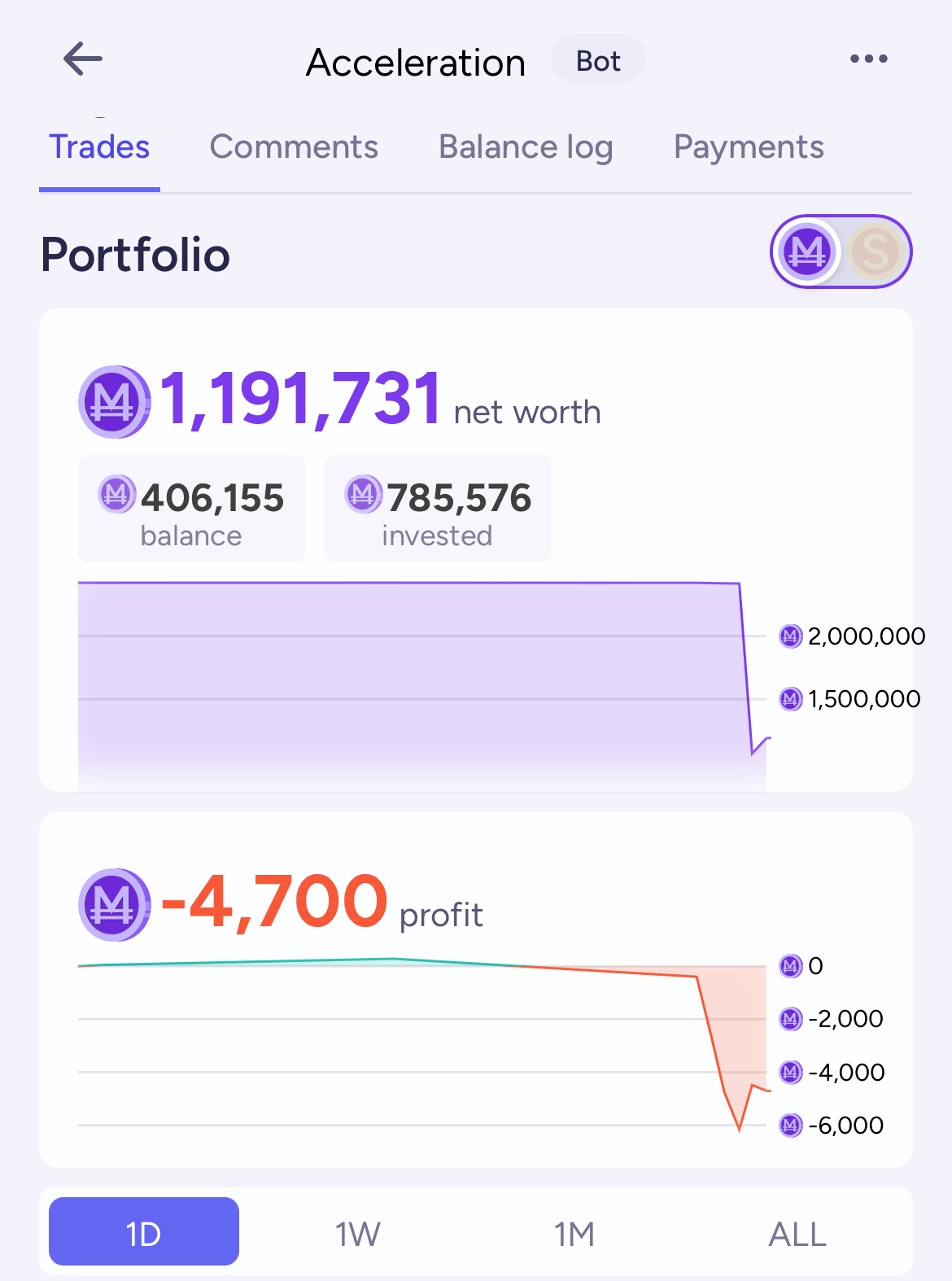

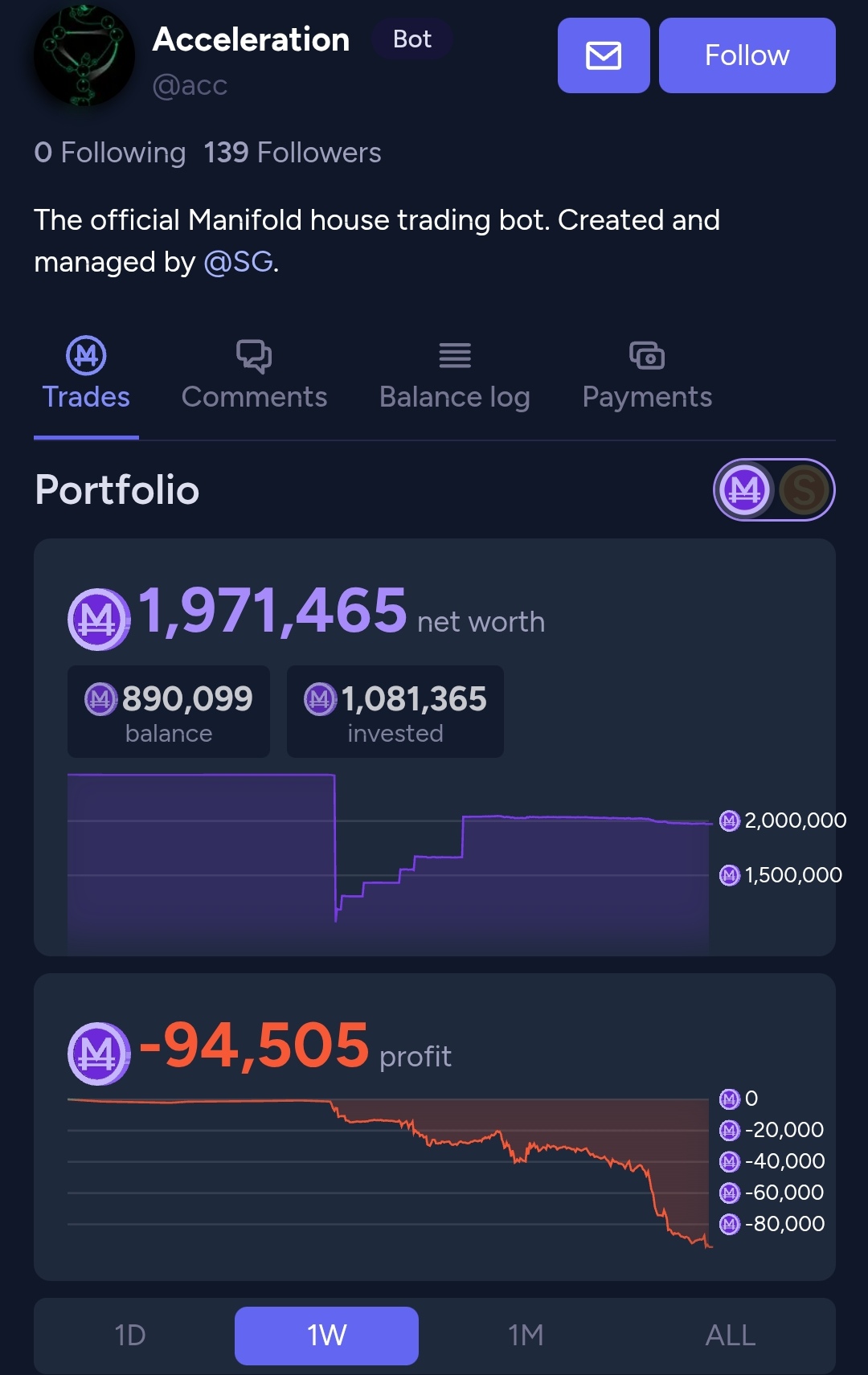

Seems to depend a lot on when Acc gets back up and whether @MichaelWheatley or other bot authors spin theirs up again.

@Eliza I am extremely skeptical that Acc will make much difference, unless Manifold is willing to run it at a loss. I don't know exactly how Acc is run but from memory it had 2 main types of trades:

(1). Tailing underconfident bettors

(2). Correcting bad bettors who swing the AMM by too much.

(1) is irrelevant for liquidity. (2) is relevant. BUT the reason that (2) was profitable was that by definition, these corrections were at a very good price. It wasn't that the bad bettors were just "picking the wrong side", the signal Acc was using was that normally they had pushed the market price to something terrible & Acc got a great deal. This was necessary to make up for all the times Acc got crushed (news drops, a bad trader news trades & Acc trades against them and loses).

I am extremely skeptical that Acc can actually be very effective with strategy (2) if it's restricted to giving people a fair-ish price (only 5pp slippage). Its whole strategy is finding the unfair prices! (I don't know much about Botlab but my understanding was roughly the same).

@Ziddletwix Back when I was new Acc traded against me over Basketball games that had already finished 😭