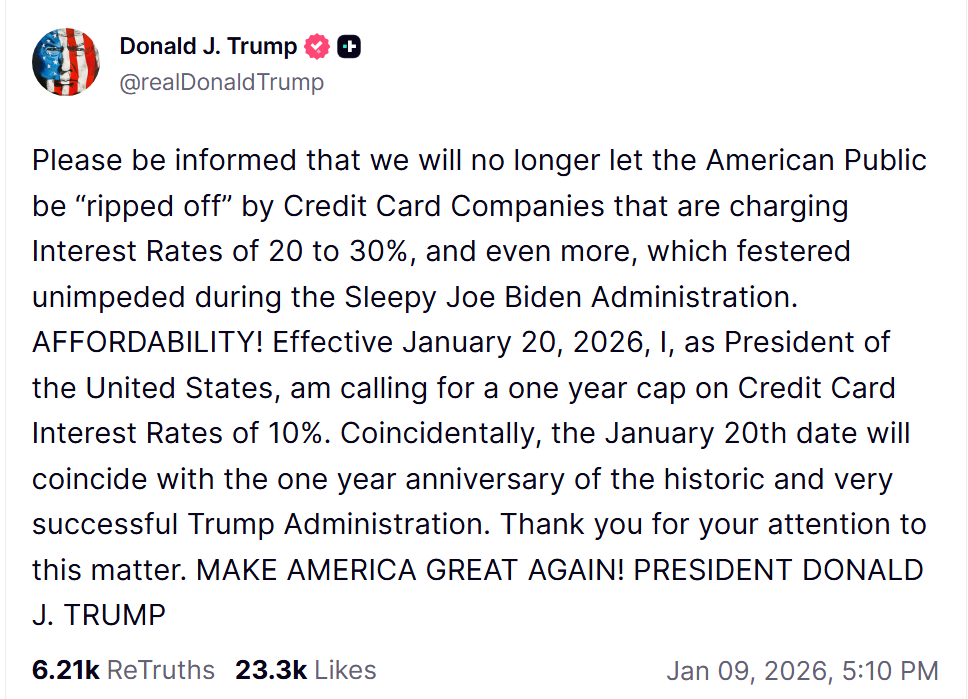

Context: https://www.cnn.com/2026/01/09/business/affordability-trump-cap-credit-card-interest-rates

Trump calls for a 10% cap on credit card rates in his latest appeal to affordability concerns

This market resolves YES if a federal law, executive order, or binding regulatory rule is signed or enacted before January 1, 2027, that mandates a cap on credit card Annual Percentage Rates (APR) at 10% (or lower) for the general public.

It does not matter what mechanism this is achieved by (EO, legislation, or CFPB rules).

However, the mechanism must be considered legally binding. If Trump posts that he's banned it, but the consensus of credible reporting indicates credit card companies have no intention of changing their behavior, then that is not sufficient.

If the measure is signed but blocked by court injunction, this still resolves YES.

The cap must apply broadly to consumer credit cards (e.g., not just military members).

If the policy is enacted as a temporary measure (e.g., expiring after 12 months), that still resolves YES.