I am not a clever person.

Rather than learning by reading, I attempt to learn by trial and error.

This has very little to do with different intelligence types, or some people learning more effectively in someways than others, it is simply because I am very stupid, I do not quickly from practical experience, in fact, sometimes I do not learn at all.

I’m going to try placing limit orders on this market to understand how such things could be profitable for the person placing the limit order.

If, after up to ten people place bets on this market, I kind of feel like I understand the point of limit orders, market will resolve to yes.

If, after 10 people play bets on this market, or one month passes, and I still don’t really get how placing a limit order would be beneficial to the person placing them, market will resolve to no.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ713 | |

| 2 | Ṁ468 | |

| 3 | Ṁ322 | |

| 4 | Ṁ270 | |

| 5 | Ṁ266 |

In case it helps, here's a little explainer I wrote up on how to use limit orders to cash out of a market:

Say there's a market, like the one about room-temperature superconductors that traders have been irrationally exuberant about. You dump a bunch of money on NO. Gradually sanity starts to prevail (no superconductor, sadly) and you'd like to cash out your position. If you just start selling your shares, you push the price back up again. Maybe instead you'd like to just cash out when the price hits some threshold and only sell at that price. That's what limit orders are for! But limit orders are just for buying shares. You want to buy just enough YES to cancel your NO shares -- the equivalent of selling your NO -- without, God forbid, ending up with a YES position.

How exactly do you do that? Here is how, first for the case of cashing out a NO position and then the analogous case for cashing out a YES position.

## You're betting NO and want to cash out when the price drops

1. Say you're buying a bunch of NO and you have n shares, i.e., M$`n` is your payout on NO.

2. And say you want to cash out when the market probability goes down to p.

3. Put in a YES limit order at probability p, spending n*p.

4. Sanity check that you'll be buying n YES shares, i.e., your max YES payout is n. (Due to rounding, it may not perfectly match.)

5. Hit submit!

## You're betting YES and want to cash out when the price spikes

1. Say you're buying a bunch of YES and you have y shares, i.e., M$`y` is your payout on YES.

2. And say you want to cash out when the market probability goes up to p.

3. Put in a NO limit order at probability y*(1-p).

4. Sanity check that you'll be buying y NO shares, i.e., your max NO payout is y. (Again, due to rounding, it may not perfectly match.)

5. Hit submit!

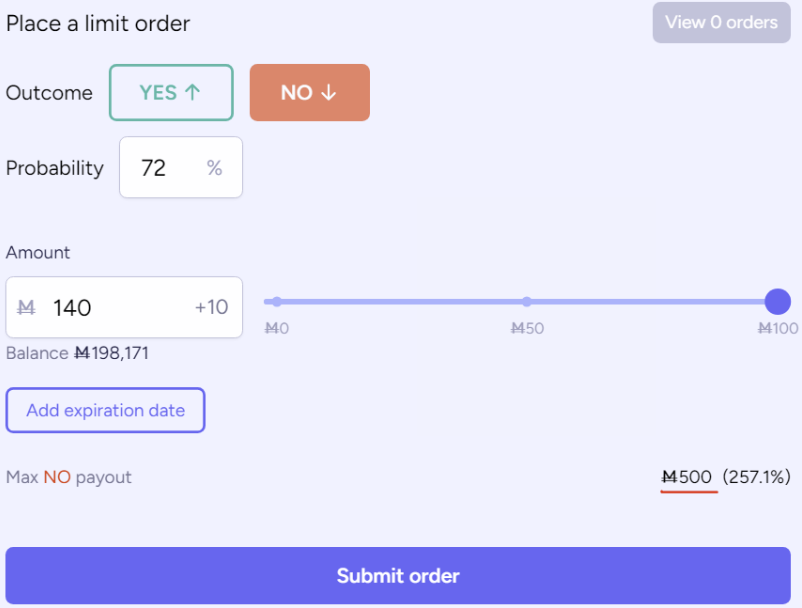

If you don't want to get out a calculator for that n*p or y*(1-p) you can let the UI do it for you: just vary the amount of the limit order until you get the number of shares you want to sell in "max NO/YES payout". In the following example, you'll sell 500 YES shares if that NO order gets filled: