I'll award up to M500 for good answers.

People are also trading

Be careful of Jevon’s paradox.

Jevon’s paradox occurs when technological progress increases the efficiency with which a resource is used, demand for that resource increases as an effect of normal supply-and-demand economy.

So, instead of shorting lithium mines, as some have suggested, invest in lithium mining! As we may very well see mining activity increase to support increased demand.

Some thoughts:

The idea of buying the minerals/elements that make up the material, strikes me as pretty dumb:

- Phosphates are incredibly cheap, and they are mostly used in things like fertilizer, I think? Even if LK-99 took off like crazy, the market for phosphates would hardly budge?

- Similarly, lead is dirt-cheap; my impression is that there aren't really lead-mining companies today since there is plenty of lead to go around based on the lead generated as a side-effect of mining silver, zinc, etc? The price of lead would probably go up a bit if everyone started using LK-99 all over the place, but... surely we could ramp up lead production pretty fast. It is just hard to imagine "we literally can't dig up enough lead" becoming the crucial bottleneck here...

- On the bright side, copper is actually valuable. On the downside, even in the most insanely bull case for LK-99, the whole idea is that we'd be making amazing new superconductive wire out of lead+copper+phosphate, and making tons of this new material as fast as we can, so that we could... replace ordinary copper wire! So I would actually expect the price of copper to go down??

(It's also possible that, even if LK-99 is a RTAPSC, we end up using a slightly different substance for the sake of improved current density or whatever... like gold-doped lead instead of copper, or who knows. So I am hesitant to bed on the exact materials of the current formula.)

A more plausible economic bottleneck is the companies that could get good at synthesizing the new superconductor and using it to produce superconducting wire/tape and other things. Unfortunately, I don't know what these companies might be! Probably not existing superconductor companies; they're all invested in previous totally-different materials.

Skeptical that ordinary semiconductor companies like TSMC would benefit hugely, at least right away. They've spent decades refining the nano-scale technology that we use to create ordinary non-superconducting chips! Trying to add LK-99 would probably mean going way back to basics and using way larger transistors. More plausible is the idea that companies focused on quantum computing chips in particular would get a huge boost from adopting this technology; can anybody help me out by pointing to some companies with that focus?

Note that depending on whether the superconductor could tolerate high magnetic fields and high currents, that would unlock huge efficiencies in electric turbines and motors, power transmission, etc (think General Electric, Vestas wind turbines, MRI machines, etc?). But if it can only do low current density, the impact would be more limited to creating really sensitive antennas and magnetometers and other scientific equipment, plus quantum computing chips as mentioned above. I would love some guidance on which companies might stand to benefit from hugely improved antennas/magnetometers/etc. See more info here, although beware that Andrew Cote has been a bit misrepresentative / willing to over-hype things: https://twitter.com/Andercot/status/1686527228165963779?s=20

As I understand it, transmission-line companies would only see about a 5% efficiency boost from superconductors, vs 30% for turbines, which is why I'm more hyped about energy generation companies than power-line transmission companies. (Although in practice, of course, transmission companies would benefit indirectly from a boom in energy generation, and vice versa...)

A dream high-field/high-current superconductor would also be revolutionary for fusion power, making it much easier to generate powerful magnetic fields that confine the plasma. Unfortunately, unless you are a silicon valley VC, you can't really invest into fusion companies! You could pull some kind of bank-shot move by betting on companies that benefit from cheap power (aluminum smelting? idk), but this is a very indirect path that relies on multiple miracles (RTAP superconductor, plus high-field/high-current, plus we make fusion plants, and it all happens pretty soon).

By contrast, I am pretty skeptical of the idea that you could create giant utility-scale batteries using loops of superconducting wire -- not gonna bother digging up the links right now, but some commentary from various informed folks has made it sound like this would not be as promising or useful IRL as it looks based on the basic physics. Rather than "shorting fossil fuels and buying renewables", personally I would be more tempted to invest in the companies that make the turbines for both wind & fossil fuel plants, since if LK-99 is a dream superconductor, everyone will want to spend money to upgrade their turbines to get the huge ~30% efficiency boost.

I don't quite understand how maglev trains work, but I assume it has something to do with the Meissner effect? (Rather than just using superconductors to create really strong electromagnets??) IMO the most plausible theories about potential superconductivity in LK-99 involve "1D" superconductivity that wouldn't create the same magnetic levitation behavior... so I wouldn't bank on anything that relies specifically on levitation. (But again, idk how maglev trains work.)

Re: @SG 's idea of TSLA, I think you'd figure that Tesla would probably be a good idea for the reasons stated (smart engineers, adaptable, basically an electric motor company), UNLESS you thought that superconductors were going to allow huge utility-scale energy storage using loops of wire, in which case maybe Telsa is hurt (if you see it as mostly a company that has just built a bunch of huge battery-making factories, and the value of batteries is about to fall), and maybe it is helped (if it's mostly a car company that benefits from lower prices on batteries/lithium/etc). I don't know enough about Tesla to have an opinion here, but I also think that superconducting wire-loop batteries are unlikely even in a dream scenario.

My takeaways from all the above:

1. Turbine companies and MRI companies aren't the worst pick in the world... sadly I am kind of limited to US stocks, so GE and GEHC (technically a different company, which makes lots of MRI machines) seem like reasonable picks. But, turbines and MRIs rely on getting a double-miracle of an RTAP superconductor which can furthermore handle high-field and high-current.

2. Since I'd really prefer to only bet on ONE crazy miracle at a time, I'd love to be able to put together a portfolio of US stocks that would benefit from the boost to quantum-computing chips, and antennas/magnetometers/sensors (this also feels more focused/targeted than investing in a $100B behemoth megacorp like GE). Unfortunately, I don't really know anything about these industries! Anybody with insight here, if you've read and appreciated this comment of mine, please chime in and I would be very grateful!

3. I would also appreciate insight on what types of US companies might be well-positioned to start synthesizing LK-99. ESPECIALLY assuming that it is a finnicky 1D superconductor and we want to try and create very carefully-grown samples where all the 1D grain is in the same direction, or where individual crystals grow very large, or etc. Since, if it turns out to be very easy to synthesize by practically just mixing up big vats of lead & copper, then you wouldn't expect that to become a bottleneck.

This also depends on the time-scale you're considering.

If you have a specific horizon in mind, why not buy some out-of-the money call options on stocks of some of the companies suggested by other posts, with suitable expiry, such that you can get more leverage to the upside? This would appear relatively safe, because your downside is limited by the premium you pay initially.

(But beware, these are nonlinear instruments with complicated dependency on time and implied volatility, so definitely make sure you understand the details.)

buy LEAPS on copper ETF’s such as CPER. If you can find any on lead those would be good as well. The idea is if this takes off the mining demand goes up and and ideally these stocks make big moves. Using way out of the money options would hopefully see some nice gains in the process. This is all speculation though and not financial advice. Even if this stuff proves real there is no telling how long it’s take to productionize and create the demand for the raw resources.

Here are a few blog posts with at least sorta plausible analysis:

https://www.nextbigfuture.com/2023/08/are-existing-superconducting-companies-going-to-win-in-an-lk99-room-temperature-superconducting-world.html

https://www.nextbigfuture.com/2023/08/what-might-the-first-commercial-product-for-an-lk99-type-room-temperature-superconductor.html

Unrelated: in my earlier comment I expressed interest in knowing which companies might benefit from the use of superconductors to create quantum computers. IonQ is the largest publicly-traded purely quantum-computer focused company in the US, but they /don't/ use tech that would benefit from superconductivity. So, they wouldn't be a direct winner.

Invest in Korean companies (In particular, Power Logics )

I'm Korean.....superconduct STOC...??

Korean STOCK : KOSDAQ 047310, POWERLOGICS (파워로직스)

It is a company related to the Quantum Energy Research Institute, which has the prime technology of normal temperature and normal pressure superconductors.

Currently, stocks of Quantum Energy Lab are unlisted and cannot be trade

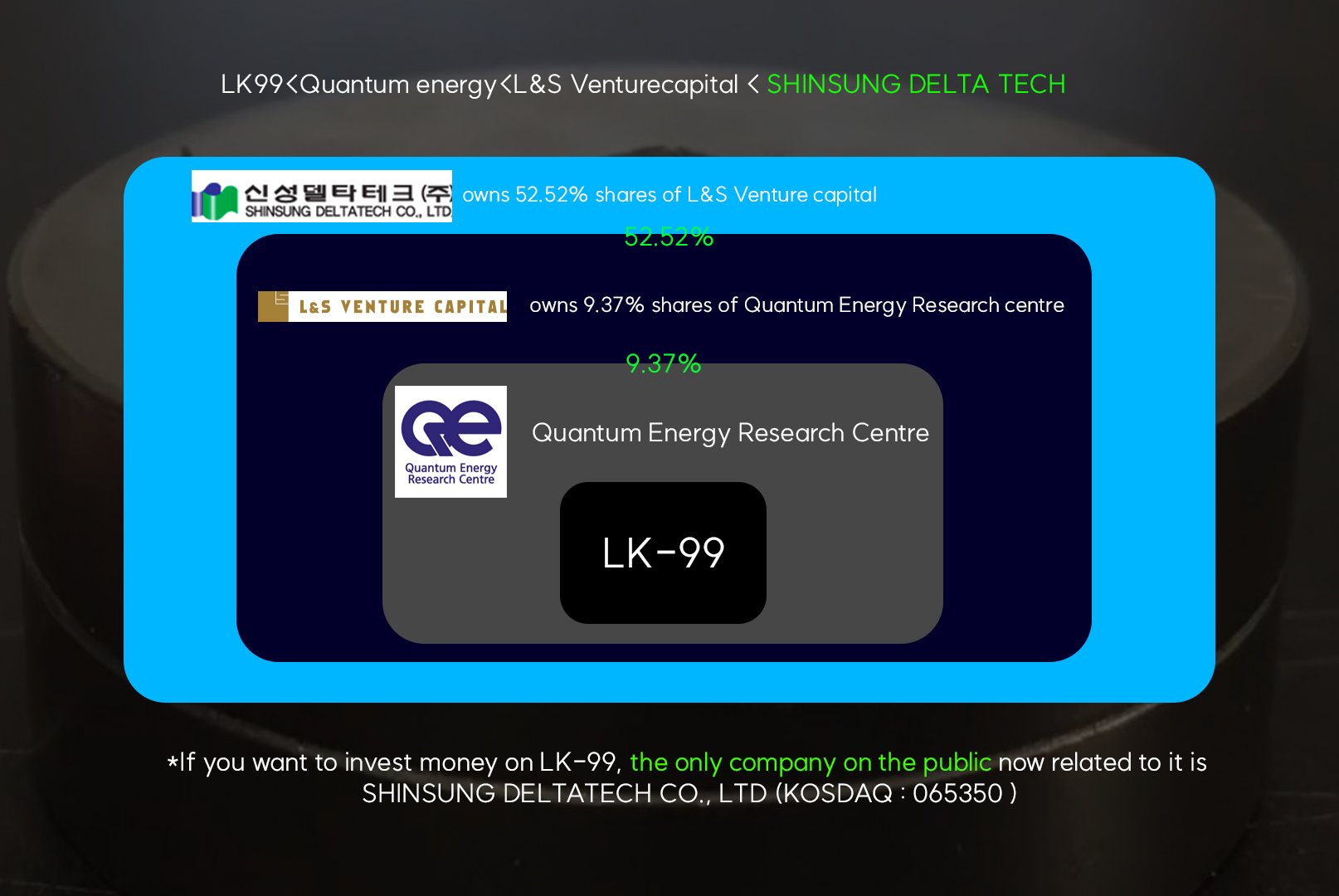

good luck to you toolk-99 related Korea stock is "Shinsung Delta Tech" this company has 9% ownership percentage on LK-99 company

Assuming you're in the US, Kalshi now has a real money prediction market on a "major journal" (from a specific list/set of criteria) reporting a room temp superconductor exists by 2024. It's trading at 28 cents and there's not a ton of liquidity, but tripling a couple thousand dollars isn't bad, and more liquidity would probably appear. Upside: nearly direct exposure, downside: will lose 100% of what's invested if wrong

Sorry, but I assign low credibility to others recommending buying META or AAPL because they're "tech giants", just because superconductors obviously benefit microprocessors. Facebook's flirtation with hardware has proven pretty bad: they're still marching on with the Quest 3, but the Quest Pro is being wound down, which is a bad sign of health. Notice that the other pick, Apple, often is accused of selling nothing but premium products, but Facebook doesn't have the confidence to try to offer a comparatively "midrange" buy against the Vision Pro? Apple itself doesn't have a road to exploiting tech in a general way, they're deeply committed to their brand. Fundamentally, Apple and Facebook are at some level still "software companies", even if they may design some hardware now and then, because they are focused on owning a consumer market and not on owning the business market. You might as well buy into an index fund or something.

IF you believe that buying more "general" tech hardware as a result is a good idea, then buy TSMC (NYSE: TSM, TWSE: 2330) stock instead, they're the ones who actually make the chips. A few other people have recommended them, but to explain: They're currently a semiconductor foundry but they're at the leading edge of all the latest tech. They make most of the chips for AMD, Apple, and Nvidia, and while someone might unseat them as #1, it's likely they'll remain a competitor in future markets.

A list of semiconductor manufacturers near the "leading edge":

TSMC (NYSE: TSM, TWSE: 2330)

Intel (NASDAQ: INTC)

Samsung (OTCPK: SSNLF)

Global Foundries (NASDAQ: GFS)

The last is not aiming to be as innovative as the rest. They have a 12nm process, but not lower. They own many foundries but many of them are cast-offs from when AMD and IBM backed out of chipmaking. However, I wouldn't discredit them outright, as they've secured big deals with corps like GM, and a lot of chipmaking is in the more "tried and true" angle, so they don't have to be making "5nm" semiconductor chips today to be making superconductor-informed chip technology in ~2035, and their focus on chips in things like cars is probably just as important, economically.

However... I probably wouldn't, this area will be weirdly priced due to a lot of other reasons like the AI boom and the China-USA "chip war". I might instead focus on companies even further "downstream", which either mine raw copper like

Freeport-McMoRan (NYSE: FCX)

BHP (NYSE: BHP, ASX: BHP, LSE: BHP)

Or that do the refining and "basic goods" manufacturing (and often also recycling!) and thus are likely to do a lot of business with whoever capitalizes on perfecting such a simple process (assuming they don't decide to branch out a little and do it themselves!):

Mitsubishi Materials (OTCMKTS: MIMTF)

Umicore N.V (OTCMKTS: UMICY)

But as you might guess, I understand the semiconductor market a little better.